MicroStrategy shares set a new record amid rising Bitcoin prices. Since the beginning of the year, MSTR has shown more impressive results than BTC.

Following BlackRock’s increased investment in Bitcoin, MSTR’s share price reached its highest level in 24 years.

MicroStrategy Shares Up 470% in 2024

Previously, on October 29, MSTR’s price peaked at $260 per share. In September, the figure increased by 125%, and since the beginning of the year – by 470%. Although Bitcoin has yet to reach its all-time high (ATH), MicroStrategy stock has surpassed its last peak reached in early October and continues to rise.

The positive dynamics for shares of Michael Saylor’s company are fueled by investments from BlackRock. Previously the company increased its stake in MicroStrategy up to 5.2%.

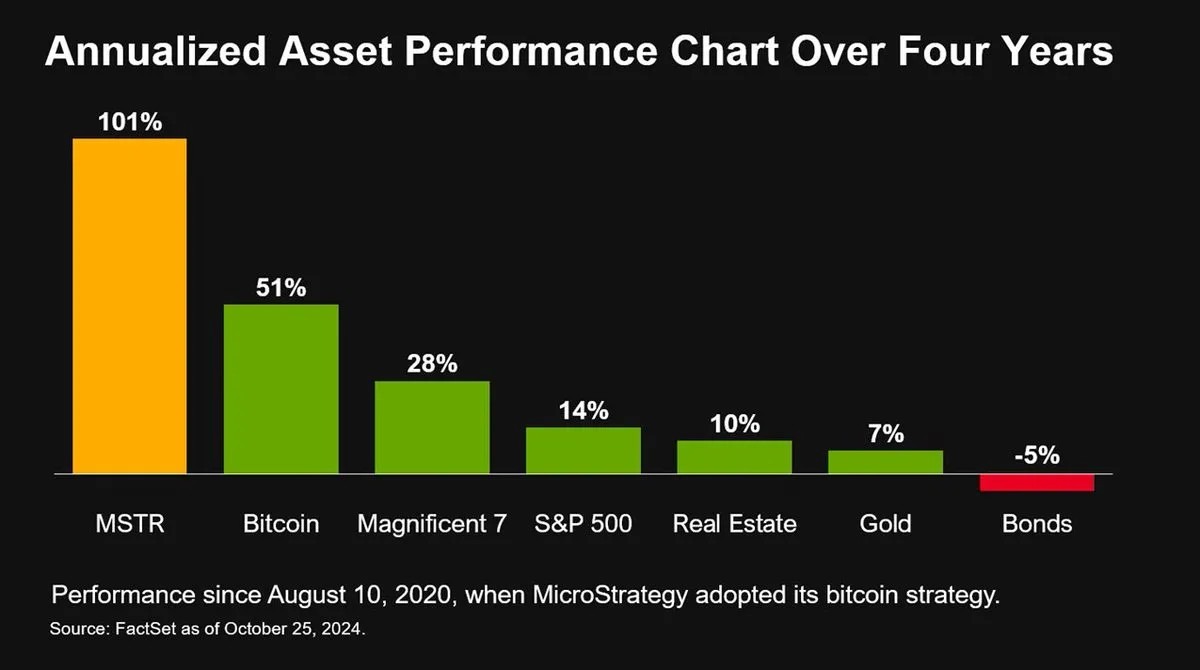

Saylor also recently noted that MSTR stock has outperformed not only Bitcoin, but many other assets as well. For example, the S&P 500 index, real estate and gold.

Graph of annual return on assets for 4 years. Source: Michael Saylor

Graph of annual return on assets for 4 years. Source: Michael Saylor

Throughout 2024, MicroStrategy actively issued bonds to purchase Bitcoin. Now the investment giant is the largest public company in terms of the number of BTC under management. The company owns 252,220 BTC, which is 1.2% of the total volume of the first cryptocurrency by capitalization. The average purchase price is $39,266 per BTC.

Some experts believe that the connection between MSTR and BTC will boost MicroStrategy’s stock price.

Price dynamics for Bitcoin and MicroStrategy. Source: Timothy Peterson

Price dynamics for Bitcoin and MicroStrategy. Source: Timothy Peterson

However, the PlanG investor is more cautious about the growth of MicroStrategy shares. His MSTR cost analysis is based on a log-linear chart.

Meanwhile, yesterday, October 29, the price of Bitcoin broke through the $72,000 level. Investor sentiment in the market is becoming increasingly optimistic ahead of the US presidential election.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.