- The GBP/USD bearish thesis on the daily chart remains valid around the US CPI.

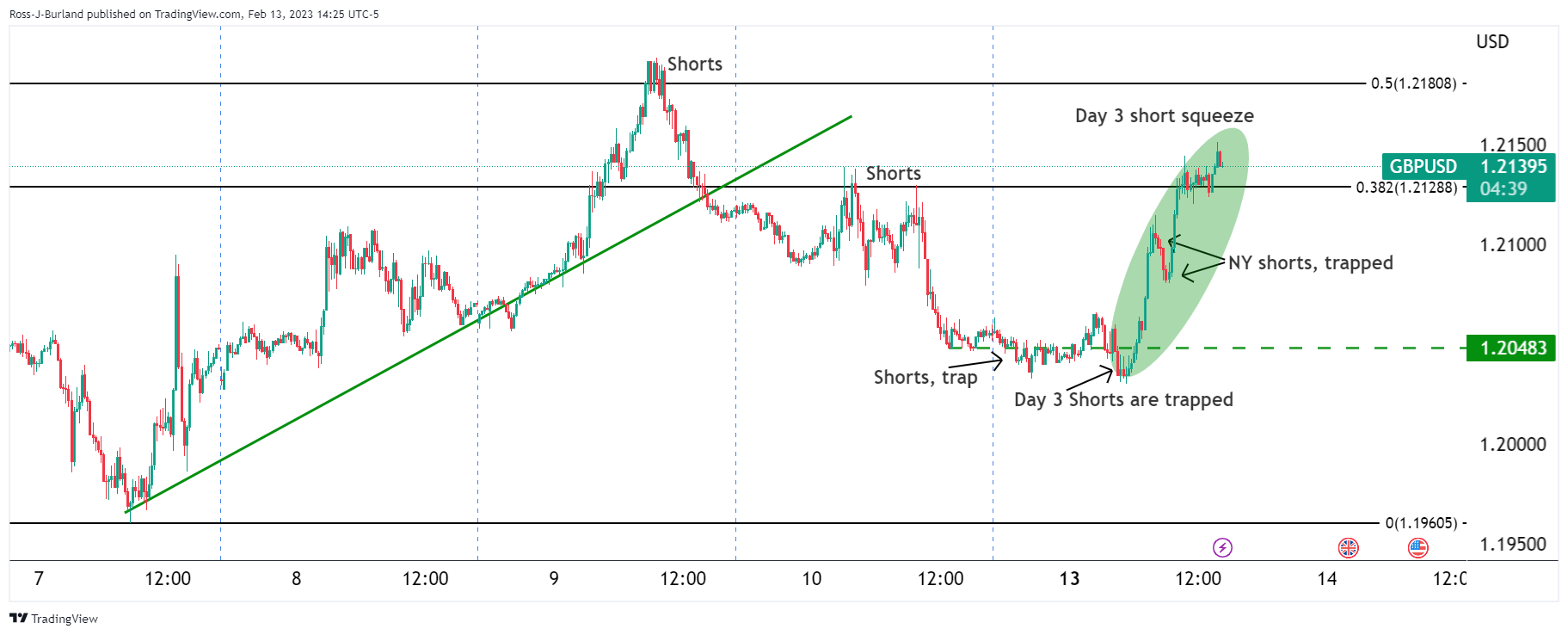

The pair GBP/USD has been on a roll as it pulls away from the shorts caught at the start of the day that were looking for a break below 1.2050 for the opening balance of the week. At the time of writing, GBP/USD is trading at 1.2140 and up 0.8% on the day.

Illustrated below are price developments and the case for a long position in the American session, pending this week’s fundamental data on the US Consumer Price Index and US Retail Sales. next day.

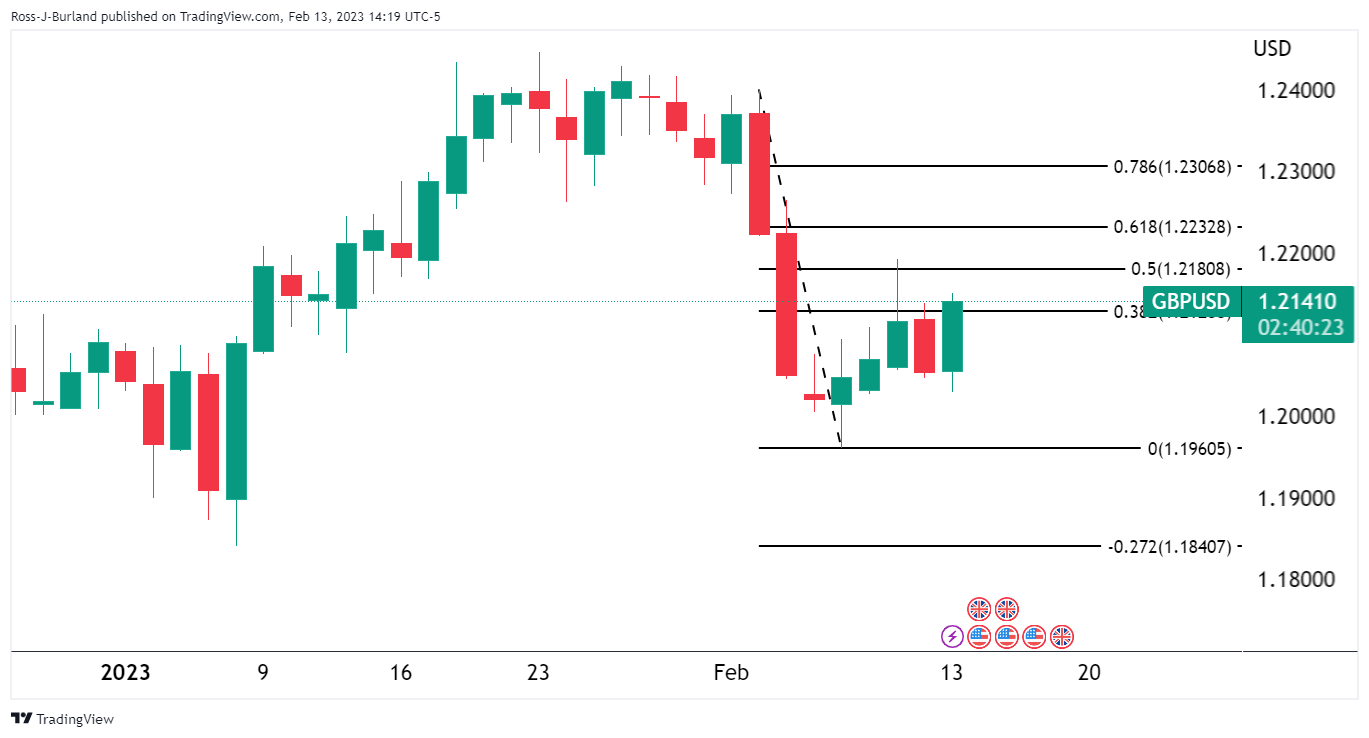

GBP/USD daily chart

At first glance earlier in the day, the market seemed poised for a bearish continuation given the correction to 50% mean reversion and strong rejection from bears. However…

The bulls put in a short squeeze as illustrated above.

GBP/USD M15 Chart

As illustrated, the market was overwhelmed by sellers and the bulls took advantage of that to start the week. On Thursday, there was an influx of supply and on Friday more shorts entered the market. On Monday, the bears tried to get on board with what looked like an extension to the downside and an opportunity to break below 1.2050. However, there was a breakout of the structure to the long side, as follows:

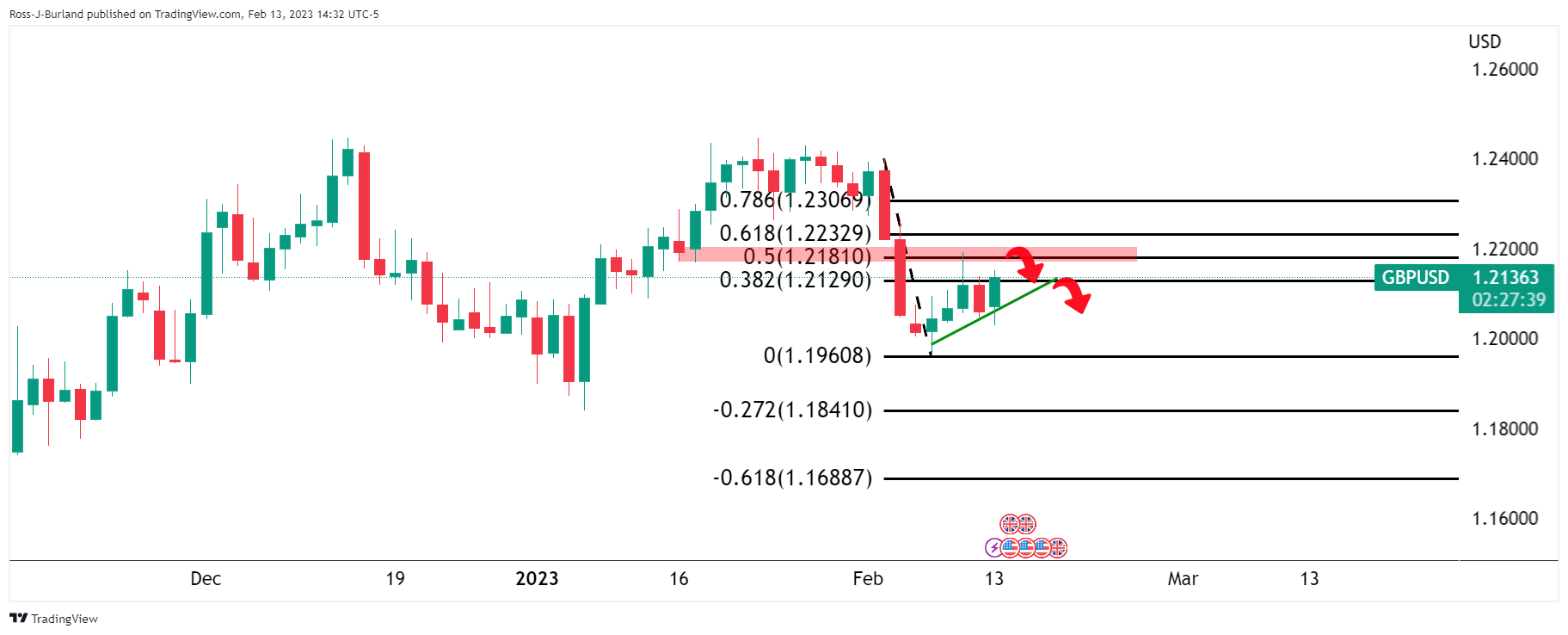

GBP/USD bears still in play

However, the bearish thesis on the daily chart remains valid around CPI US with price still below the psychological level of 1.2200 and 50% mean reversion resistance having a confluence with the front support facing left:

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.