Peter Brandt stated that the consequences of the halving have significantly impacted the mining industry, forcing many participants to either curtail their activities or actively sell off accumulated assets to pay operating costs.

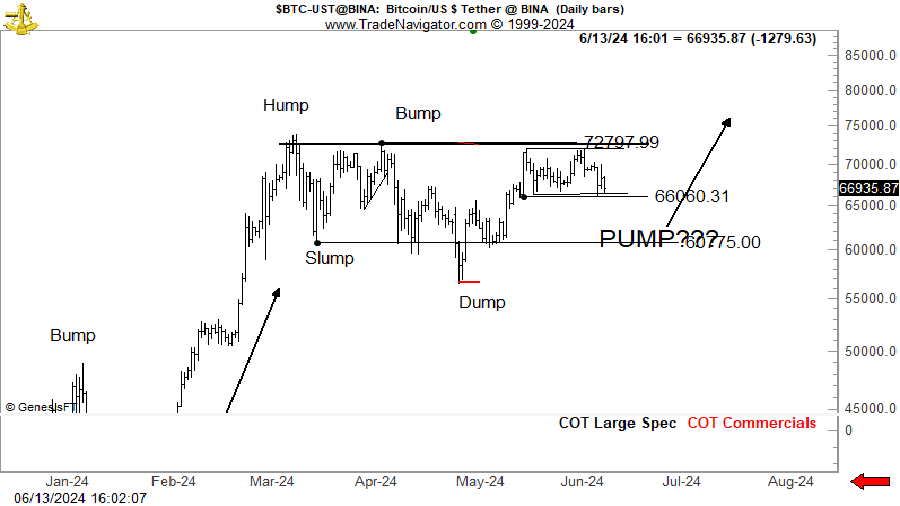

According to the expert, the surge in sales may not allow Bitcoin to maintain support at $65,000, and the first cryptocurrency could decline to the next psychological level of $60,000. Brandt suggests that if Bitcoin’s market value falls below $60,000, this could lead to a 20% decline. -th correction to $48,000.

We note that the current price phase of BTC is not any extraordinary event and is consistent with the historical price trajectory and halving cycles, which lays the foundation for the asset’s future sustainable bullish growth.

Earlier, Peter Brandt shared his forecast that the new peak of the Bitcoin bull cycle at $130,000-$150,000 could be reached at the end of August 2025.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.