BNB technical analysis

From April 17 to June 12, 2023, the value of BNB fell by more than 37%. At the same time, more than 27% fell on just seven days, from June 5 to June 12. Investors actively got rid of cryptocurrencies in connection with the lawsuit that the US Securities and Exchange Commission (SEC) filed against Binance.

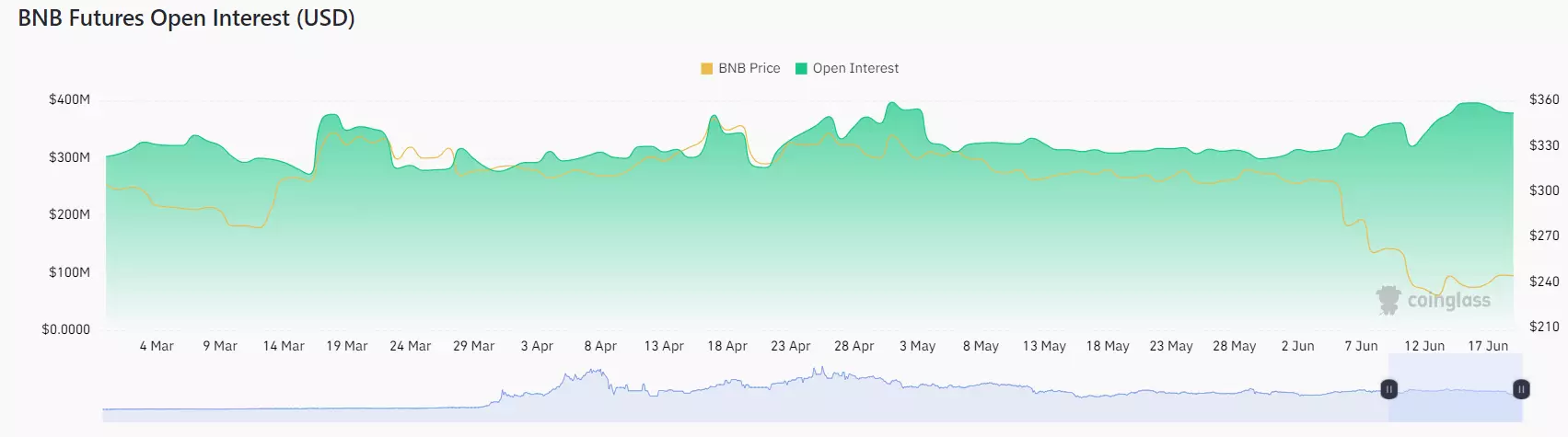

Interestingly, all this was accompanied by a positive change in the Open Interest indicator, which shows the total number of futures contracts at the end of the day. This takes into account instruments opened both long and short. Their number grew until June 16, when the figure reached a maximum for a month and a half and reached $395.52 million.

Source: coinglass.com

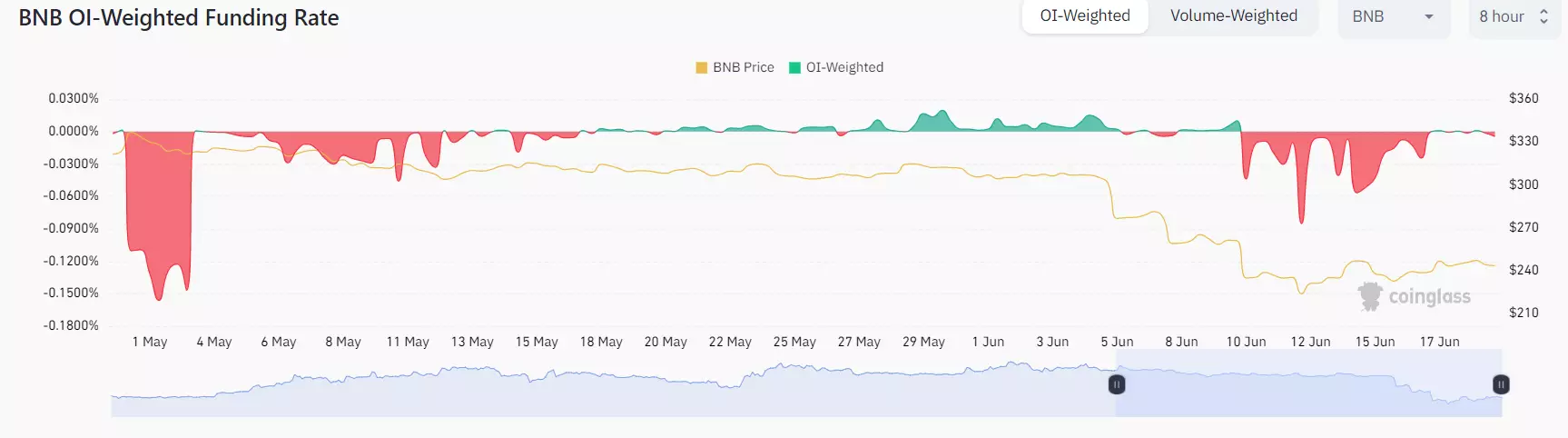

At the same time, the Weighted Funding Rate has been below zero since June 10. This means that the bears were ready to pay the bulls to keep the short positions open.

Source: coinglass.com

There was a situation when the number of futures in BNB was growing, and the market was dominated by bear players, which naturally indicated a further decline. Also in favor of the judgment was the fact that the Binance cryptocurrency was sold by large players. Network analyst Lookonchain disclosed information according to which a major player who has not committed any action for two years,

sold 10,000 BNB worth $2.3 million

There were also rumors that Binance CEO Changpeng Zhao personally launched

merge cryptocurrency. True, CZ (pseudonym of the head of the exchange) later himself

refuted this informationcalling it a manifestation of FUD (fear, uncertainty, doubt).

From the point of view of technical analysis, the picture is ambiguous. On June 12, BNB reached its local low of $220.4. It coincided with the minimum values of December 2022. In other words, the coin has reached a support level. After that, it bounced off the level and rose by almost 10% (price at the time of writing on Monday, June 19, $242). The immediate target should be the resistance level of $252.8. At the same time, a dead cross formed on the chart not too long ago, a situation where the faster 50-day moving average (in purple) crossed the slower 200-day moving average (in green) from top to bottom. This is usually considered a bearish omen.

Source: tradingview.com

So, if we touch on the pure value of BNB, now the negative prevails. Is there a positive in the fundamental aspect?

Luban update

About the upcoming Luban update,

reported back in May 2023. And so, on June 11, the update was activated. Luban offers three improvements: BEP-126, BEP-174 And BEP-221. Binance Chain itself paid special attention to the first:

“The long-awaited update introduces the Fast Finality mechanism. With Fast Finality, block reorganization is a thing of the past. What does this mean for you? Improved protection against double-spend attacks and MEV reorganizations, irreversibility of transactions after confirmation, and efficient operations for exchanges and DeFi protocols. While BEP-126 does not directly speed up transactions or reduce fees, the update helps keep the BNB Chain ecosystem safe and secure.”

The Fast Finality mechanism, in fact, is an acceleration of block formation. This is quite a useful thing: users will be able to make sure that they receive reliable information from the last completed block and can decide on further actions.

BEP-174 presents a proposal to improve the management of internet relays. Not so long ago, a white list of repeaters was put into effect. It is proposed to introduce a control mechanism that could register a single repeater. Managers will be selected or removed by the project management. BEP-221 lays the groundwork for the next CometBFT Light Block Validation update, which is directly related to validation.

Blockchain of the second level

On June 15, on its official Twitter page, the platform

published 17 second video. In it, the BNB Chain team announced that soon those who wish will see the full power of their blockchain. As soon as the decision of the second level will be released. The video says that the Layer 2 solution will increase throughput, as well as make the transaction processing process more economical. The solution is already

being tested.

So far there are more questions than answers. Quite a lot of speculation about this decision. Twitter comments on the video

statements like:

“Good distraction marketing, classic.”

Industry experts suggest that a second layer solution will cure the scalability problem in the long run. Many people face the problem. expected

new solution for decentralized applications (dApps) and decentralized finance (De-Fi) projects.

In other words, life inside Binance Chain continues to boil. The Luban update has been released, the implementation of the second-level blockchain is next in line. But the price of BNB is in a bearish trend: investors continue to experience excitement in connection with the SEC lawsuits about the world’s largest crypto exchange.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.