- The GBP/USD pair is trading flat but struggling on Friday, trying to hold above the 1.2400 area.

- The British pound’s mid-week recovery remains under threat as markets trim gains.

- Falling UK data is strengthening the Pound.

GBP/USD remains just above the 1.2400 area as the pair grapples with the upper end of the recent consolidation. The British Pound (GBP) is struggling to maintain gains against the US Dollar (USD) this week.

The Pound peaked at 2.25% against the dollar in mid-week, and has since retreated to a more reasonable 1.65%.

Despite a broad market risk bid fueled by markets once again speculating that the Federal Reserve (Fed) has ended interest rate hikes, GBP/USD remains stuck in the mid-range as UK data misses the mark.

UK retail sales fall 0.3% month-on-month in October

UK retail sales fell month-on-month, with the October figure at -0.3%, a reversal of the market forecast for a 0.3% rise. However, investors focused on the losses of recent months as September’s figure was revised even further downwards, going from -0.9% to an exorbitant -1.1%.

Annualized UK retail sales were even worse, at -2.7% in October versus -1% previously, and accelerating above the -1.5% forecast.

Next week investors will pay attention to the release of Minutes from the latest Fed meeting on Tuesday.

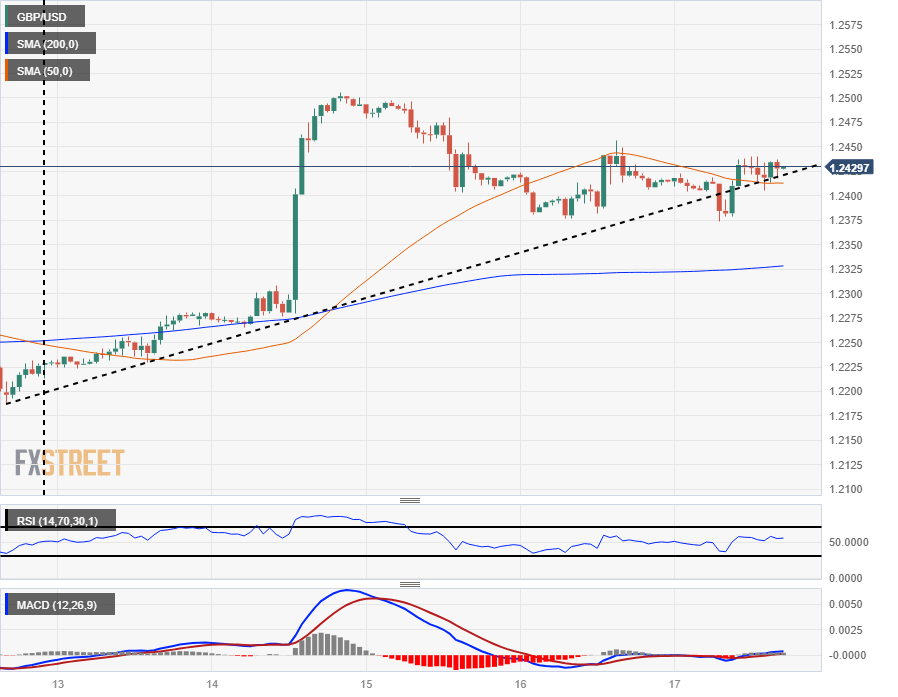

GBP/USD Technical Outlook

The GBP/USD pair is in positive territory for the week, up 1.65%, as the British pound holds on to what remains of its mid-week gains.

A short-term uptrend line from last week’s lows near 1.2200 continues to keep intraday action higher as hourly candles battle the 50-hourly SMA, but a 200-hourly SMA that flattens is poised to continue attracting bids back to the mid-range.

Daily candlestick charts have GBP/USD tied to the 200-day SMA as the pair struggles to develop new long-term momentum, with this week’s high in the 1.2500 area representing the key figure to beat for the Bulls.

GBP/USD Hourly Chart

GBP/USD Daily Chart

GBP/USD Daily Chart

GBP/USD Technical Levels

GBP/USD

| Overview | |

|---|---|

| Latest price today | 1.2428 |

| Today I change daily | 0.0019 |

| Today’s daily variation | 0.15 |

| Today’s daily opening | 1.2409 |

| Trends | |

|---|---|

| daily SMA20 | 1.2248 |

| daily SMA50 | 1.2257 |

| SMA100 daily | 1.2511 |

| SMA200 daily | 1.2442 |

| Levels | |

|---|---|

| Previous daily high | 1.2456 |

| Previous daily low | 1.2376 |

| Previous weekly high | 1.2429 |

| Previous weekly low | 1.2187 |

| Previous Monthly High | 1.2337 |

| Previous monthly low | 1.2037 |

| Daily Fibonacci 38.2 | 1.2407 |

| Fibonacci 61.8% daily | 1.2426 |

| Daily Pivot Point S1 | 1.2372 |

| Daily Pivot Point S2 | 1.2334 |

| Daily Pivot Point S3 | 1.2292 |

| Daily Pivot Point R1 | 1.2451 |

| Daily Pivot Point R2 | 1.2493 |

| Daily Pivot Point R3 | 1.2531 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.