According to the report, between January and April 2024, cryptocurrency trading activity increased by 30% compared to the same period in 2023. Brazil took first place among Latin American countries in this parameter.

Kaiko experts emphasize that despite the correction, the trading volume of virtual coins paired with the Brazilian real continues to grow, and the growth rate is higher than in trading pairs with the US dollar.

The vast majority of transactions took place on the largest cryptocurrency exchange, Binance. However, as analysts have pointed out, the dominance of this trading platform in the Brazilian market is gradually declining.

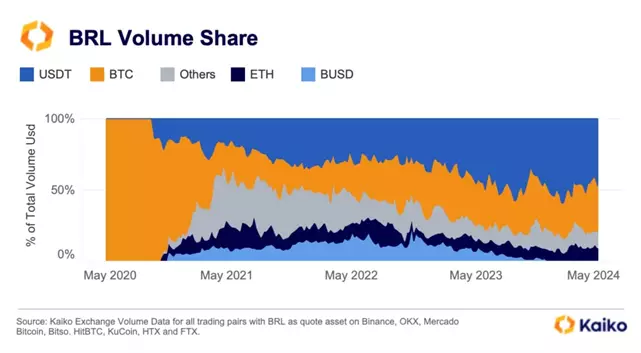

The Brazilian population most often trades in pairs BRL/USDT and BRL/BTC. BUSD trading volumes began to decline in mid-May 2023. By comparison, the Mexican peso (MXN) traded at $3.7 billion this year and the Argentine peso (ARS) traded at $300 million.

Previously, the Central Bank of Brazil selected the French company Giesecke+Devrient (G+D) to jointly test its own digital currency (CBDC) for payments in the absence of the Internet.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.