- EUR/USD bulls need a dovish speech from Fed Chairman Powell, which could weigh on the US dollar.

- A break of the session highs would leave 1.0725 vulnerable in the short term.

- The daily ATR is 100 points, so there is room for a range extension during the day.

He EUR/USD is hitting a wall of resistance in the US session as the countdown begins for the Federal Reserve’s Jerome Powell intervention. In the next few moments he will give a speech at the Economic Club of Washington, DC Signature Event.

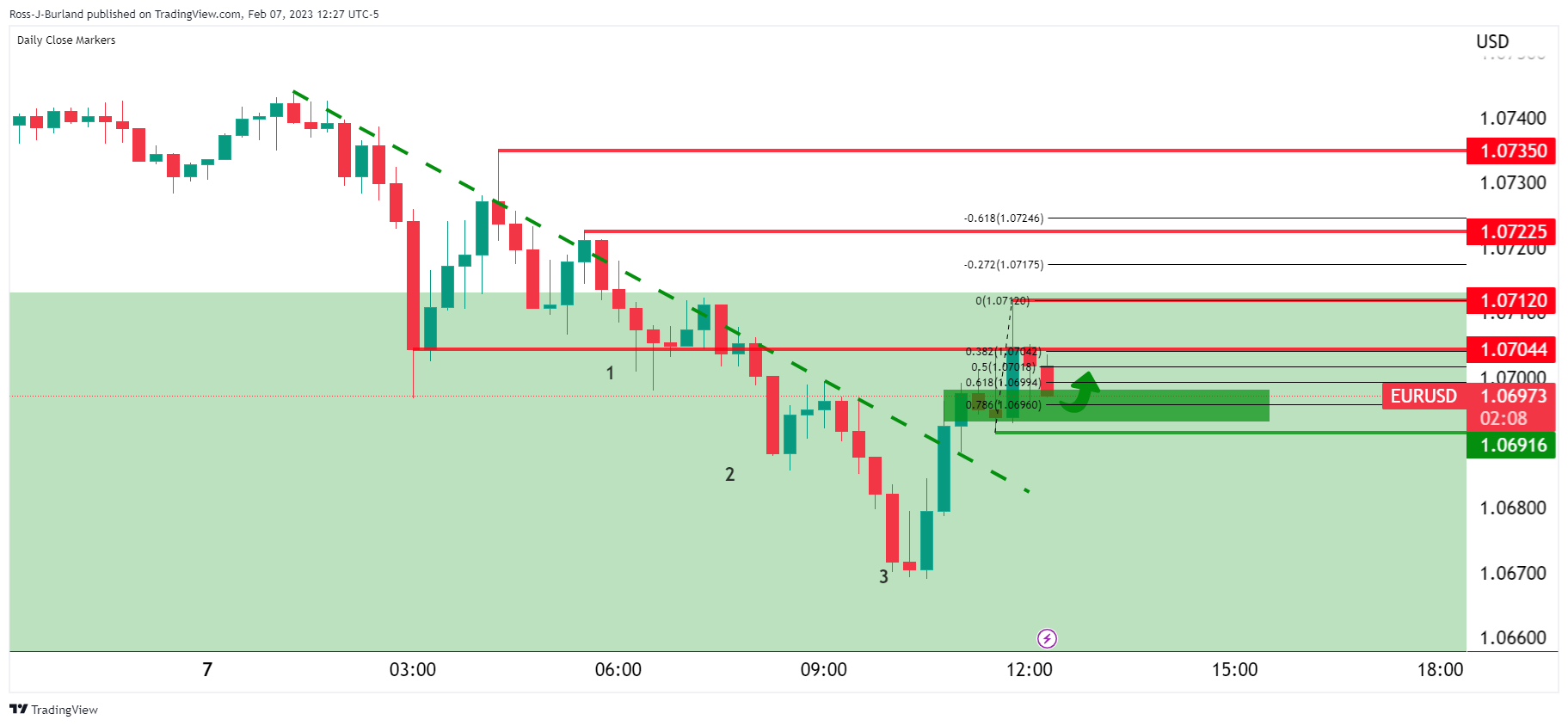

On the eve of the event, the US dollar came under pressure that gave euro bulls some life. We have seen a rally from the session lows that created a three-push pattern on the 15-minute chart and a subsequent burst higher an hour after the open on Wall Street.

Illustrated below is the breakout of the structure and the prospects for a continuation to the upside based on the outcome of the Powell event.

EUR/USD M15 chart

The bulls have entered:

extended …

However, prior to the event, there is reluctance to hold stocks. If the talk is dovish, the dollar could take a hit and prices could break out of the session highs and head for 0.725 in the near term. The daily ATR is 100 pips, so there is room for a range extension during the day, as the market has only completed around 75% ATR so far.

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.