- Gold extends bounce from levels below $1700.

- Advance has next resistance at $1730.

The Prayed is rising modestly on Thursday and is trading at two-day highs at $1723, extending Wednesday’s advance. This comes in the face of a weakening dollar, lower Treasury yields, and ahead of the European Central Bank’s decision and Powell’s speech.

The dollar is pulling back against most currencies on Thursday. The 10-year Treasury bond yields 3.24%far from yesterday’s peak of 3.35%, while the 2-year tranche yields 3.43%, whereas the previous day it reached 3.52%.

Within minutes, the European Central Bank will announce its monetary policy decision, which is expected to be a hike of 75 basis points. Later it will be the turn of the report on unemployment benefits, Lagarde’s press conference and then a presentation by Jerome Powell.

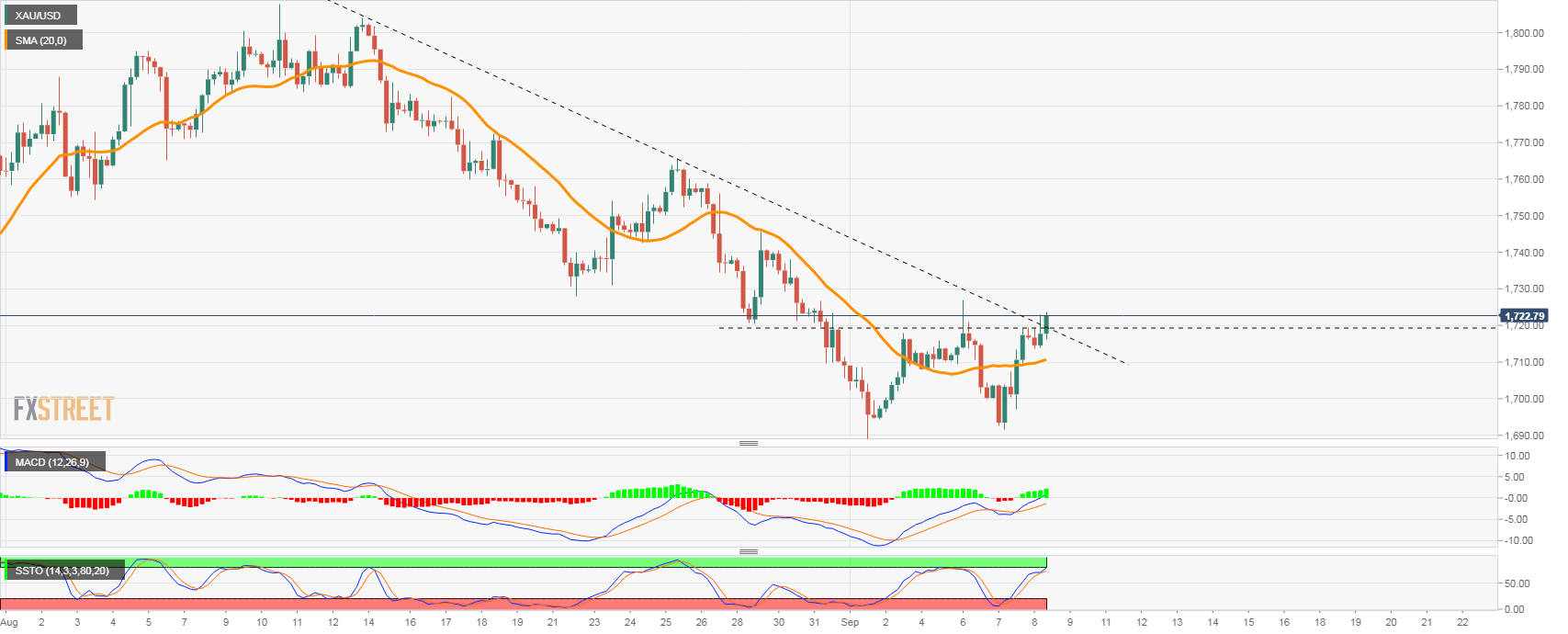

The technical landscape The very short-term price has improved for gold, after managing to hold onto long-term support, where the 2021 and 2022 lows are in the $1,675 area. The bounce from this level continues and is breaking a short-term bear line and the $1720 level.

If it continues above $1,720, the bias will be to the upside, with the next resistance at $1,730 and $1,740. A return below $1,710 would put XAUUSD under pressure again, exposing $1,700.

XAUUSD 4 hour chart

XAU/USD

| Overview | |

|---|---|

| Today last price | 1722.16 |

| Today Daily Change | 3.78 |

| Today Daily Change % | 0.22 |

| Today daily open | 1718.38 |

| trends | |

|---|---|

| Daily SMA20 | 1743.11 |

| Daily SMA50 | 1747.72 |

| Daily SMA100 | 1800.25 |

| Daily SMA200 | 1834.15 |

| levels | |

|---|---|

| Previous Daily High | 1719.54 |

| Previous Daily Low | 1691.47 |

| Previous Weekly High | 1745.58 |

| Previous Weekly Low | 1688.92 |

| Previous Monthly High | 1807.93 |

| Previous Monthly Low | 1709.68 |

| Daily Fibonacci 38.2% | 1708.82 |

| Daily Fibonacci 61.8% | 1702.19 |

| Daily Pivot Point S1 | 1700.05 |

| Daily Pivot Point S2 | 1681.73 |

| Daily Pivot Point S3 | 1671.98 |

| Daily Pivot Point R1 | 1728.12 |

| Daily Pivot Point R2 | 1737.87 |

| Daily Pivot Point R3 | 1756.19 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.