The Eigenlayer crypto project team has completed the second distribution of EIGEN tokens. Analysts from Arkham calculated who got the most coins. Despite the long-awaited unlocking of EIGEN, Eigenlayer statistics indicate a decrease in market participants’ interest in the project

We’ll tell you how the EIGEN airdrop went and what’s wrong with the Eigenlayer performance.

Who got the most EIGEN

The developers announced the launch of the EIGEN token on April 29, 2024. The first distribution of coins took place in May. Its conditions provoked a wave of criticism against the project team. Airdrop participants were outraged by the small size of the rewards and unclear restrictions.

The second distribution of EIGEN tokens took place in mid-September. Coin trading was launched only on the night of September 30 to October 1.

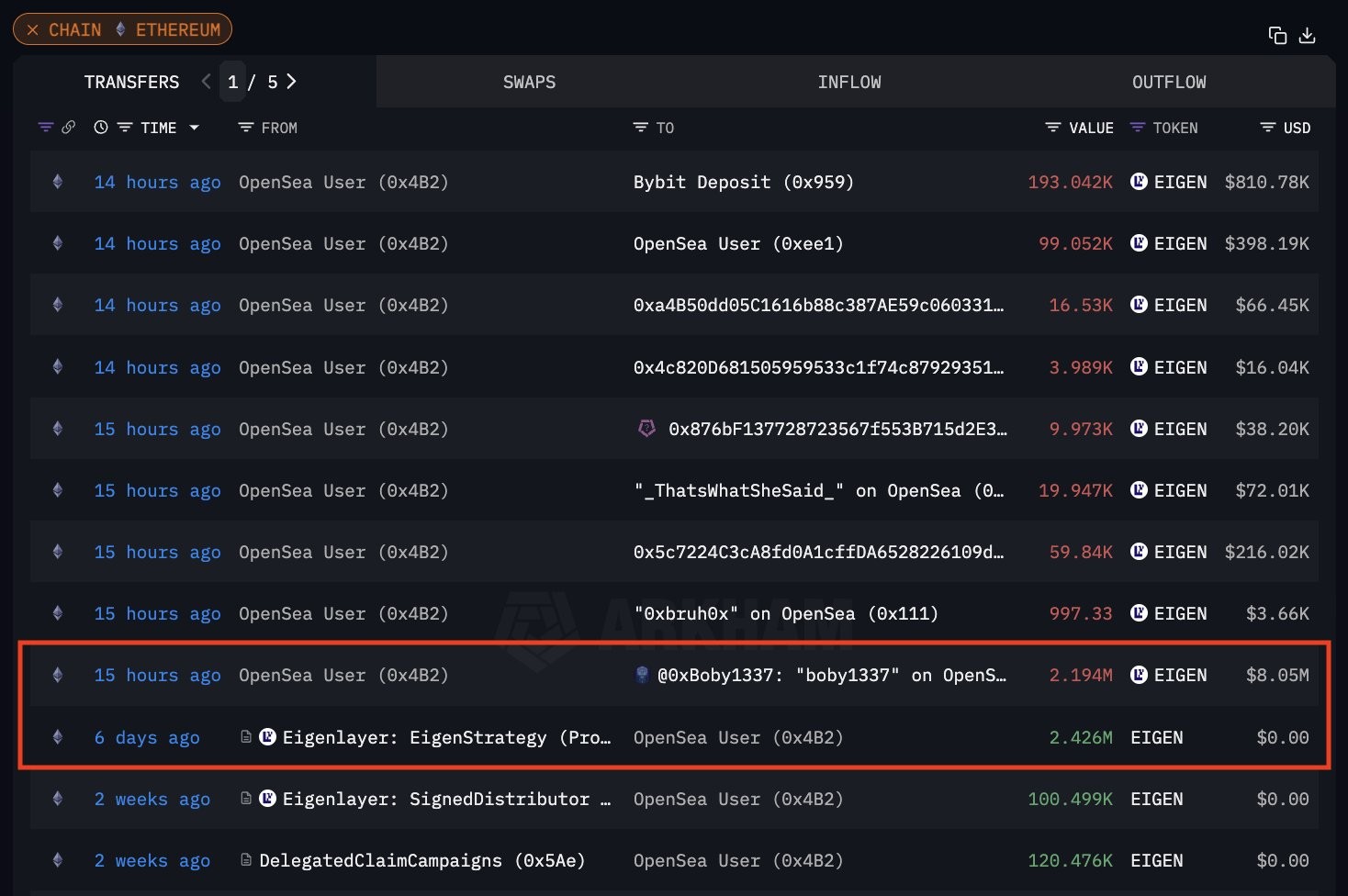

Arkham Analysts analyzed the results of the Eigenlayer airdrop, which took place in two stages, and found out who got the most coins. The leader of the first distribution was a user with the nickname @0xBoby1337. He got EIGEN for $8.05 million.

Information about Eigenlayer tokens from user @0xBoby1337. Source: Arkham

Information about Eigenlayer tokens from user @0xBoby1337. Source: Arkham

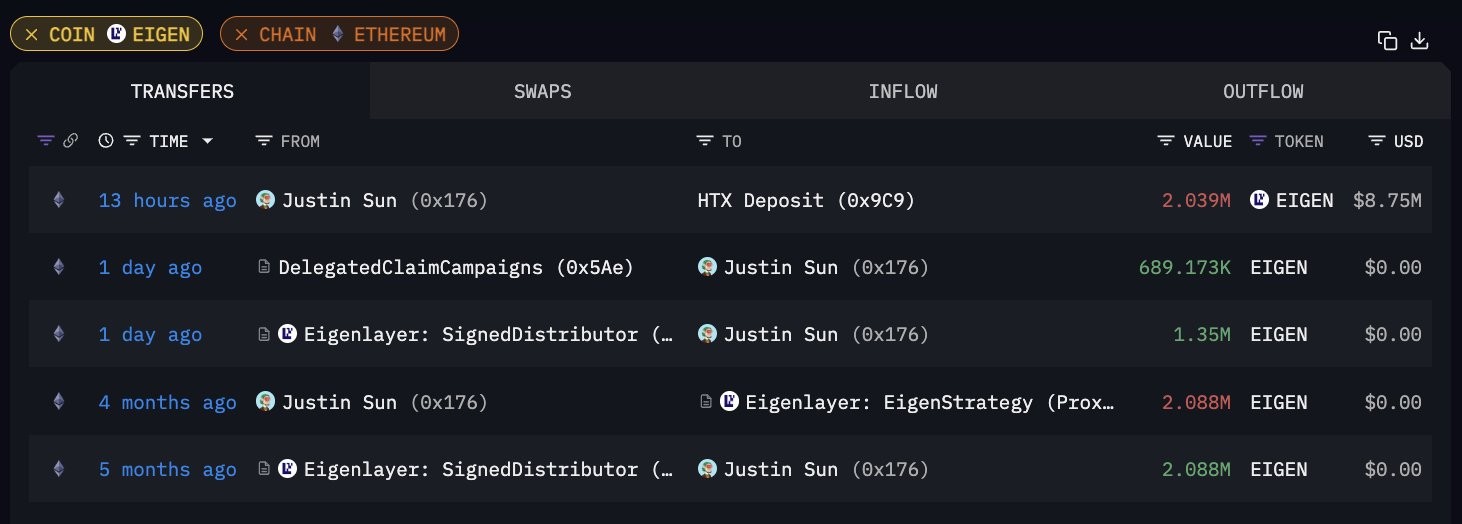

The leader of the second distribution was the founder of the TRON crypto project, Justin Sun. He received the Eigenlayer cryptocurrency for $8.75 million. According to analysts, Sun sent the coins to the HTX crypto exchange, with which he has a business relationship. The leader of the second distribution was the founder of the TRON crypto project, Justin Sun. He received the Eigenlayer cryptocurrency for $8.75 million. According to analysts, Sun sent the coins to the HTX crypto exchange, with which he has a business relationship.

Transfer of Justin Sun’s EIGEN tokens to HTX. Source: Arkham

Transfer of Justin Sun’s EIGEN tokens to HTX. Source: Arkham

What does unlocking EIGEN mean?

According to the project teamunlocking EIGEN tokens opens up new opportunities for participants in the project ecosystem. For example, developers can now build Actively Validated Services (AVSs) based on EIGEN staking.

Eigenlayer also claims that unlocking tokens will become a catalyst for the expansion of the project’s ecosystem.

What’s wrong with Eigenlayer

Eigenlayer is an Ethereum restaging protocol. It was launched in February 2024. The point of restaking is to simultaneously stake coins on the main network and on other sites in order to increase profits from work.

Eigenlayer’s TVL (total value locked in the project network) was at peak levels in early June 2024. After an attempt to storm the $20 billion mark, the metric began to decline. As of the time of writing, TVL Eigenlayer stopped at $11.4 billion.

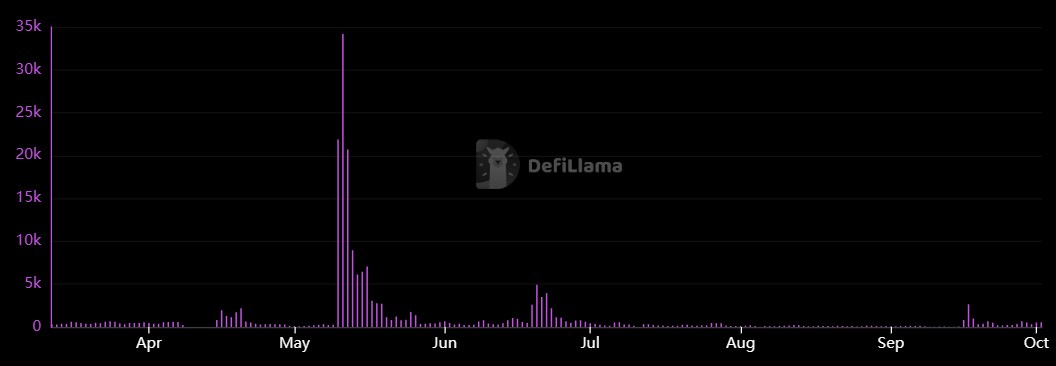

The number of transactions in Eigenlayer peaked in mid-May 2024. Since then, the metric, like TVL, has been declining regularly, with the exception of rare bursts of activity.

Number of transactions on the Eigenlayer network. Source: DeFi Lama

Number of transactions on the Eigenlayer network. Source: DeFi Lama

Other metrics, including the number of new and active addresses, are also declining. The changes indicate a decline in market interest in Eigenlayer.

Cryptocurrency EIGEN

EIGEN is the native token of the Eigenlayer restaking protocol. As of the time of writing the review, the coin is in 84th place in the capitalization rating and is trading at $4.02. At the start of trading, EIGEN dropped to $3.52. The maximum value of the cryptocurrency was recorded at $4.53.

The coin is traded on many major crypto exchanges, including Binance, Coinbase, Uniswap and Bybit. Over 40% of EIGEN’s trading volume, as of the time of writing, comes from Binance.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.