- EUR/USD bounces off three-day highs and advances above parity level.

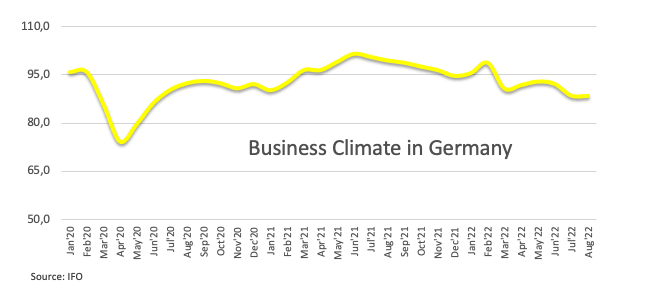

- The German business climate was almost unchanged in August,

- The Jackson Hole Symposium will be in the spotlight for the next few days.

The best overall tone in the risk complex makes the EUR/USD break above parity again, though the upside has so far stalled around 1.0030/35 on Thursday.

The EUR/USD slope of the dollar and Jackson Hole

EUR/USD extends the rebound from the cyclical lows in the 0.9900 zone recorded earlier in the week, thanks to the dollar’s renewed bid stance.

In fact, the Dollar Index (DXY) is retreating from the area of recent highs north of 109.00, as investors appear to have priced in a 75 basis point rate hike in September, as well as a hawkish speech from Jerome Powell on Friday.

On the national calendar, Germany’s business climate, according to the IFO Institute, fell slightly in August to 88.5 (from 88.6), while French business confidence fell to 104 in the same month (from 106) and the final figures showed a GDP growth rate in Germany of 1.7% year-on-year and 0.1% quarter-on-quarter in the second quarter. Later in the session, the ECB will publish the minutes of the last meeting.

Across the Atlantic, another revision of US GDP will be released alongside the initial weekly claims.

EUR/USD Levels

So far, the pair is up 0.44% at 1.0006 and faces the next resistance at 1.0202 (August 17 high), followed by 1.0256 (55-day SMA) and finally 1.0368 (monthly maximum of August 10).

On the other hand, a break below 0.9899 (Aug 23 2022 low) would target 0.9859 (December 2002 low) on track for 0.9685 (October 2022 minimum).

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.