- The index continues Friday’s advance north of 109.00.

- US 2-year bond yields rose to new 5-year highs near 3.50%.

The dollar, in terms of the Dollar Index (DXY), continues to rise and hit new two-decade highs near 109.50 earlier in the week, an area where it last traded in September 2002.

US Dollar Index is supported by yields and the Fed

The index is trading in positive territory for the second consecutive session and extends the Powell-led rebound beyond Monday’s 109.00 barrier.

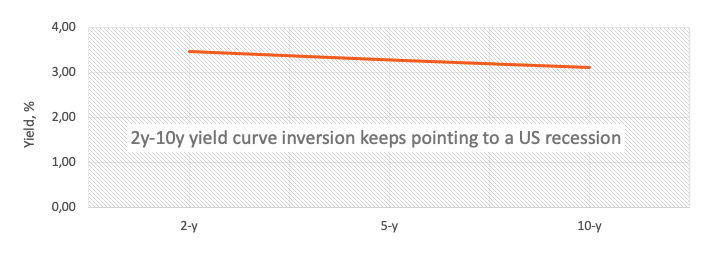

In fact, investors are still adapting to boss Powell’s assertive message at last Friday’s Jackson Hole event, which gave the dollar a further boost and sponsored further gains in US yields, especially at the short end of the curve.

The Fed’s continued aggressive stance has been reinforced by Powell and markets now see a 75 basis point rate hike as the most likely scenario for the Fed meeting in September. In this sense, the CME Group’s FedWatch tool sees that probability around 75%, from 47% a week ago.

On the US docket, the Dallas Fed manufacturing indicator will be released, to be supported by a couple of short-term auctions and a speech by Fed Vice President Lael Brainard (permanent voter, dove).

Dollar Index Levels

Now, the index is up 0.39% at 109.25 and a break above 109.47 (high of 2022 recorded on July 15) would aim for 109.77 (monthly high of September 2002) and then at 110.00 (round level).

On the other hand, the next support emerges at 107.58 (weekly low Aug 26), seconded by 106.37 (55-day SMA) and then 104.63 (monthly low Aug 10).

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.