What is a bear trap

Bears in the trading of some assets, including cryptocurrency, are called sellers who play on the decline. The concept is purely conditional, since any trader will situationally both sell and buy. The bear trap is a pattern on the price chart, which occurs after a downward movement. The meaning of the figure is that when a local minimum is reached, the minimum breaks through. At this point, the bears get a sell signal. However, this is just fiction. The price reverses and immediately begins to rise.

Usually, the formation of a bear trap is accompanied by the achievement of a strong support level. After it manages to be reached and broken down, a sell signal appears. However, this is a trap. After some time, the price returns to the support level, which has now become resistance, breaks it from the bottom up and the growth begins.

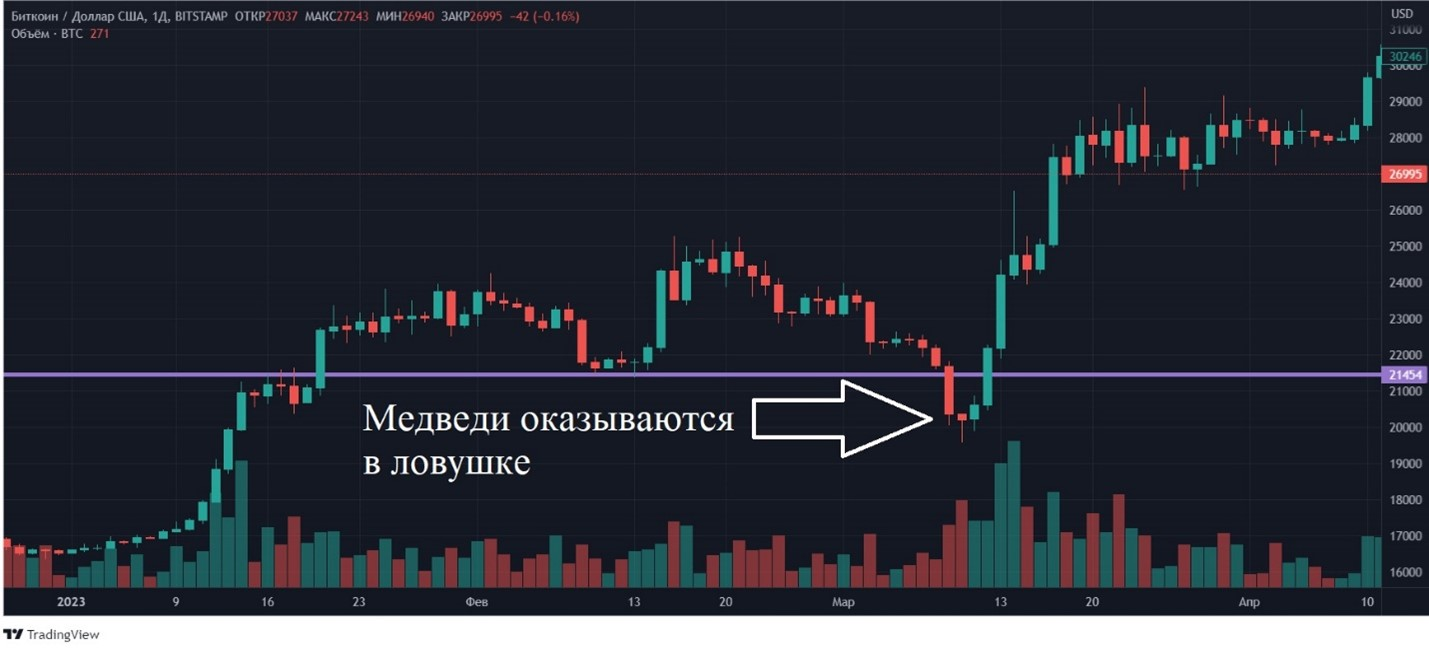

For example, in January 2023, Bitcoin was steadily growing. In the first days of February, BTC corrected to the area of $21,350-$21,450. Thus, a resistance level was formed. After that, BTC started to grow again, exceeding $25,000 on the 20th of February. Further correction followed. At the same time, the support level should have been around $21,350-$21,450. However, on March 9, bitcoin dropped lower, announcing that bears rule the ball and further declines should be expected.

Source: tradingview.com

But it was not there. Already on March 11, Bitcoin began to grow, and on March 12 it crossed the level of $21,450. This is how the bears were trapped and had to liquidate their positions.

Source: tradingview.com

In addition to the bear trap, there is also a bull trap.

What is a bull trap

This a phenomenon on the chart, the opposite of a bear trap. The victims are not sellers (bears), but buyers (bulls). The bull trap itself occurs after the rise in cryptocurrency quotes.

It usually forms upon reaching a certain level of resistance and breaks through it. It’s time to buy. Many bulls take advantage of this and begin to acquire cryptocurrency. However, the trend immediately changes: the price returns to the level and continues to decline. Bulls in this case are the losers.

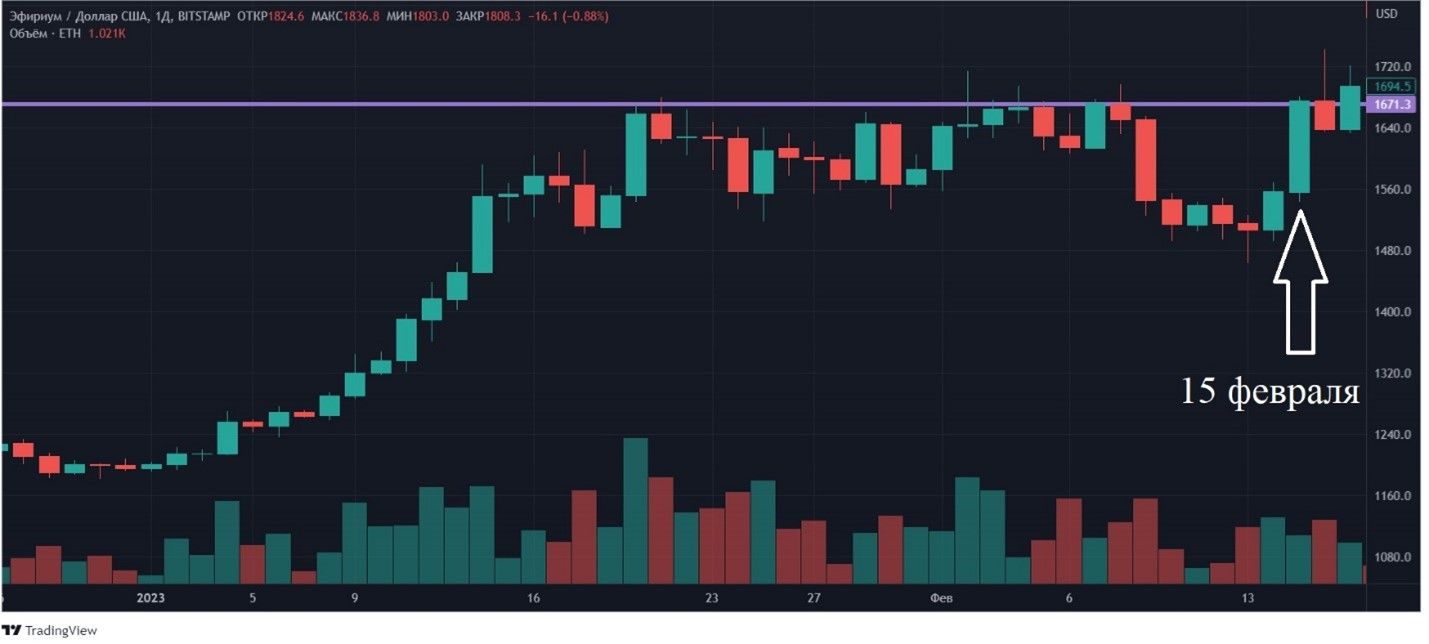

Let’s take an example from real practice. For the first 20 days of 2023, ETH was growing in price, reaching $1,671. After that, a lull began in the form of a sideways movement. This went on until Wednesday, February 15th, when Ether closed above $1,671.

Source: tradingview.com

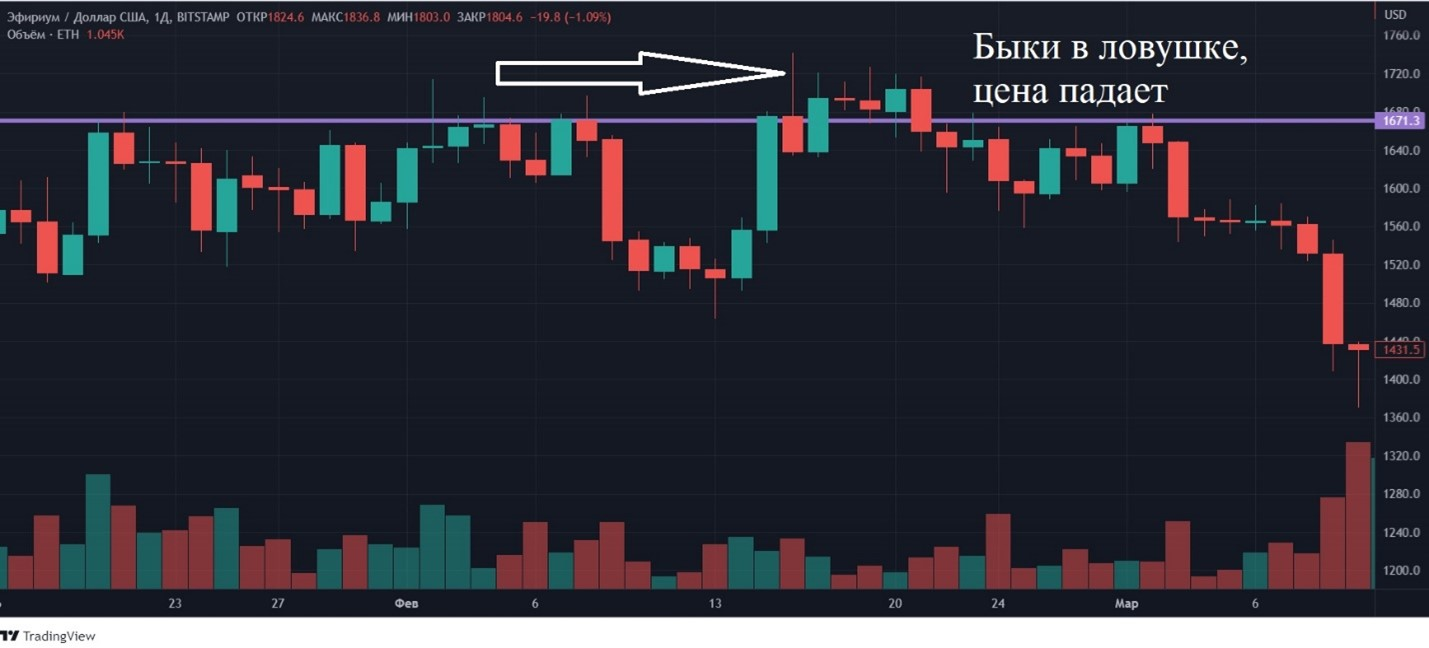

However, subsequent events showed that this was only a trap for the bulls. There was no impulse growth. After trading above the level for six days, Ethereum fell below $1,671 on February 21 and began to decline. Short-term bulls had to close their positions.

Source: tradingview.com

How to find a trap and not fall into it

If we talk about 100% probability, then nothing. The formation of both a bear and a bull trap occurs as if after the fact. After the price rises or falls below the resistance or support level, we cannot predict anything. You can not see in advance what will happen to the price. At the same time, we only get a buy signal in the case of a bull trap or a sell signal in the case of a bear trap. Only after a while we see the result. However, there are a number of tricks that can reduce the likelihood of losses.

First and probably the most effective method is to trade on larger timeframes: daily, weekly, monthly, and so on. The shorter your trading period, the more traps will occur. If we talk about investors who mostly use fundamental analysis, then their risks are the least.

Secondwhat you can do is pay attention to the volumes. If the level breaks through at low speeds, then this is an occasion to think about the occurrence of a trap. If, on the contrary, the level breaks through on large volumes, then most likely the trend will continue.

Also various technical methods can be used: oscillators, Fibonacci levels, candlestick analysis. All of them can give specific signals so as not to get into a mess. With regard to cryptocurrencies, this is especially important due to the high volatility. If you short Bitcoin and fall into a bear trap, you risk losing your entire account altogether.

It is worth remembering that there is no universal way that would become a solution in any case. Start with your trading style.

How to make money on traps

Again: who trades how. If you are scalping – ultra-frequency trading – then traps simply will not be taken into account. Their formation will take too long. You simply cannot afford to wait that long. While the trap is formed, the scalper can take profit several times on the intraday price movement.

The investor – the one who trades on the long side – will also not pay attention to the traps, since they are just noise for him. A long-term investor will restock as much as necessary, and will come out in a plus.

Inexperienced traders are more likely to fall into the trapwho are just getting acquainted with crypto markets. Medium-term traders can also get there. Again, the question is not whether you will fall victim to a bull trap or a bear trap, but how effective your risk management system is and how much loss you will incur. Remember that getting 100% profit always and everywhere is unrealistic. At some point, everyone loses.

In short, bear and bull traps are standard patterns in the crypto market. They are formed only after a strong trend movement. It is impossible to identify them in advance with absolute certainty.

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.