A popular analyst explained how Bitcoin halving cycles could turn a $5 investment in BTC into $130,000.

Renowned crypto analyst Plan B believes that those who trade in line with Bitcoin’s halving cycles will earn more than those who buy and hold the currency. The veteran trader points out that BTC rose mainly during the three previous halvings.

At the same time, BitMEX founder Arthur Hayes noted that geopolitical unrest could also fuel a bull run in the market.

How the Bitcoin halving could turn $5 into $130,000

Traders who only trade the cryptocurrency market during halving periods could make up to 2,500% profit. Popular analyst Plan B is confident:

Halvings, which occur on the BTC network approximately every four years, have historically caused significant price spikes as the rate of new coin issuance decreases by 50%. This growing supply shortage presents an opportunity for forward-thinking investors to make big money.

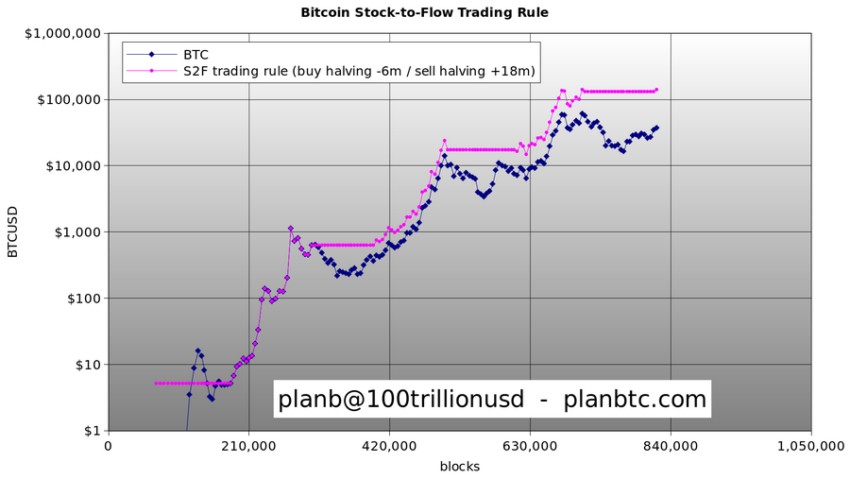

Stock-to-Flow model Source: PlanBTC.com

Stock-to-Flow model Source: PlanBTC.com

According to the Stock-to-Flow model created by Plan B, traders should purchase Bitcoin six months before the halving and sell 18 months after the event. This approach allows you to take advantage of Bitcoin’s cyclical patterns, making money during periods of significant price growth and avoiding subsequent bear markets.

Bitcoin benefits during periods of geopolitical instability

BitMEX founder Arthur Hayes believes that buying Bitcoin during times of geopolitical uncertainty and war is a strategically beneficial decision.

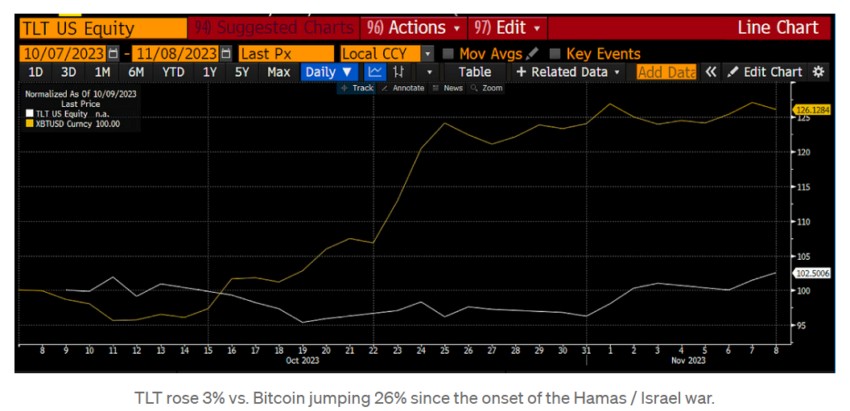

According to Hayes, BTC has demonstrated resilience and outperformed traditional assets such as long-term US Treasuries during the conflicts between Ukraine and Russia, as well as between Hamas and Israel. By comparison, Bitcoin’s price has risen 26% since the start of the war in the Middle East, while TLT, an exchange-traded fund (ETF) that tracks yields on US Treasury bonds maturing over 20 years, has risen just 3%.

Bitcoin and TLT profitability. Source: Bloomberg

Bitcoin and TLT profitability. Source: Bloomberg

Hayes also noted that Bitcoin has confirmed its status as a hedging tool in the face of uncertainty associated with geopolitical tensions.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.