- EUR/USD is recovering from its weekly lows and trading at 1.0818 following Jerome Powell’s comments about a possible pause in the Fed’s tightening cycle.

- Progress in the US debt ceiling negotiations sparks optimism, with House Speaker McCarthy suggesting a deal could be reached over the weekend.

- In the Eurozone, the Producer Price Index rises month by month, while the ECB officials express their concern about the inflation of services, advocating a rise in rates.

He EUR/USD It is rebounding from its weekly lows after breaking through the 100-day EMA, recovering to 1.0800 following the remarks by Jerome Powell of the US Federal Reserve, in which he opened the door for a pause in the Fed’s tightening cycle. In addition, the risk-off momentum weighed on bullish market sentiment, which weighed on the US dollar. At the time of writing, the EUR/USD pair is trading at 1.0818, after hitting a low of 1.0759.

Investor optimism grows as US debt ceiling discussions progress and European Central Bank monitors inflation

US stocks post solid gains. Fed Chairman Jerome Powell noted that inflation is currently above the target level and underscores the Fed’s unwavering commitment to steer inflation back toward the 2% target, saying “failure would do more damage.” In addition, Powell pointed to the strength of the banking system and suggested that tightening bank credit conditions could prevent a possible rate hike.

The sparse US economic calendar left investors pondering the recent data. The strength of retail sales and industrial production boosted the demand for the dollar. This, coupled with the drop in jobless claims, has led investors to reconsider the three rate cuts planned by the Federal Reserve (Fed) for the end of the year. As a consequence, the probability of a rate hike in June has gone from 15% to 40.4% in one week.

As for the US debt ceiling discussions, House Speaker McCarthy and Senate Majority Leader Schumer are preparing to schedule votes in the coming days. McCarthy was optimistic that the current discussions could lead to a deal this weekend, declaring: “Now I see that a deal can be reached.”

In the Eurozone, Germany’s Producer Price Index (PPI) rose 0.3% mom, up from -1.4% in the prior month. In annual terms, the PPI rose 4.1%, which represents a sharp slowdown from 6.7% in March. The data serve as support for the statements of members of the European Central Bank (ECB).

Earlier in the day, remarks by Fed officials made headlines. Fed Williams mentioned that the natural interest rate remains low despite the pandemic. By contrast, Michelle Bowman chose not to comment on monetary policy.

On the front of the European Central Bank, Vice President Luis de Guindos pointed out that “inflation in services is what worries the ECB the most”, which justifies high rates. On Friday, ECB President Christine Lagarde added that the central bank must keep rates “sustainably higher” to combat inflation.

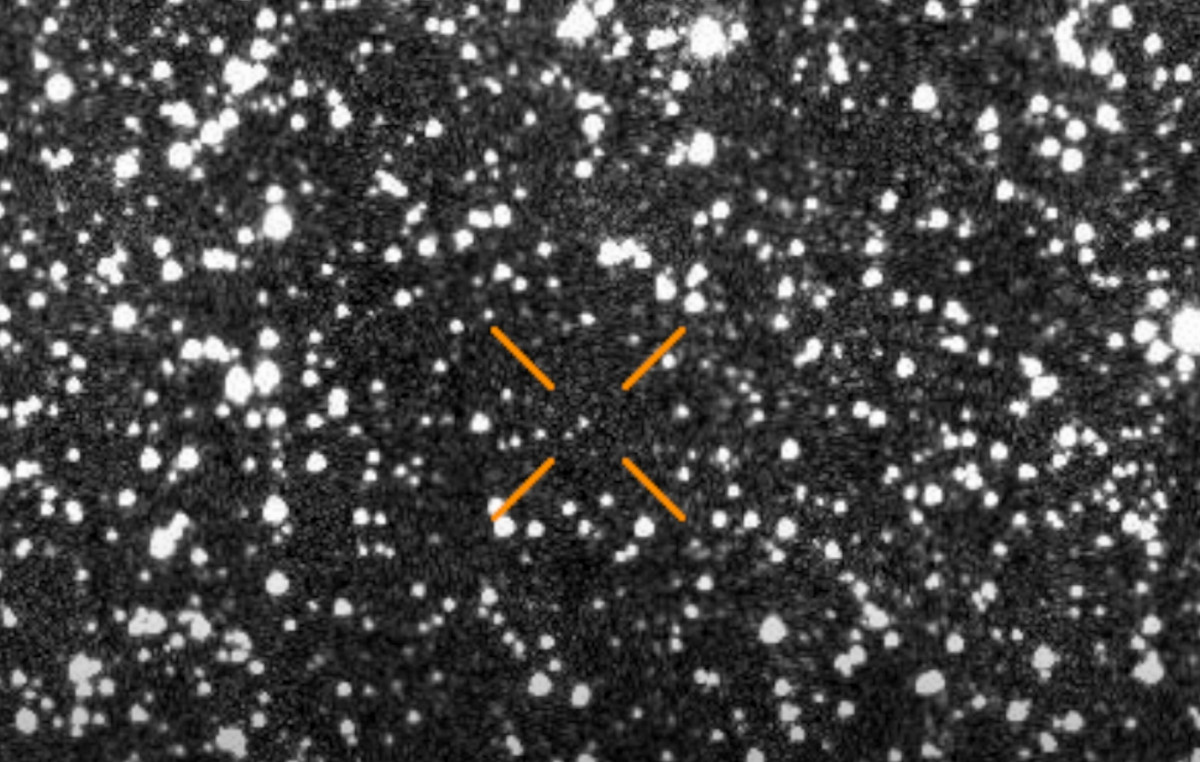

EUR/USD Technical Analysis

EUR/USD

| Overview | |

|---|---|

| Last price today | 1.0821 |

| Today I change daily | 0.0051 |

| today’s daily variation | 0.47 |

| today’s daily opening | 1,077 |

| Trends | |

|---|---|

| daily SMA20 | 1.0961 |

| daily SMA50 | 1.0891 |

| daily SMA100 | 1.0807 |

| daily SMA200 | 1.0464 |

| levels | |

|---|---|

| previous daily high | 1.0848 |

| previous daily low | 1.0762 |

| Previous Weekly High | 1.1054 |

| previous weekly low | 1.0848 |

| Previous Monthly High | 1.1095 |

| Previous monthly minimum | 1.0788 |

| Fibonacci daily 38.2 | 1.0795 |

| Fibonacci 61.8% daily | 1.0815 |

| Daily Pivot Point S1 | 1.0739 |

| Daily Pivot Point S2 | 1.0708 |

| Daily Pivot Point S3 | 1.0654 |

| Daily Pivot Point R1 | 1.0825 |

| Daily Pivot Point R2 | 1.0879 |

| Daily Pivot Point R3 | 1,091 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.