- The EUR/USD pair took a step back in early trading on Tuesday, and bidders are looking to bounce back.

- Economic data from the US and EU in mid-week will complicate the charts.

- The ECB’s rate call is just around the corner, along with US inflation figures due out soon.

The EUR/USD pair is determined to restore balance on Tuesday and is pushing 1.0735 in afternoon trading after falling to intraday lows near 1.0705.

The Euro (EUR) is at lows against the Dollar (USD) for the day, below Tuesday’s opening prices near 1.0747, and further below the early day’s peak of 1.0770.

The tug of war is likely to continue in the short term, as in the middle of the week the economic calendar is loaded with data, both from the US and the Eurozone (EU).

US and EU data

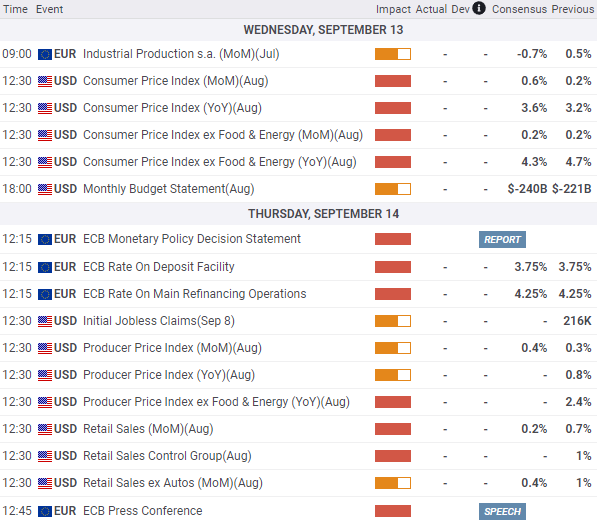

The US Consumer Price Index (CPI) figures and the federal government’s monthly budget report will be released on Wednesday. Market analysts expect the general CPI for August to rise to 0.6%, compared to 0.2% the previous month. For its part, the core CPI for August (CPI minus food and energy costs) would remain at 0.2% from the previous month.

The US federal budget deficit for August is also expected to decline, to $240 billion from $221 billion the previous month.

On Thursday, the European Central Bank (ECB) will make its latest interest rate announcement; Investors expect the ECB to keep interest rates stable, although recent hawkish comments from ECB officials have led to an increase in the number of market participants expecting a further rate hike.

30 minutes after the ECB’s interest rate decision, a press conference will be held where investors will be on the lookout for any clues about the European central bank’s interest rate policy.

Figures from the United States Producer Price Index (PPI) will also be published on Thursday, as well as retail sales. The monthly PPI for August is expected to rise, albeit slightly, from 0.3% to 0.4%. Meanwhile, retail sales growth is expected to decline to 0.2% from 0.7% in July. Although this is positive data, a contraction in growth figures could be a sign of a weakening economy, so market participants will be paying close attention to this publication.

EUR/USD Technical Outlook

The Euro fell against the Dollar during early trading on Tuesday, following an initial rise on the charts, and the pair is struggling to generate significant momentum from the 100 hourly SMA. The hourly MACD histogram begins to turn bullish, and the moving average is preparing to exchange places with the indicator line.

The EUR/USD pair has closed in the red for the last eight consecutive weeks, and buyers will try to reverse the pair’s recent rejection of the 100-day SMA, which has turned flat and threatens to turn bearish. Additionally, the bearish reversal of the 100-day SMA and 50-day EMA complicates the bids.

Meanwhile, the MACD on daily candles shows oversold conditions, although the MACD slow line histogram shows more room for EUR/USD to fall further in the event of a failed bid to restore bullish momentum.

EUR/USD Daily Chart

EUR/USD technical levels

EUR/USD

| Overview | |

|---|---|

| Latest price today | 1.0734 |

| Today Daily variation | -0.0016 |

| Today’s daily variation | -0.15 |

| Today’s daily opening | 1,075 |

| Trends | |

|---|---|

| daily SMA20 | 1.0819 |

| daily SMA50 | 1.0946 |

| SMA100 daily | 1.0908 |

| SMA200 daily | 1.0825 |

| Levels | |

|---|---|

| Previous daily high | 1.0759 |

| Previous daily low | 1.0701 |

| Previous weekly high | 1.0809 |

| Previous weekly low | 1.0686 |

| Previous Monthly High | 1.1065 |

| Previous monthly low | 1.0766 |

| Daily Fibonacci 38.2 | 1.0737 |

| Fibonacci 61.8% daily | 1.0723 |

| Daily Pivot Point S1 | 1.0714 |

| Daily Pivot Point S2 | 1.0678 |

| Daily Pivot Point S3 | 1.0656 |

| Daily Pivot Point R1 | 1.0773 |

| Daily Pivot Point R2 | 1.0795 |

| Daily Pivot Point R3 | 1.0831 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.