- GBP/USD bears could be lurking and ready to move below 1.2400.

- US data remains a thorn in the side for dollar bulls.

The pair GBP/USD it has rallied on the day, trading as high as 1.2377 in recent trade, while the US dollar tumbles, causing a flight into riskier assets and riskier currencies such as sterling. Sterling rallied from a low of 1.2312 as Bank of England interest rate sentiment continues to support the currency despite bearish technical developments on the charts (more on that below).

Meanwhile, there are several issues at stake: the US dollar, on the one hand, has been under pressure following new disinflationary economic data on Thursday, which has shown that the US economy is losing momentum. On the other hand, the yen has bounced as traders continue to bet that the Bank of Japan will stop its ultra-easy monetary policy.

Disinflationary background in the United States

In terms of data, yesterday the Federal Reserve’s Beige Book showed that since the previous report, overall economic activity has been relatively flat, and overall contacts expected little growth in the coming months.

key notes

Sales prices increased at a modest or moderate pace in most districts, although many said the pace of increases had slowed compared to recent reporting periods.

Employment continued to grow at a modest or moderate rate in most districts.

In In general, growth expectations for the coming months are low.

Wage pressures remained high in all districts, although five reserve banks reported that these pressures had eased slightly.

Before this publication, the Producer Price Index, the PPI and Retail Sales, which showed disinflationary tendencies in the data, reinforced expectations that the Federal Reserve will continue to reduce its pace of tightening in the coming meetings.

It is also worth noting that US Atlanta Fed GDP stood at 3.5% in the fourth quarter (4.1% previously).

Meanwhile on Thursday, although the Philadelphia Federal Reserve’s monthly manufacturing survey showed a marked improvement in the prices paid index, which skidded to 24.5 in January from 36.3 last month, the reading nonetheless , which is a key measure of inflation at the producer level, it was the lowest since August 2020.

The fourth-quarter earnings outlook also “looks grim,” Reuters reports: “Companies are reporting earnings 2.6% above expectations, compared with a long-term average of 4.1% since 1994 and 5.3% in the last four quarters, according to IBES data from Refinitiv”.

the dollar recedes

Subsequently, the US Dollar Index, DXY, has been unable to lift off the bottom, an area on the charts marked as a bearish target as follows:

”The DXY index, above, shows the US dollar finding resistance in a W formation on the hourly chart. A supply correction could be expected to find 102.00/25 in the next few sessions as price returns to the neckline of the pattern at a 38.2% correction of the Fibonacci level.”

Dollar Index Update:

Bank of England outlook supports GBP/USD

However, the British pound has not been able to really take off on its own despite the fact that the UK Consumer Price Index showed the day before that it is holding close to 40 year highs. In particular, data showed yesterday that there was a rise in services inflation and an acceleration in food and drink prices, which will be of some concern to Bank of England policymakers. ING analysts Bank, commenting on the Consumer Price Index, stated that “it is important to note that basic services rose from 6.4% to 6.8%, a fact that the Bank of England should take special account of and that, added to the wage data, should tip the balance towards a 50 basis point rise in February.”

Therefore, a hawkish Bank of England could still inject some resistance into the pound. Bank of England Governor Andrew Bailey argued earlier in the week that a shortage of workers in the labor market posed a “significant risk to lower inflation.” The implication is that the Bank could continue to be more hawkish. in its policy decisions this year,” Rabobank analysts said. We expect another 50 basis point rate hike in February and then three more 25 basis point rate hikes as the bank pushes to cut the last few percentage points. of inflation in the service sector, which will be more affected by wage growth,” say Rabobank analysts.

GBP/USD Technical Analysis

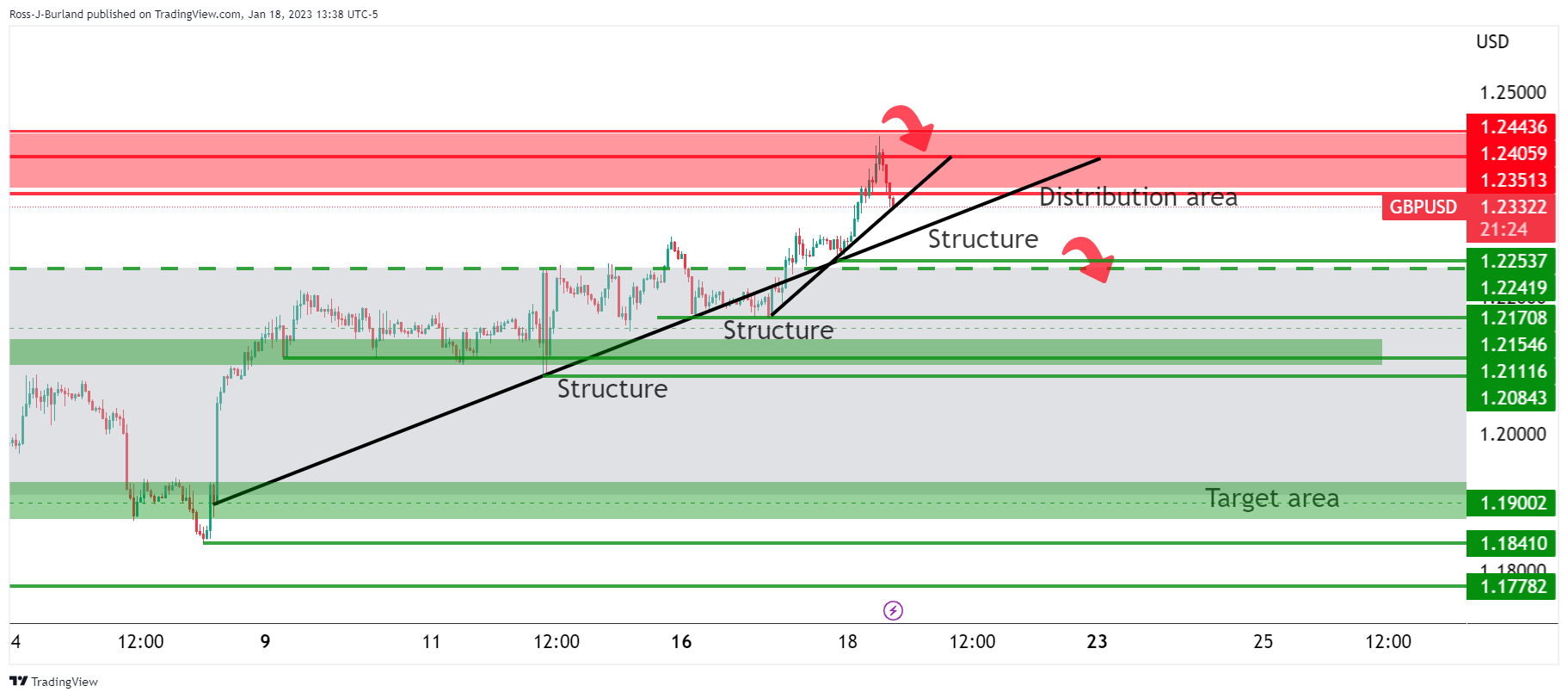

On the hourly time frame, GBP/USD micro trend line support was seen yesterday to watch the structure around 1.2250. A break there was explained to be a key development if it occurs as it would open up the risk of a GBP/USD blow-off to test the 1.2170 and then 1.2080 structure.

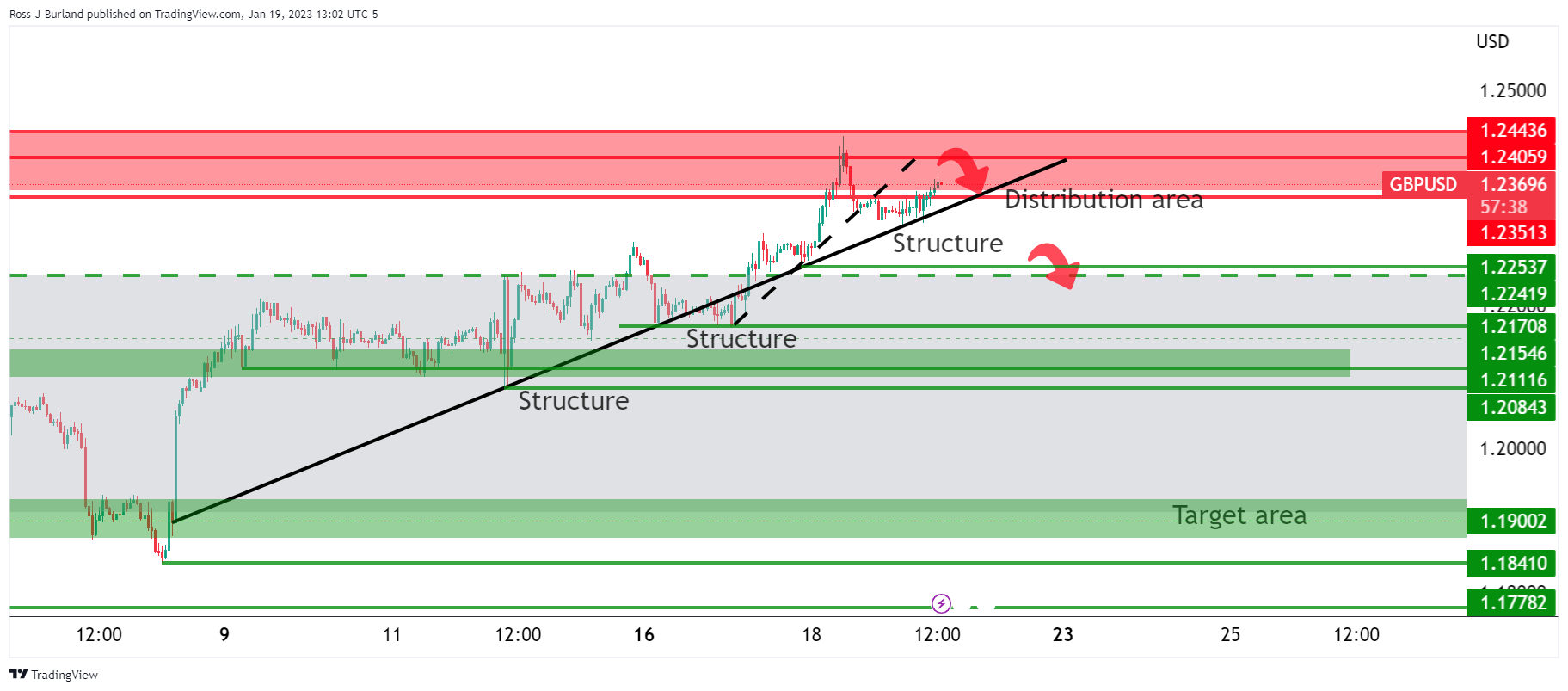

GBP/USD Update

As seen, the GBP/USD has effectively broken the micro trend line. It is perfectly natural for subsequent price action, depending on the market, to eat away at previous highs and that is what we are seeing: the mitigation of price imbalances left behind:

Therefore, the technical trend for GBP/USD remains bearish as long as it remains below 1.2400.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.