In recent months, the cryptocurrency market has been moving in a narrow range. Against this background, many analysts and ordinary members of the crypto community do not understand whether the bull market has begun or has already ended.

At least five on-chain indicators indicate that the bull cycle is currently in its earliest stages. About it wrote analyst under the nickname ELI5 of TLDR at X (formerly Twitter).

What indicators hint at the beginning of a bull market?

In order to answer the question of what stage the crypto market is currently at, ELI5 of TLDR chose Bitcoin (BTC) as the underlying asset. It is behind the first cryptocurrency by capitalization that all other digital assets are moving.

Here are some indicators that indicate the early stage of a bullish cycle:

- Bitcoin dominance. Historically, bull cycles begin with BTC's market share reaching high levels. The token's dominance is currently around 56%.

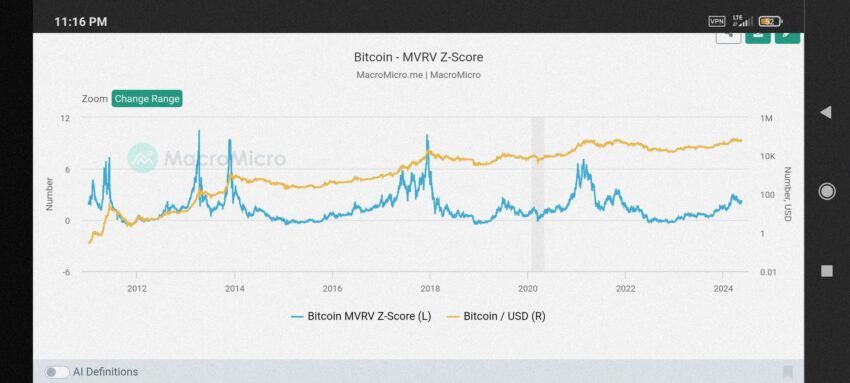

- Bitcoin MVRV Z indicator. This indicator shows the ratio of the market and realized value of BTC and is adjusted using the z-score statistic. The latter helps to assess how much the current value differs from the average. According to LookIntoBitcoin, MVRV is now less than three and has not exceeded six since March 2021.

- Puell's coefficient. This is another metric that shows the peaks of Bitcoin market cycles. After the fourth halving, the Puwell ratio dropped below one. Usually during the top of the cycle the indicator exceeds three.

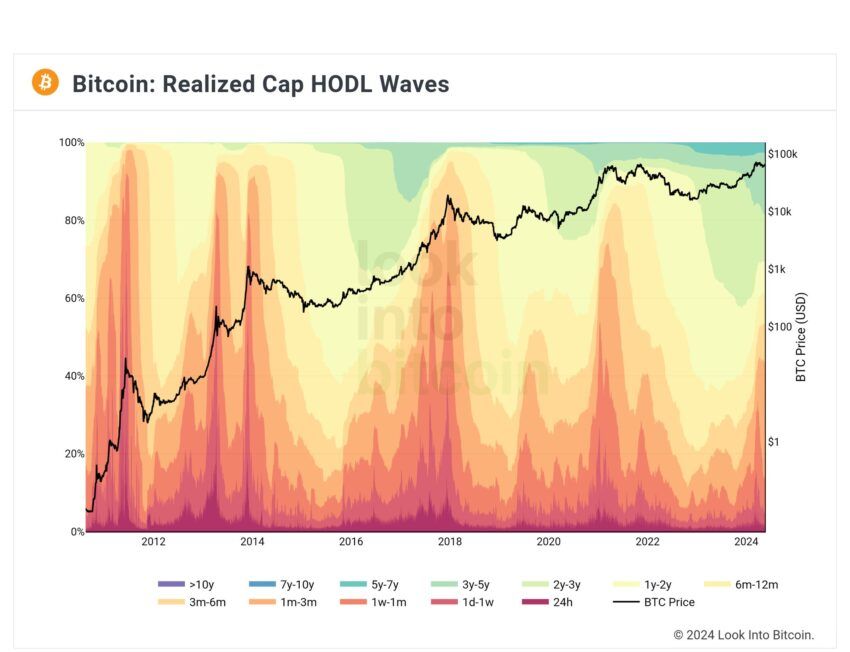

- Hodl waves. These are graphs showing how much BTC is held by different groups of investors over time. According to this metric, most new owners have already sold their bitcoins, which may indicate a possible price increase.

- Miners' income for each hash. The indicator shows how much money BTC miners are earning. Although this figure will decline over time due to increasing network complexity, in the past it has spiked to $0.3 per terahash to coincide with the peaks of market cycles.

Or maybe the market has reached the top?

On the other hand, several on-chain metrics indicate that the market has in fact already warmed up and peaked. These are the indicators:

- PRHODL Ratio indicator. It compares the average price of recently purchased coins with the prices observed in the market one or two years ago. When new buyers pay more, it may mean the market is at its peak and prices will soon begin to fall.

- Cumulative value-days destroyed (CVDD). She analyzes the movement of old coins. If they start to move, it may indicate the top of a cycle.

According to CoinGecko, at the time of writing, Bitcoin is trading at $67,249. Over the past week, BTC has risen in price by 6.8%. But that's still 9.1% below the all-time high reached in March this year.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.