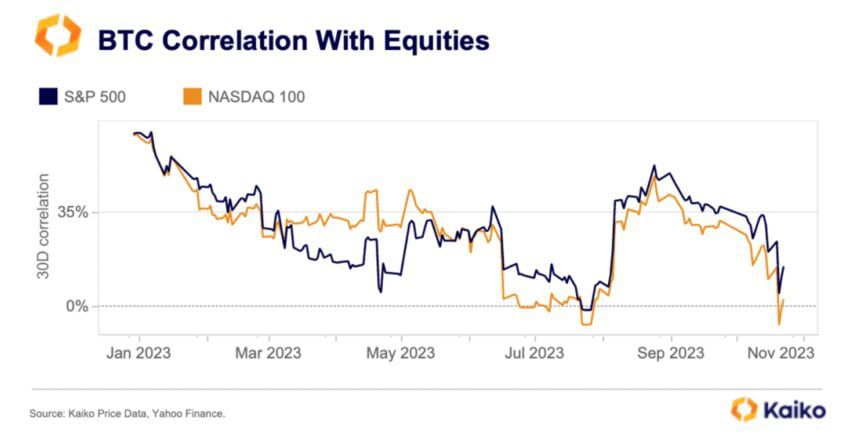

BTC’s correlation with the S&P 500 and Nasdaq is now -0.7 and -0.69, respectively. Investors view stocks as riskier assets than Bitcoin.

Bitcoin’s (BTC) correlation with stocks fell below zero for the first time since July of this year. The indicator dropped due to macroeconomic problems. Analysts pointed this out Kaiko.

What does it mean

As of October 30, the correlation of the first cryptocurrency with the S&P 500 index amounted to -0.7, and with the Nasdaq Composite – -0.69. These dynamics indicate that BTC is gaining wider acceptance in the global market.

At the same time, gold is growing along with digital assets. They are viewed by investors as the safest refuge for their funds during macroeconomic difficulties. At the same time, stocks have become riskier, so players are now actively selling securities.

BTC Market Share Breaks 30-Month High

On October 26, the rate reached a record high of 54.1%. This is the highest since the 2021 bull market, when Bitcoin’s market share was over 70% at its peak.

The breakthrough occurred against the backdrop of a rise in the value of the first cryptocurrency above $35 thousand on the night of October 23-24. Then the Depository Trust and Clearing Corporation (DTCC) listed a spot Bitcoin ETF from BlackRock, iShares Bitcoin Trust. It appeared under the ticker IBTC.

The crypto community is now actively awaiting approval of applications to launch spot Bitcoin ETFs. Some analysts believe that the US Securities and Exchange Commission (SEC) could make a final decision as early as January 10, 2024.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.