- The rebound of the Euro accelerates against the Dollar.

- European stocks show some weakness after the US data.

- The Dollar Index (DXY) loses ground and retests the 103.30 zone.

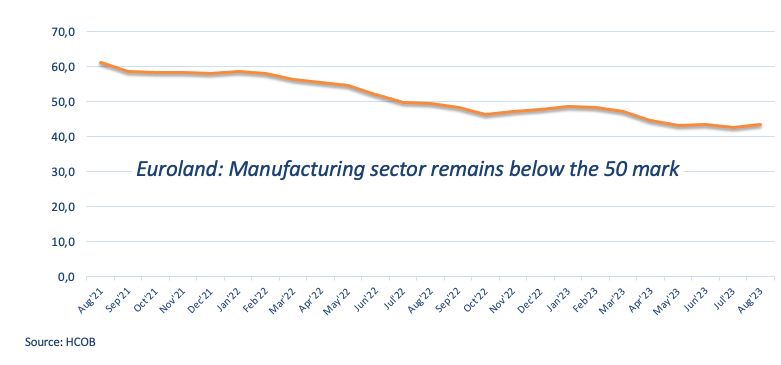

- No surprises in the final German and Eurozone manufacturing PMIs.

- US Nonfarm Payrolls surprise to the upside with 187,000 jobs in August.

He Euro (EUR) manages to gain momentum against the Dollar (USD) after the publication of the US NFP, raising the EUR/USD to the 1.0880 zone by the end of the week.

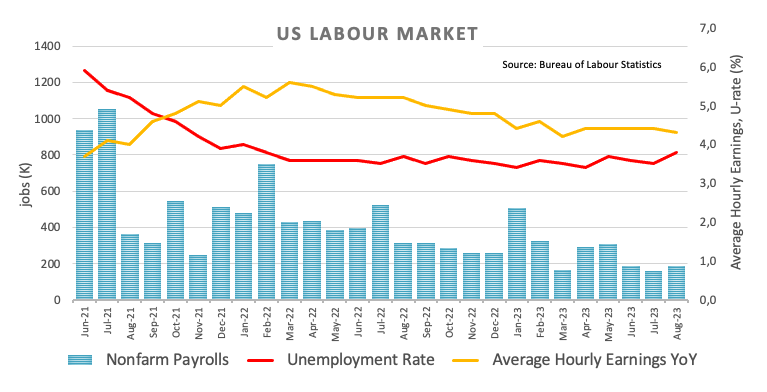

The pair’s advance is in line with the dollar’s renewed bid stance. He Dollar Index (DXY), which tracks the dollar against a basket of six other major currencies, deflates to the 103.30 zone after the US economy added 187,000 jobs in August, more than initially estimated. However, the unemployment rate rose unexpectedly to 3.8% (from 3.5%) and average hourly earnings – a proxy for wage inflation – rose 4.3% from a year earlier, also below consensus.

Meanwhile, investors continue to price in a pause by the Federal Reserve in its tightening campaign, especially in light of further signs of cooling in the US job market.

Returning to the European Central Bank (ECB), there is great uncertainty about the possible measures to be adopted after the summer, in the midst of a quite divided Governing Council and growing speculation about the possibility that a stagflation scenario is brewing. in the region.

In terms of data, the final manufacturing PMIs for Germany and the Eurozone stood at 39.1 and 43.5 respectively in August. These figures, which signal a persistent contraction in industrial activity, were broadly in line with preliminary estimates.

Later in the US session, the ISM manufacturing PMI will take center stage, followed by construction spending and the final S&P global manufacturing PMI.

Daily Market Roundup: Euro Extends Rebound After Payrolls

- The Euro rebounds against the Dollar.

- The final PMIs for Europe were broadly in line with the preliminary data.

- China’s Caixin manufacturing PMI returned to the expansionary path.

- The PBOC cut the benchmark interest rate to 4% to support the Chinese yuan.

- Investors’ attention is now focused on the ISM manufacturing PMI.

- The US economy added 187,000 jobs in August, according to NFP figures.

- Investors reckon the Fed will be on hold for the rest of the year.

Technical Analysis: Euro now seeks 1.0900 and higher

EUR/USD regains some bullish traction after Thursday’s sharp pullback and 3-day lows near 1.0830.

Should the bulls regain control and EUR/USD breaks above Wednesday’s weekly high at 1.0945, the pair is expected to reach the interim 55-day SMA at 1.0965 before the psychological barrier of 1.1000 and the monthly high of August 10 at 1.1064. Once the latter is broken, the pair could challenge the July 27 high at 1.1149. If the pair breaks above this zone, it could relieve some of the bearish pressure and potentially visit the 1.1275 high reached on Jul 18, 2023. Further up is the 2022 high at 1.1495, closely followed by the round level of 1.1500.

The resumption of the downside bias could motivate the pair to initially test the key 200-day SMA at 1.0815 before the August 25 low at 1.0765. The break of the latter exposes the May 31 low at 1.0635 before the March 15 low at 1.0516 and the 2023 low at 1.0481 recorded on January 6.

Sustained losses in EUR/USD are likely once the 200-day SMA breaks convincingly.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.