- GBP/USD is trading at 1.2395, with slight gains, but still below the key 1.2400 level.

- The Federal Reserve is expected to keep rates steady, while the Bank of England is expected to raise rates by 25 basis points.

- UK inflation data and the US Federal Reserve’s monetary policy decision are the key developments to watch this week.

The British pound (GBP) halts last week’s decline against Dollar (USD) and made minuscule gains against the latter despite rising US Treasury yields as the UK and US central banks are expected to reaffirm their restrictive stance. Thus, the GBP/USD pair is trading at 1.2395 after reaching a daily low of 1.2369, although it is still below 1.2400.

The British Pound stabilizes against the Dollar, as the Federal Reserve and the Bank of England announce their monetary policy decisions.

US stocks extended losses as sentiment deteriorates ahead of central bank bonanza. The Federal Reserve is expected to keep rates unchanged amid the latest round of economic data, which revealed rising inflation on the consumer and producer side. Instead, consumer spending expanded, although at a slower pace.

The Federal Funds Rate (FFR) would likely remain in the 5.25%-5.50% range, and at the same meeting, Fed officials would update their economic projections. In the June Summary Economic Projections (SEP), the Fed anticipated economic growth of 1%, an unemployment rate of 4.1%, PCE inflation of 3.2%, core PCE inflation of 3.9%, and a maximum FFR of 5.60. %.

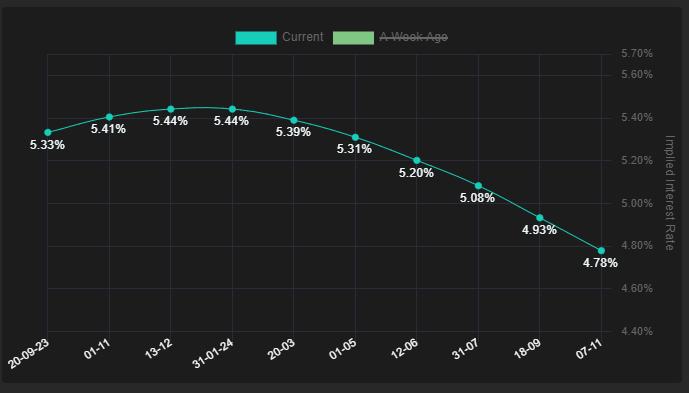

The swap market shows that the FFR would reach its maximum level at current prices, while estimates for the first rate cut are in July 2024, as the image below shows.

Source: Financialsource

Across the pond, the Bank of England (BoE) is expected to raise rates by 25 basis points, to 6.50%, which, according to swap markets, would be the highest level expected. Although UK inflation has fallen from 11.1% to 6.8%, it is the highest among developed countries, and is falling at a slower rate than estimated. Furthermore, the UK economy is slowing more than economists expected, which could deter the BoE from continuing to increase Bank Rate due to the risk of triggering a recession.

The UK economic docket will reveal data on inflation ahead of the BoE decision on Wednesday. A rebound in the Consumer Price Index (CPI) is expected, while the core CPI would slow down a bit. The main event of the week on the US front would be the Federal Reserve’s monetary policy decision, followed by Fed Chairman Jerome Powell’s press conference.

GBP/USD Price Analysis: Technical Outlook

The bearish bias remains intact, as the daily chart shows. With GBP/USD trading below the 50-day and 200-day moving averages (DMAs) while moving lower and hitting a successive series of lower highs and lower lows, it would keep the GBP/USD pair around current levels. . To change its neutral bias, buyers must break the last swing low of August 25 at 1.2548; Otherwise, further declines are expected, with sellers targeting the May 25 low at 1.2308. Below that level, further declines are expected, with the March 15 swing low at 1.2010.

GBP/USD

| Overview | |

|---|---|

| Latest price today | 1.2393 |

| Daily change today | 0.0010 |

| Today’s daily variation | 0.08 |

| Today’s daily opening | 1.2383 |

| Trends | |

|---|---|

| daily SMA20 | 1.2559 |

| daily SMA50 | 1.2723 |

| SMA100 daily | 1.2652 |

| SMA200 daily | 1.2433 |

| Levels | |

|---|---|

| Previous daily high | 1,241 |

| Previous daily low | 1,237 |

| Previous weekly high | 1.2548 |

| Previous weekly low | 1.2379 |

| Previous Monthly High | 1.2841 |

| Previous monthly low | 1.2548 |

| Daily Fibonacci 38.2 | 1.2395 |

| Fibonacci 61.8% daily | 1.2386 |

| Daily Pivot Point S1 | 1.2365 |

| Daily Pivot Point S2 | 1.2348 |

| Daily Pivot Point S3 | 1.2325 |

| Daily Pivot Point R1 | 1.2406 |

| Daily Pivot Point R2 | 1.2428 |

| Daily Pivot Point R3 | 1.2446 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.