- US economic data supports risk appetite and the New Zealand dollar.

- Wall Street in the red after the open but off the lows, commodities rebound.

- The NZD/USD pair tries to recover the level of 0.6400, although it remains in negative territory.

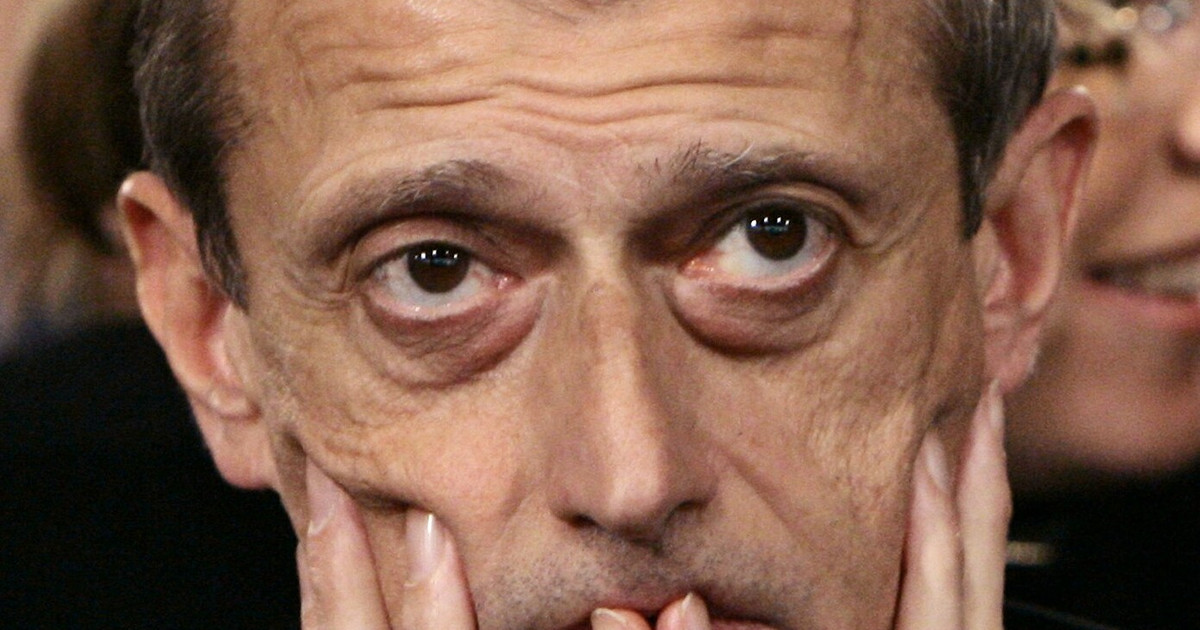

- New Zealand Prime Minister Jacinda Ardens will step down.

The pair NZD/USD it rebounded from the lowest level since last Friday and rose to 0.6402, supported by an improvement in market sentiment following the release of better than expected US economic data. The NZD remains lower, unaffected by the resignation of New Zealand Prime Minister Jacinda Ardens.

Positive economic news in the US

Thursday is proving to be a different day from Wednesday, when the Retail Sales and Industrial Production reports showed larger-than-expected declines for December. Data released Thursday beat expectations. Initial claims for jobless benefits fell below 200,000 to their lowest level in four months. The Philadelphia Fed rose more, from -13.7 to -8.9.

Wall Street down, but sentiment improves

The economic data helped the dollar, but also risk appetite, which ended up weighing more on the USD, pushing the NZD/USD pair away from the lows. Share prices on Wall Street continue to fall but are not at their minimum, with an average fall of 0.50%. Crude oil and gold are up around 0.54%.

Politics in New Zealand

New Zealand Prime Minister Jacinda Ardern announced that her term will end on February 7. She does not have “energy” to run for re-election in the October 14 general election. In a few days a new leader will be voted. The announcement had little impact on the kiwi. New Zealand’s main stock index fell 0.28%.

AUD/NZD Volatility

The AUD/NZD pair bottomed during the Asian session at 1.0735 on the weaker than expected Australian jobs report and then bounced and turned positive on the day. It has broken above 1.0800 again.

NZD/USD Technical Outlook

The NZD/USD pair is looking to return to range trading with support at 0.6330/50 and resistance at 0.6410/20, after pulling back from Wednesday’s multi-month high of 0.6529. The bias remains to the upside as it remains above the 20-day SMA which sits at 0.6335.

A firm daily close above 0.6450 should point to a test of the recent high and further gains. If the NZD/USD doesn’t get it anytime soon, a deeper correction looks likely.

technical levels

NZD/USD

| Overview | |

|---|---|

| Last price today | 0.64 |

| Today Change Daily | -0.0029 |

| today’s daily variation | -0.45 |

| today’s daily opening | 0.6429 |

| Trends | |

|---|---|

| daily SMA20 | 0.6334 |

| daily SMA50 | 0.6296 |

| daily SMA100 | 0.6057 |

| daily SMA200 | 0.6204 |

| levels | |

|---|---|

| previous daily high | 0.6531 |

| previous daily low | 0.637 |

| Previous Weekly High | 0.6418 |

| previous weekly low | 0.6314 |

| Previous Monthly High | 0.6514 |

| Previous monthly minimum | 0.623 |

| Fibonacci daily 38.2 | 0.6469 |

| Fibonacci 61.8% daily | 0.6431 |

| Daily Pivot Point S1 | 0.6356 |

| Daily Pivot Point S2 | 0.6282 |

| Daily Pivot Point S3 | 0.6194 |

| Daily Pivot Point R1 | 0.6517 |

| Daily Pivot Point R2 | 0.6604 |

| Daily Pivot Point R3 | 0.6678 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.