The viral nature and attractive opportunity of easy money is what sets memcoins apart from other cryptocurrencies. These two factors have pushed trading volumes of meme tokens to new highs.

Due to their growing popularity, more and more crypto market players are becoming interested in memcoins. They hope to become the next protagonist of a new success story and get a lot of X’s on memcoins. However, this is not at all easy, and this type of trading requires an even more responsible approach from the cryptan. Let’s tell you why.

How to make money on memcoins: a selection of strategies

You may not like memecoins, but you can’t ignore them—the market capitalization of the meme coin sector currently exceeds $54 billion. That’s why many experts, like Galaxy Digital’s Mike Novogratz, have openly emphasized the importance of these tokens:

Fun fact: Galaxy’s love of cryptocurrencies saw the company generate nearly $300 million in net income in 2023 as the cryptocurrency market surges.

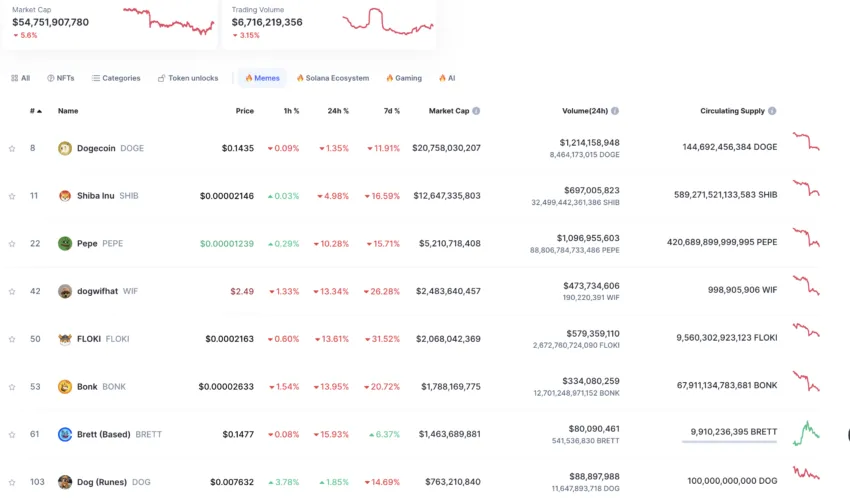

Top memcoins by market capitalization. Source: CoinMarketCap

Top memcoins by market capitalization. Source: CoinMarketCap

Crypto traders who pay attention to memcoins are primarily hoping for quick profits. Crypto analyst Atlas confirmed that traders who have the necessary knowledge can make up to 100x trading meme coins.

Atlas shared several important strategies for those interested in memcoins:

1. Study social networks

First of all, the analyst advises reading what they are saying about the project on various social networks, especially on X (formerly Twitter). If this project does not have an official and active X-account at all, it is better to stay away from it. If there are his critics online, you should be wary.

2. Use additional tools

For example, Atlas advises paying attention to DEX Screener or DEXTools – they will help you understand how tokens are distributed among holders. If a high percentage of the total supply of tokens is held in the wallets of the project’s creators, this could be a red flag and an indication that the project is a scam.

3. Take a closer look at token sniping

Another tactic currently being discussed is token sniping – a strategy that involves purchasing tokens as quickly as possible at the very start of trading.

This process is facilitated by some popular Telegram bots such as BONKbot, SolTradingBot and Unibot. When a new pool of tokens appears, “memcoin snipers” act quickly: they copy the contract, analyze it and quickly buy tokens through the aforementioned bots.

Nevertheless, the analyst also reminds about the principles of safety during trading: he advises not to be distracted by numerous new projects, but to focus on established market leaders – for example, such as Notcoin (NOT).

4. Get acquainted with other people’s strategies

Crypto trader KingWilliam suggests another tactic: monitor new pairs on DEXScreener and copy the strategies of leading traders. Tools like AlphaTrace provide insight into the most winning strategies.

5. Be aware of the risks.

Finally, experienced market players advise not to forget that the memcoin sector is full of various risks, including the danger of becoming a victim of scammers. This is where tools like RugCheck come to the rescue – they help assess the risk that a new project will be the work of attackers.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.