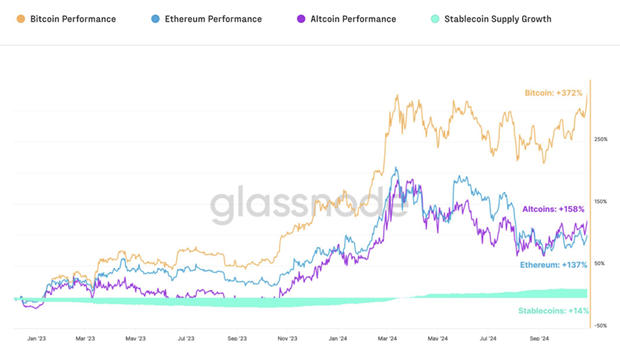

IN Glassnode And Fasanara Digital noted the rapid recovery of the crypto market after the bankruptcy of the crypto exchange FTX that started in November 2022. Since then, Bitcoin’s capitalization has increased by 372%, and the dominance of the first cryptocurrency has increased from 38% to almost 60%, and now the market is preparing for a change of phases.

Ether’s market share fell from 17% to 12.8% due to a lack of capital inflow and decreased interest in this asset from retail investors, experts said.

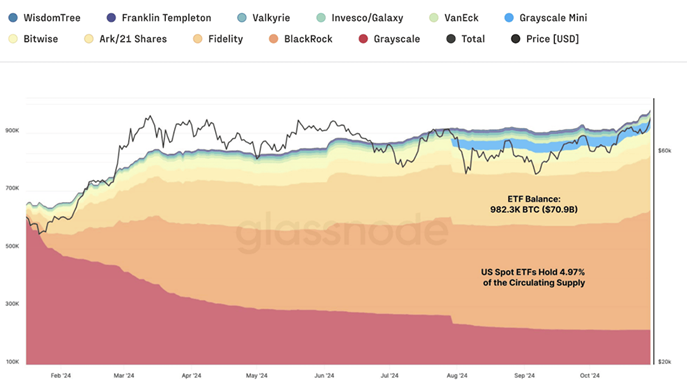

They drew attention to a sharp increase in the activity of institutional investors-legal entities, the reason for which was the launch of the first spot bitcoins.ETF in the USA. Assets under management of the funds reached $70.9 billion, which is about 5% of the circulating supply of Bitcoin.

Glassnode and Fasanara Digital specialists recorded an increase in the volume of Bitcoin spot trading and open futures positions for the first cryptocurrency – the latter reached a historical high of $37.1 billion.

One of the most important trends of the fourth quarter of 2024 was the tokenization of real world assets (RWA). Interest in RWA opportunities from investors continues to grow, experts concluded.

Previously, MV Global conducted a survey of large investors, the results of which revealed that investors believe that the cryptocurrency market will peak in the second half of 2025.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.