- EUR/USD falls below 0.9900 and marks new cycle lows.

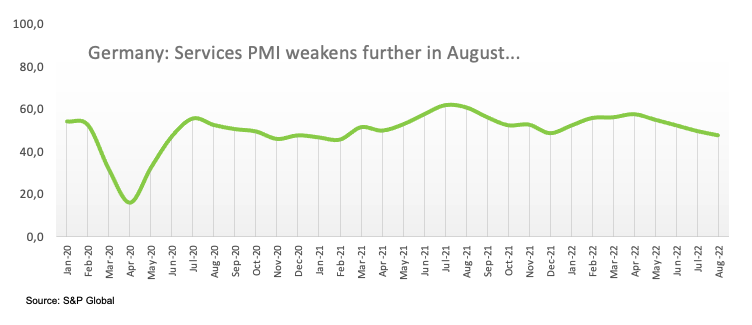

- Germany’s final services PMI stood at 47.7 in August.

- US markets will remain closed due to the Labor Day holiday.

The sellers returned to the European currency and dragged EUR/USD to new lows in the 0.9880/75 region for the first time since December 2002 during the European session on Monday.

EUR/USD weakens on dollar strength and ECB caution

The EUR/USD manages to leave behind the initial pessimism and bounces from nearly two-decade lows below 0.9900 at the beginning of the week, always against the background of a new buying interest around the dollar.

Indeed, the DXY dollar index surged to a 20+ year high above the 110.00 barrier before the opening bell in the old continent on Monday as investors continue to adjusting to the prospects of additional rate hikes by the Fed in the coming months.

However, and before the appointment of the Fed, the ECB will meet at the end of this week and investor expectations still seem to favor a 75 basis point rate hikeall this in the midst of high inflation that does not stop and with the specter of energy collapse that continues to haunt the region.

Regarding the economic data, the final figures of the Services PMI in Germany was 47.7 in August, while in the eurozone as a whole it was 49.8. Later in the session, retail sales in the euro zone will close the daily calendar.

What can we expect around the EUR?

The EUR/USD remains under pressure and breaks the 0.9900 level to flirt with levels last seen almost 20 years ago.

For now, the price action around the European currency is expected to closely follow the dynamics of the dollar, geopolitical concerns, fragmentation fears and the divergence between the Fed and the ECB. The latter, meanwhile, closely follows the prevailing debate about the magnitude of the next interest rate hikes by both the ECB and the Federal Reserve.

Among the negative aspects for the common currency are the growing speculations about a possible recession in the region, which seem to be underpinned by the decline in sentiment indicators, as well as by the incipient slowdown in some fundamental variables.

EUR/USD levels

At time of writing, the EUR/USD pair is down 0.39% on the day, trading at 0.9912. A break of 0.9877 (Sep 5 low) would target 0.9859 (Dec 2002 low) on the way to 0.9685 (Oct 2002 low). On the other hand, there is initial resistance at 1.0090 (26 Aug high), ahead of 1.0192 (55-day SMA) and 1.0202 (17 Aug high).

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.