What is a discount rate

The discount rate is the interest that commercial banks pay to the central bank of a particular country if they borrow from it. In the United States, the role of the central bank is performed by the Federal Reserve. It would seem, well, let him do it, what does cryptocurrency have to do with it? To understand this issue, you need to dig a little deeper into the essence of the banking system.

How do banks make money?

Most of the operations of any credit institution are issuing loans and accepting deposits. If the rates on both products were the same, then the banks would not make a profit. Therefore, deposit rates are always lower than loan rates. But how are they installed?

This is where the discount rate comes into play. Banks will offer higher interest rates on loans and deposits, the higher it is. This is quite logical. If a commercial organization is forced to take out a loan at a conditional 5%, then how can it make money? The answer is simple – raise the percentage to exceed 5%. Naturally, this process is not easy, deposits also need to be attracted, so the rate on them is growing.

This is all great, but why does the crypto industry attach such importance to a purely banking instrument?

The impact of betting on cryptocurrency

The main goal of investors is to make money. How this will be done through cryptocurrency or through something else is essentially not important. Bitcoin, and even more so altcoins, are assets with high volatility and high risks. Investors understand this very well. If a country has high interest rates on loans, then the appetite for risk – for cryptocurrencies – decreases (in Russia the central bank rate is now a huge 20%).

There are two explanations here. On the one hand, loans become more expensive. Thus, it is less profitable to borrow money for investment. On the other hand, deposits also become more expensive and provide guaranteed risk-free returns. Why buy Bitcoin, which can fall by several tens of percent, when there is a source of big money that will definitely not decrease in price?

But why do investors pay specifically to the indicators set by the US Federal Reserve? After all, central banks set rates all over the world, not just in America.

The importance of the Fed rate

America is something of a Mecca for the crypto industry and crypto investors. Cryptocurrencies and everything connected with them often come from the USA. Why is there such a stir in the states about spot ETFs for Bitcoin and Ethereum? Why are Kraken and Coinbase American exchanges? How come the largest investment companies are based in the USA?

Because it is the United States that remains the leader in terms of capital volumes, and the dollar is the dominant world currency. Most of the high-tech developments come from America, although Asian countries are trying to challenge this palm.

Don’t think that rate changes by central banks outside the US have no impact on cryptocurrencies. It actually does. But the impact is still much smaller.

Okay, if the US central bank rate is such a powerful tool, then why didn’t the latest reduction in it lead to a sharp increase in the value of cryptocurrencies? Why hasn’t Bitcoin reached its all-time high?

BTC and the Fed rate in September 2024

FirstWhat should be noted is that after the September rate cut, Bitcoin rose to $66,508 or 7.69%. So there was a certain growth, but it’s another matter that it was not maximum.

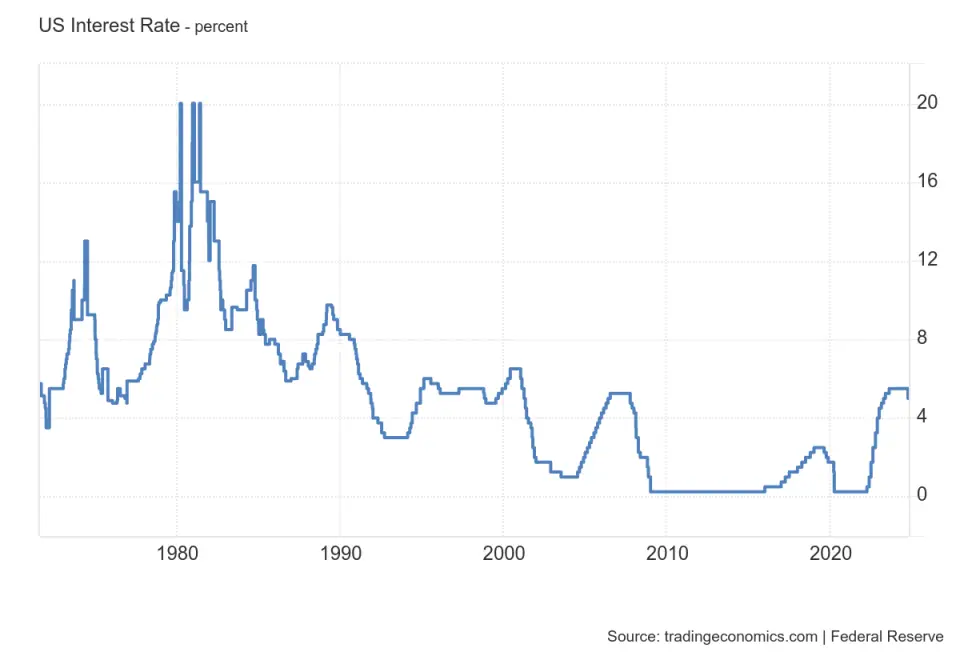

Second: The Fed did cut the rate by 50 basis points, to 4.75%-5%, but this is still too unpalatable for the US. The indicator still remains the highest in the last 16 years, meaning that there have not been such expensive loans in the country since 2007.

Source: tradingeconomics.com

Third — a reduction in the key rate was expected. There was debate about what decision the Fed would make: would it lower the rate by 25 or 50 basis points? But the decision itself was expected. If you look at the data, from September 6 to September 18, Bitcoin increased by 17.53%. Thus, most of the growth occurred in the period before the decision by the American regulator.

Fourth — the mood of crypto investors is largely determined by another pressing agenda – the presidential elections in the United States, which should end in early November. Their outcome could have a much greater impact on the crypto industry than a local reduction in the key rate. Therefore, investors are cautious about cryptocurrencies.

Fifth — reducing the rate is not always the key to success. For example, in October 2007, the Fed also began to carry out an operation to ease monetary policy. The result was a weakening economy that contributed to the global financial crisis of 2008. Such experiences make investors cautious when making decisions.

Conclusion

A decrease in the key rate has a positive impact on cryptocurrencies, as it makes credit money cheaper, and as a result, causes investors to have an increased appetite for risk. If the indicator remains high, then traditional instruments, such as bank deposits, become more attractive.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.