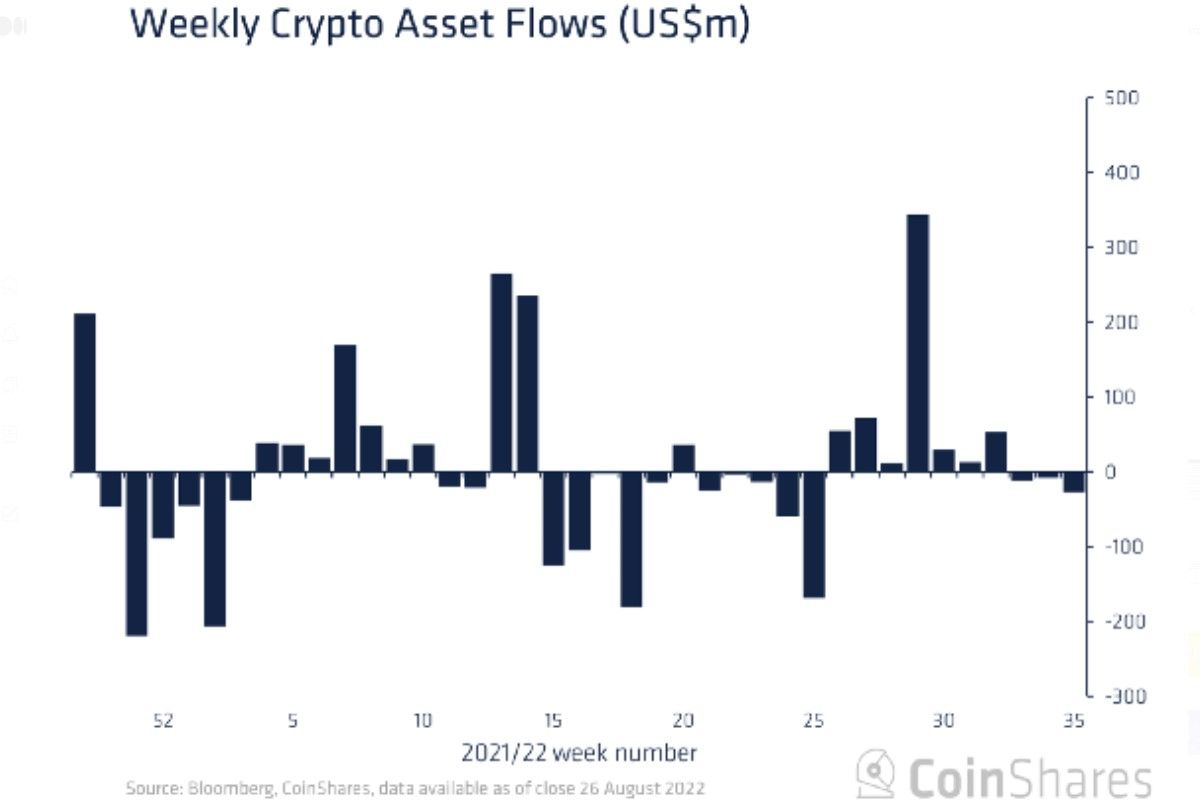

Analyst firm CoinShares posted a report claiming that crypto funds experienced a $27 million capital outflow last week.

According to analysts, investors withdrew $46 million in three weeks. Experts say that the level of investment products volumes remains very low and last week amounted to $901 million, which is the lowest level since October 2020.

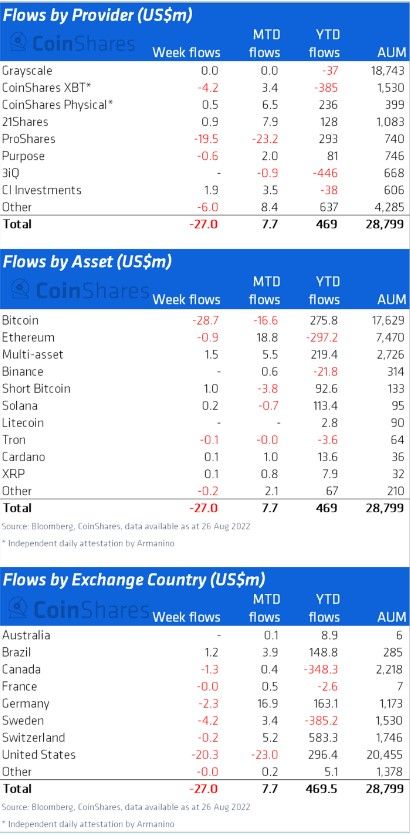

According to CoinShares, what is happening is partly due to seasonal effects, and this highlights the continued apathy among investors after the recent price decline. At the regional level, minor outflows were observed across the board, but were concentrated mainly in the US, Sweden and Germany. The total outflow in these countries was $20 million, $4.2 million and $2.3 million, respectively. The only exception was Brazil, which saw a minor inflow totaling $1.2 million.

The report states that Bitcoin funds lost $29 million in three weeks. According to experts, investors continue to invest in short BTC-based investment products. Last week, about $1 million was invested there.

The situation means minimal but permanent caution on the part of investors associated with the tough policy of the US Federal Reserve System (FRS). The Ethereum market saw a minor outflow totaling $1 million, which means that despite growing confidence that the ETH merger will happen in September, investors are choosing to wait until the merger is successfully completed. Analysts are seeing minor capital inflows into the Solana, Cardano, XRP, Tezos, Chainlink and Uniswap markets as a positive sign.

According to research agency Arcane Research, cryptocurrency owners massively withdraw funds from exchanges and crypto lending services, preferring to store them in cold wallets.

Source: Bits

I’m James Harper, a highly experienced and accomplished news writer for World Stock Market. I have been writing in the Politics section of the website for over five years, providing readers with up-to-date and insightful information about current events in politics. My work is widely read and respected by many industry professionals as well as laymen.