The sharp increase in activity in the Bitcoin derivatives market is reminiscent of the events of the end of 2021, when the first cryptocurrency reached its peak, writes RBC Crypto with reference to Bloomberg.

According to a representative of the largest Bitcoin options exchange Deribit, open interest in derivatives instruments on the platform reached $14.9 billion, which is $500 million higher than in October 2021.

According to journalists, the increased interest in various types of investment instruments for Bitcoin is caused by the expectations of market participants regarding the imminent approval of a Bitcoin ETF by the US Securities and Exchange Commission (SEC). Investors are expecting an influx of new capital, for which the cryptocurrency market was previously inaccessible.

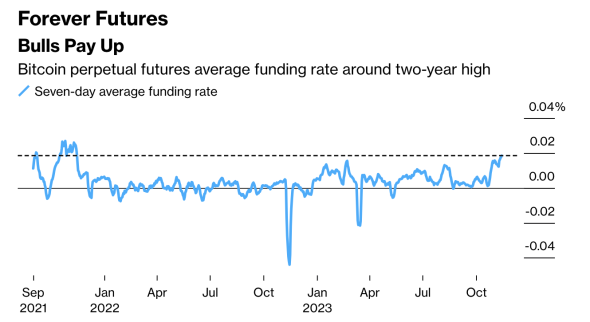

The expectations of market participants are also reflected in the so-called funding rate for perpetual Bitcoin futures.

Funding rate graph. Source: Bloomberg, according to CryptoQuant

Funding rate graph. Source: Bloomberg, according to CryptoQuant

Journalists note that the funding rate for perpetual futures for Bitcoin has recently been positive 0.02%, which is very close to the figure at the end of 2021, when Bitcoin peaked at $69 thousand.

Last week, the Chicago Mercantile Exchange (CME) ranked first in terms of Open Interest in Bitcoin (BTC) futures trading, surpassing Binance for the first time. The influx of interest in traditional futures contracts on a regulated US exchange, according to some analysts, may indicate increased institutional interest in Bitcoin.

A few days ago, Coinbase analysts said that the approval of a Bitcoin ETF by the SEC will open the cryptocurrency asset market to a new class of investors, including investment advisors, pension funds and institutions that previously did not have access to the digital asset market.

Currently, several large investment companies are awaiting approval of their own Bitcoin ETFs by the US Securities and Exchange Commission. The potential launch of such ETFs is considered in the crypto community to be a catalyst for a new bull cycle in the market.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.