According to analysts at audit firm KPMG, the decline in investment activity will see the cryptocurrency industry end 2022 with results well below the previous year.

Summing up the preliminary results of the first half of 2022, KPMG analysts said that a global change in the profile of investors is recorded in the cryptocurrency market. If before 2018 a significant part of investments came from retail investors, now a large share falls on institutional investors.

This has led to significant changes in the perception of risks associated with crypto assets. If from the point of view of a retail investor, crypto assets are completely uncorrelated with traditional assets, then from the point of view of investment risk for institutional investors, they act very similarly.

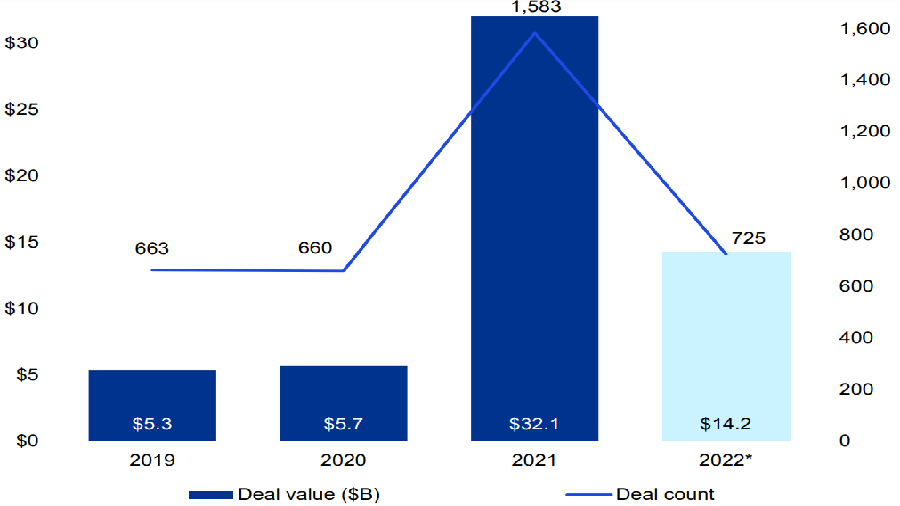

Last year, institutional investors invested a record amount of $32.1 billion in the industry. However, this year, after a series of bankruptcies of companies significant for the cryptocurrency industry, the strategy of institutional investors has changed dramatically.

Some investors significantly reduced their activity, while others began to seek recapitalization to reduce potential risks. As a result, after a record high in previous years, global investment in the industry fell to $14.2 billion in the first half of 2022.

Assessing the current market potential, KPMG analysts came to the conclusion that as investments in liquid cryptocurrencies and blockchain continue to decline steadily, we should not expect any significant market growth until the end of 2022.

The other day, Ethereum co-founder Vitalik Buterin said in an interview with former Bloomberg Opinion columnist Noah Smith that the fall in the cryptocurrency market has its advantages, as the crisis will provide an opportunity in the future to reduce the volatility of digital assets to the level of stock market volatility.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.