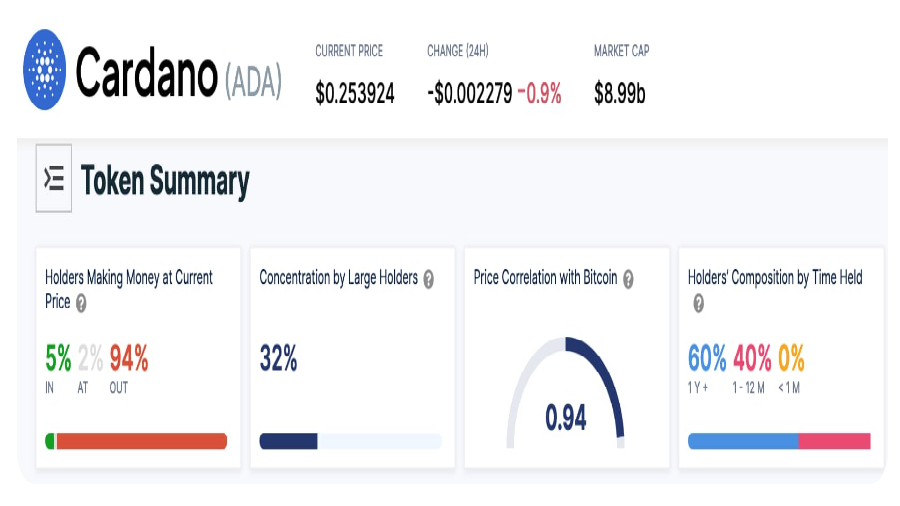

Data from a crypto market intelligence platform shows that 94% of Cardano (ADA) investors were left in the red. At the same time, 2% of holders have reached the zero level and do not receive income, and only 5% of early Cardano holders receive profit from investments in the asset.

The majority of ADA owners, more than 60%, are long-term holders who have owned the crypto asset for a year or more.

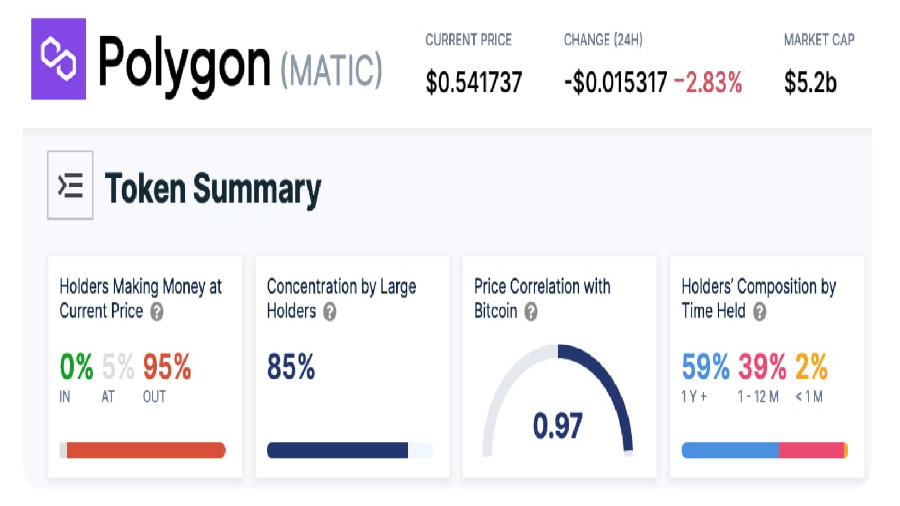

Polygon (MATIC) ranks second among the three unprofitable crypto projects in terms of ownership, with 95% of holders in the red. The break-even position was maintained by 5% of Polygon investors.

59% of holders retain their assets for more than a year. According to IntoTheBlock, 85% of Polygon’s outstanding shares are in the hands of large holders, and none of the investors receive income from investing in MATIC.

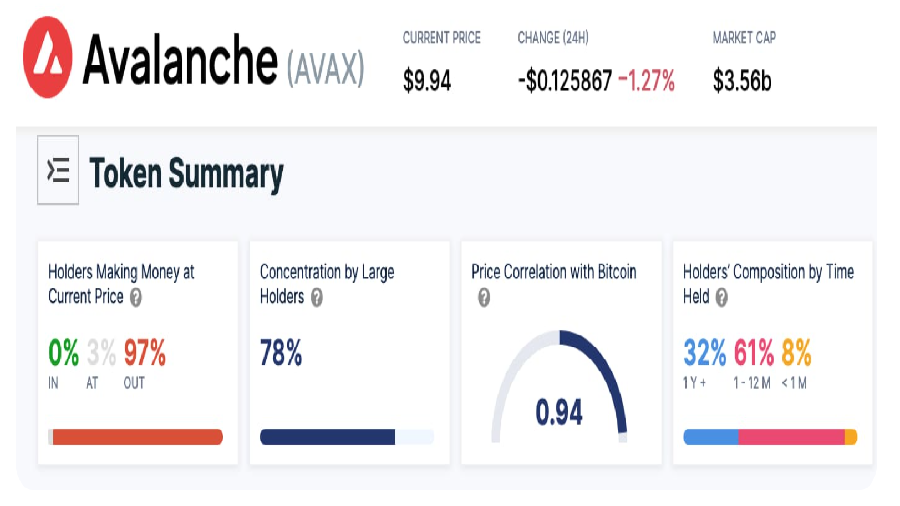

Avalanche (AVAX) is ranked No. 19 by market capitalization, according to CoinMarketCap, and No. 15 among projects tracked on IntoTheBlock’s dashboard.

As with MATIC, AVAX investors make no profit on the asset, and 97% experience losses altogether. However, unlike ADA and MATIC, long-term holders of the asset make up only 32%, and 68% hold AVAX for up to one year.

An analysis of IntoTheBlock data shows: the situation with a drop in the profitability of ADA, MATIC and AVAX, which are among the top 20 cryptocurrencies by market capitalization, is only a special case of a general decline in the value of crypto assets and the ongoing market crisis. Investors who invested in the assets of Arbitrum (ARB), Axie Infinity (AXS), Chiliz (CHZ), Bored suffer losses. Ape Yacht Club ApeCoin (APE), The Sandbox (SAND), Algorand Protocol (ALGO) and many others.

The continuation of the downward trend in the digital asset market was commented on by the host of the YouTube channel DataDash, Nicholas Merten, saying that in the coming years investors should not expect a significant increase in the capitalization of cryptocurrencies due to a reduction in liquidity in the markets.

Earlier, analysts from CoinCodex, which specializes in providing crypto market participants with online metrics and technical analysis of digital asset price movements, painted a rosy picture for investors of the Cardano blockchain and its crypto asset ADA.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.