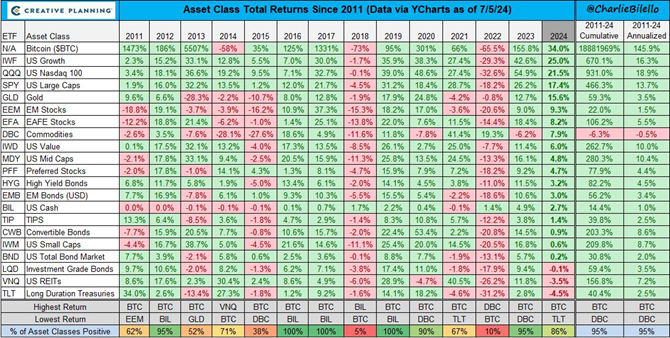

Michael Saylor made his point by pointing to a chart comparing the price performance of various asset classes over several years, including Bitcoin, gold, emerging market stocks, emerging market bonds, and Treasuries.

According to the figures provided by the investor, the best results were shown by Bitcoin, shares of young companies (US Growth index) and the Nasdaq 100 index:

“Bitcoin’s returns are higher than those of traditional investment vehicles.”

Michael Saylor showed that from 2011 to 2024, Bitcoin’s cumulative performance increased by 18,881,969%, while over the same period the Nasdaq 100 index increased by 9.31% and gold by 59.3%.

Earlier, Michael Saylor predicted that Bitcoin would rise to $10 million, declaring that the first cryptocurrency would offer economic immortality for corporations.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.