Halving

Bitcoin reached $42,000 for the first time in a year and a half. How much impact did the upcoming halving really have? Let’s look at past data. How BTC behaved around this time (about five months before the next reduction in rewards for miners) in 2012, 2016 and 2020.

The earliest was the November 2012 halving. Then the price increase began about a year in advance, in December 2011. From the November 2011 lows to the November 2012 halving, Bitcoin gained more than 500%. And in August 2012 it showed a historical maximum of $16. In other words, at its peak the growth exceeded 719%.

Source: tradingview.com

In 2016, the situation repeated itself. Growth began again about a year before the halving – in August 2015. The difference from the events of 2012 was that the historical maximum was not rewritten. And the maximum growth turned out to be more modest – about 294%.

Source: tradingview.com

The next halving happened in May 2020. The growth, uncharacteristically in comparison with the other two cases, began a year and a half before the reduction in Bitcoin production. And in March 2020, there was a drawdown below $4,000. However, you need to take into account the fact that the year was unusual – the coronavirus pandemic. In any case, Bitcoin did not reach its historical maximum before the halving. The growth at its maximum slightly exceeded 300%, and took place back in June 2019. Then a correction followed.

Source: tradingview.com

Now let’s move on to the upcoming halving in April 2024. What are we observing? Bitcoin began to grow in January 2023, that is, approximately a year and a half before the halving. Thus, the current cycle is more similar to the events of 2020 (it is unknown whether there will be a drawdown before April), and not to those that occurred in 2012 and 2016. At the same time, there is no talk of any historical highs. Moreover, so far the growth of the Bitcoin rate is quite modest compared to the periods that preceded past halvings – as of Tuesday, December 5, about 150%.

Source: tradingview.com

In short, the state of affairs is neither new nor unusual. But to say that halving was entirely the reason for Bitcoin’s almost 5% growth does not make sense.

Spot ETF Approval

For more than six months, the US Securities and Exchange Commission (SEC) has been considering the possibility of approving the launch of spot exchange-traded funds for Bitcoin. They say that a whole special group of specialists is working to assess all the risks. As a result, the deadlines for making decisions on applications are shifted at regular intervals. The current dates are considered to be the period from January 5 to January 10, 2024. Was this expectation the reason for BTC’s rise to $42,000?

When information about the possible approval of the ETF first leaked to the media, BTC made a noticeable upward surge, which was marked by an increase of more than 34%. We can talk about a certain excitement among the audience, which is positively disposed BEFORE the appearance of any specifics. Then a representative of the SEC speaks and the enthusiasm decreases. Until next time.

Source: tradingview.com

Overall, we can assume that in December 2023, a month before the possible approval of spot ETFs, investors will be full of optimism.

US Federal Reserve rate decision

US Federal Reserve Chairman Jerome Powell believes that it is premature to talk about a sharp reduction in the base rate. Moreover, the official made it clear that, if necessary, the tightening of monetary policy will continue.

However, markets may have taken the rhetoric positively since rate cuts were at least being mentioned. However, again, was this the specific reason for the December 4th surge? Hardly.

Number of liquidations

Liquidation is the forced closure of a trader’s position by an exchange when he does not have enough collateral and the price of an asset goes against it. Interesting statistics emerged in the first four days of December 2023. The number of short liquidations exceeded the number of long liquidations. On December 4, their volume generally exceeded $200 million. The question arises: where do short sellers go during liquidation? Answer: either they leave the market or become bulls, bringing new liquidity and increasing demand, and as a result, the price.

Source: coinglass.com

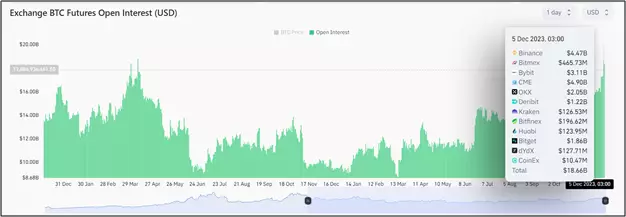

In addition, open interest (the number of futures and options on exchanges) for Bitcoin on December 4 was the highest since April 2022, amounting to $18.66 billion. This suggests that investors believe in the movement of BTC.

Source: coinglass.com

What will happen to Bitcoin next?

Prospects for Bitcoin

BTC continues to grow. The bullish trend is evident. Next target = $48,200. Back on Friday, we believed that if we managed to overcome $38,500, we could expect further growth, and this level would become support. Actually, so far everything is working out that way. Help is the price rising above the 50-week moving average (indicated in yellow):

Source: tradingview.com

Conclusion

In short, there are quite a few reasons for Bitcoin’s growth: the expectation of a rate cut by the US Federal Reserve and the approval of spot Bitcoin ETFs, as well as the upcoming halving. However, they remain more in the overall bullish trend. Specifically, on December 4, the growth of BTC was most likely associated with massive short liquidations and an increase in open interest in the historically first cryptocurrency to a one-and-a-half year high.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.