- The US Gross Domestic Product is expected to grow at an annualized rate of 2.5% in the first quarter.

- The current resilience of the US economy strengthens the case for a soft landing.

- Markets expect the Federal Reserve to begin its easing cycle in September.

The US Bureau of Economic Analysis (BEA) will publish on Thursday the first estimate of the Gross Domestic Product (GDP) for the January-March period. The report is expected to show economic expansion of 2.5% after growing at an annualized rate of 3.4% during the previous quarter.

US Gross Domestic Product Forecasts: Crunching the Numbers

Thursday's economic agenda in the US includes the publication of the first preliminary GDP report for the first quarter, scheduled for 12:30 GMT. Analysts anticipate that the first assessment will reveal a 2.5% growth rate for the world's largest economy in the January-March period, a moderately robust pace, although notably slower than the 3.4% expansion recorded in the preceding quarter.

From the latest BEA publication: “Real GDP increased by 2.5% in 2023 (from the annual level of 2022 to the annual level of 2023), compared to an increase of 1.9% in 2022. The increase in real GDP in 2023 primarily reflected increases in consumer spending, nonresidential fixed investment, state and local government spending, exports, and federal government spending that were partially offset by decreases in residential fixed investment and private inventory investment “Imports decreased.”

Market participants will also pay close attention to the GDP Price Index (GDP deflator), which represents the average change in the prices of all new domestically produced final goods and services in an economy over a specified period, usually a year. or a quarter. It essentially reflects the rate of inflation or deflation in an economy. During the last quarter of 2023, the GDP Price Index rose 1.7% and is now forecast to rise 3.0%.

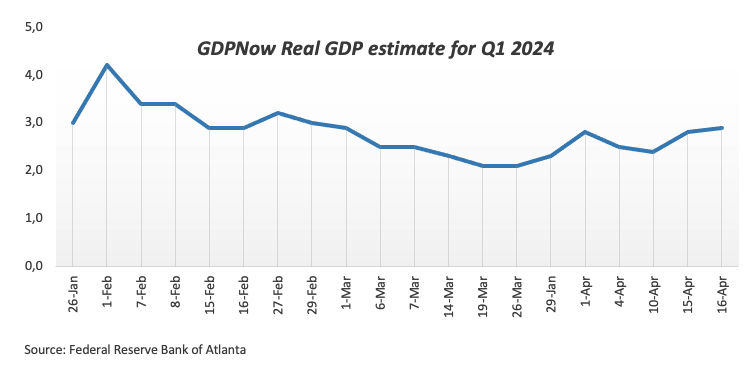

On the other hand, the Atlanta Fed's real GDP estimate for the first quarter also supports the solid performance of the US economy during that period.

According to analysts at TD Securities: “GDP growth is likely to have cooled slightly at the beginning of the year, but at a still firm pace following two stronger expansions of 4.9% and 3.4% quarter-on-quarter at a rate annualized (TA) in the third and fourth quarters of last year, respectively. Final domestic sales growth was probably firmer in the first quarter than the headline suggests (TD: 2.8% q/q TA), as we expect net trade and inventories to modestly dent still-solid consumer spending.”

When is the GDP published and how can it affect the Dollar?

The US GDP will be published this Thursday at 12:30 GMT. Meanwhile, the Dollar appears to have embarked on a consolidation phase ahead of the first estimate of US GDP for the first quarter, as well as inflation recorded by the Personal Consumption Expenditures (PCE) Price Index to be published on Friday.

Meanwhile, the macroeconomic outlook remains consistent with growing anticipation among market participants ahead of the US Federal Reserve's (Fed) first interest rate cut in September. In this regard, the CME Group's FedWatch tool considers that the probability of a drop in interest rates is around 70%, compared to almost 3% a month ago.

Still around the start of the Fed's easing cycle, Federal Reserve Bank of Atlanta President Raphael Bostic predicted that US inflation would reach 2% more gradually than previously anticipated, but he did not rush to cut rates. New York Federal Reserve Bank President John Williams stressed that the Fed's decisions are based on positive data and the strength of the economy, adding that the Fed can become restrictive if higher rates are needed. Fed Governor Michelle Bowman suggests efforts to reduce inflation may have hit a roadblock, creating uncertainty about the ability of interest rates to return to the Fed's target. Finally, in his latest comments, Fed Chairman Jerome Powell showed no rush to start reducing interest rates, coinciding with the general opinion of those responsible for setting rates.

A preview of the results

Higher-than-expected GDP growth in the first quarter could reinforce expectations that the Fed will delay the start of its easing program, probably until September or December, which in turn should translate into further strength in the US dollar (USD). ). The Dollar is also expected to remain firm in case the GDP price deflator increases.

Alternatively, a sharp change in sentiment around the US dollar, and therefore a challenge to the markets' current bets in favor of a rate cut at the end of the year, would require an unexpectedly worse data than estimated, which It seems pretty unlikely at the moment.

Technical data on the US Dollar Index (DXY)

Pablo Piovano, Senior Analyst at FXStreet, notes: “Should the bullish sentiment gain strength, the US Dollar Index (DXY) could face the high reached until 2024 at 106.51 (April 16). Breaking this level could encourage market participants to embark on a possible visit to the November high at 107.11 (November 1), just ahead of the 2023 high at 107.34 (October 3).”

Pablo adds: “Looking in the opposite direction, the April low at 103.88 (April 9) remains supported by the 200-day SMA at 103.99, and this area is expected to offer a decent containment. Breakout of this zone exposes a drop to the 100-day SMA at 103.67 before the March low at 102.35 (March 8).”

economic indicator

Annualized Gross Domestic Product

Annualized real Gross Domestic Product (GDP), published quarterly by the US Bureau of Economic Analysis, measures the value of final goods and services produced in the United States in a given time period. The evolution of GDP is the most popular indicator of the country's general economic health. The data is expressed at an annualized rate, meaning that the rate has been adjusted to reflect the amount that GDP would have changed within one year, if it had continued to grow at that specific rate. Generally speaking, a high reading is considered bullish for the US Dollar (USD), while a low reading is considered bearish.

More information.

Next post: Thu Apr 25, 2024 12:30 (Prel)

Periodicity: Quarterly

Consensus: 2.5

Former: 3 .4%

Fountain: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) publishes annualized Gross Domestic Product (GDP) growth for each quarter. After publishing the first estimate, the BEA reviews the data two more times, with the third release representing the final reading. Typically, the first estimate is the one that influences the market the most, and a positive surprise is considered positive for the dollar, while a disappointing data will likely weigh on the greenback. Second and third releases are often dismissed by market participants as they are typically not significant enough to alter the growth picture.

Frequently asked questions about GDP

What is GDP and how is it recorded?

The Gross Domestic Product (GDP) of a country measures the growth rate of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP with the previous quarter (for example, the second quarter of 2023 with the first quarter of 2023) or with the same period of the previous year (for example, the second quarter of 2023 with the second quarter 2022).

Annualized quarterly GDP figures extrapolate the quarter's growth rate as if it were constant for the rest of the year. However, they can be misleading if temporary shocks hit growth in one quarter but are unlikely to last all year, as was the case in the first quarter of 2020 with the outbreak of the coronavirus pandemic, when growth plunged.

How does GDP influence currencies?

A higher GDP result is usually positive for a nation's currency, as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attract greater foreign investment. Likewise, when GDP falls it is usually negative for the currency.

When an economy grows, people tend to spend more, which causes inflation. The country's central bank then has to raise interest rates to combat inflation, with the side effect of attracting more capital inflows from global investors, which helps the local currency appreciate.

How does the increase in GDP influence the price of Gold?

When an economy grows and GDP increases, people tend to spend more, which causes inflation. So, the country's central bank has to raise interest rates to combat inflation. Higher interest rates are negative for Gold because they increase the opportunity cost of holding Gold versus placing money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for the price of Gold.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.