- The Bank of England is expected to keep its policy rate unchanged.

- Disinflationary pressure in the United Kingdom accelerated in May.

- GBP/USD faces an initial upside barrier at 1.2860.

The Bank of England (BoE) is expected to keep its policy rate unchanged for the seventh consecutive meeting on Thursday, despite the recent acceleration of disinflationary pressures in the UK and speculation of two interest rate cuts this anus.

The Bank of England could issue a cautious message

The Bank of England is widely expected to keep its benchmark interest rate at 5.25% after its policy meeting on Thursday. In addition to the interest rate announcement, the central bank will publish the Monetary Policy Minutes.

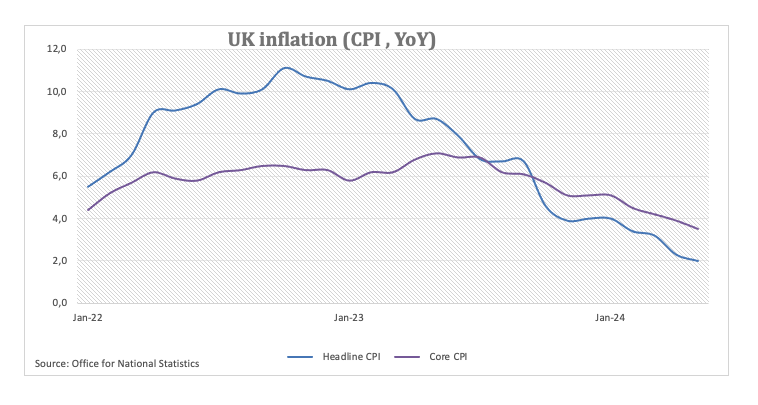

Although disinflationary pressures remained very present in May, the Bank of England appears ready to begin reducing its monetary policy rate at some point in the fourth quarter in response to the still very high services inflation (+5 .7% year-on-year compared to the +5.3% year-on-year expected in May).

Additionally, inflation figures in the UK showed that the headline Consumer Price Index (CPI) rose by 2.0% (up from 2.3% previously) and the core CPI, which excludes food and energy costs , rose 3.5% (up from 3.9%). Furthermore, it was the first time that the CPI reached the central bank’s target since October 2021.

Additionally, money markets now see around 45 basis points of monetary easing by the BoE by the end of the year and almost 30 basis points by November.

As for the next event, the latest inflation readings are unlikely to challenge the BoE’s view of beginning its easing cycle in the latter part of the year, while a cautious message, particularly highlighting services inflation and the still tight domestic labor market, should not be ruled out yet.

The BoE is generally expected to keep its policy rate at 5.25% on Thursday at 11:00 GMT. The vote is anticipated to remain at 7-2, with some revisions in the attached statement. It seems likely that traders will be particularly interested in the rate recommendations for the August meeting. It is worth remembering that in its May decision, the central bank emphasized the importance of upcoming data in formulating monetary policy decisions.

Following the bank’s event on May 9, Bank of England Governor Andrew Bailey stated that future rate cuts may need to exceed current market expectations to prevent inflation from falling below target. On Thursday, Bailey commented that even a small cut in the Bank of England’s interest rate would keep monetary policy in restrictive territory.

Additional comments from BoE officials also saw outgoing deputy governor Ben Broadbent, whose final policy decision will be on Thursday, maintain that there is a possibility of a summer rate cut. Broadbent indicated that for the BoE to justify the rate cut, the data must align with its projections. He also emphasized that he is giving more consideration to the short-term services CPI when making his decision.

His colleague Megan Greene, who had previously noted in April that high wage growth and the services CPI indicated inflationary persistence, making near-term rate cuts unlikely, has since adjusted her stance. Greene acknowledged that inflationary persistence has waned, thereby omitting the earlier reference to distant rate cuts. Consequently, if upcoming data further indicates that inflation is declining, markets could anticipate Greene voting for a rate cut at the June meeting, contributing to the previous session’s subdued sentiment.

In a preview of the BoE meeting, Rabobank senior macro strategist Stefan Koopman argued that the BoE’s Monetary Policy Committee (MPC) is expected to hold the policy rate at Thursday’s meeting. “The vote could again be split, with two members possibly supporting a 25 basis point rate cut. While the MPC is considering lowering interest rates, current data does not justify such a move. Furthermore, the political context makes a cut before the elections is unnecessarily complicated. We continue to believe that both wage growth and services inflation are not yet consistent with a sustained return to 2% inflation,” he added.

How will the BoE interest rate decision impact GBP/USD?

Although inflation continued to decline in May, the central bank is unlikely to adopt a more relaxed tone or provide a clearer indication of when interest rates could be reduced. With surprises largely ruled out, the British Pound (GBP) is expected to remain within its current familiar range for the time being.

In this context, GBP/USD maintains its constructive bias after convincingly surpassing the 200-day SMA (1.2550). FXStreet senior analyst Pablo Piovano suggests further gains could lead Cable to retest the June high of 1.2860 (June 12). Beyond that, the next target is the 2024 high at 1.2893 (March 8) before the psychological milestone of 1.3000.

On the contrary, Pablo notes that a resurgence of the selling bias could trigger some short-term corrective moves. Immediate support lines up at the June low of 1.2656 (June 12), followed closely by the 100-day and 55-day SMAs at 1.2639 and 1.2618, respectively. Further down comes the 200-day SMA at 1.2550. A deeper pullback could retest the 2024 low of 1.2299 (Apr 22).

economic indicator

BoE interest rate decision

He Bank of England sets the interbank interest rate. This interest rate affects a range of interest rates set by commercial banks, building societies and other institutions towards their own savers and borrowers. It also tends to affect the price of financial assets, such as bonds, stocks and exchange rates, which affect consumer and business demand in a variety of ways.

Last post: Thu May 09, 2024 11:00

Frequency: Irregular

Current: 5.25%

Dear: 5.25%

Previous: 5.25%

Fountain: Bank of England

The BoE FAQs

The Bank of England (BoE) decides the UK’s monetary policy. Its main objective is to achieve price stability, that is, a constant inflation rate of 2%. Its instrument to achieve this is the adjustment of basic loan rates. The BoE sets the rate at which it lends to commercial banks and at which banks lend to each other, determining the level of interest rates in the wider economy. This also influences the value of the British Pound (GBP).

When inflation exceeds the Bank of England’s target, it responds by raising interest rates, which makes access to credit more expensive for citizens and companies. This is positive for the British Pound, as higher interest rates make the UK a more attractive place for global investors to invest their money. When inflation falls below target, it is a sign that economic growth is slowing, and the Bank of England will consider lowering interest rates to make credit cheaper in the hope that companies will borrow to invest in projects that generate growth, which is negative for the Pound sterling.

In extreme situations, the Bank of England can apply a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit into a clogged financial system. QE is a policy of last resort when lowering interest rates does not achieve the necessary result. The process of QE involves the Bank of England printing money to buy assets, typically government bonds or AAA-rated corporate bonds, from banks and other financial institutions. QE usually results in a weakening of the British pound.

Quantitative tightening (QT) is the reverse of QE, and is applied when the economy is strengthening and inflation begins to rise. While in QE the Bank of England (BoE) buys government and corporate bonds from financial institutions to encourage them to lend, in QT the BoE stops buying more bonds and stops reinvesting the maturing principal of the bonds that you already own. It is usually positive for the British pound.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.