- The British Pound faces an intense sell-off against the US Dollar following positive US NFP data for May.

- The strong US NFP report has negatively impacted expectations of Fed interest rate cuts in September.

- Strong UK wage growth remains a major driver of persistent services inflation.

The British Pound (GBP) falls sharply from 1.2800 against the US Dollar (USD) in the American session on Friday. GBP/USD weakens as the United States (US) Non-Farm Payrolls (NFP) report for May showed labor market conditions remain tight despite the Federal Reserve (Fed) maintaining a restrictive monetary policy framework for a longer period.

The jobs report showed employers added 272,000 payrolls, higher than estimates of 185,000 and the previous release of 165,000, revised down from 175,000 jobs. However, the unemployment rate rose to 4.0% while investors expected it to remain stable at 3.9%. Meanwhile, average hourly earnings data, which measures wage growth momentum, jumped to 4.0% from the consensus of 3.9% and April’s reading of 4.0%, revised up from 3.9% annually. On a monthly basis, wage growth rose at a faster pace of 0.4% than estimates of 0.3%.

Daily Market Summary: Pound Underperforms US Dollar

- The British Pound declines from 1.2720 against the US Dollar as the US NFP grew at a faster pace than investors previously anticipated. Stronger-than-expected wage growth and payroll data have dampened expectations that the Fed will begin cutting interest rates as early as the September meeting.

- Recently, many economic indicators related to the labor market had signaled the normalization of working conditions, leading to market speculation that the Fed would begin reducing its key interest rates in September. US JOLTS job openings data for April and ADP employment change for May showed that new openings and private payrolls, respectively, were lower than expected. Additionally, the U.S. Department of Labor said Thursday that initial jobless claims for the week ending May 31 rose more than expected. This adds to evidence that the labor market is losing steam.

- However, the positive US NFP report has indicated that the labor market remains strong. This has led to a sharp decline in expectations for Fed rate cuts. The CME FedWatch tool shows that traders see a 54% chance of rate cuts in that month, down from 68% after the release of the US NFP report

- In the UK, the British pound will be guided by employment data for the period February to April, due to be released on Tuesday. The number of people employed in the country has decreased three times in a row. The indication of more layoffs would hurt the British pound as it would increase traders’ bets on early rate cuts by the Bank of England (BoE).

- Investors will also focus on UK average earnings data, a measure of wage growth. Strong UK wage growth momentum has remained a major driver of high inflation in services, which has been a barrier to price pressures returning towards the 2% target.

US Dollar prices for this week

PRICE of the US Dollar Today

The table below shows the percentage change of the US Dollar (USD) against the major currencies listed today. The US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.57% | 0.47% |

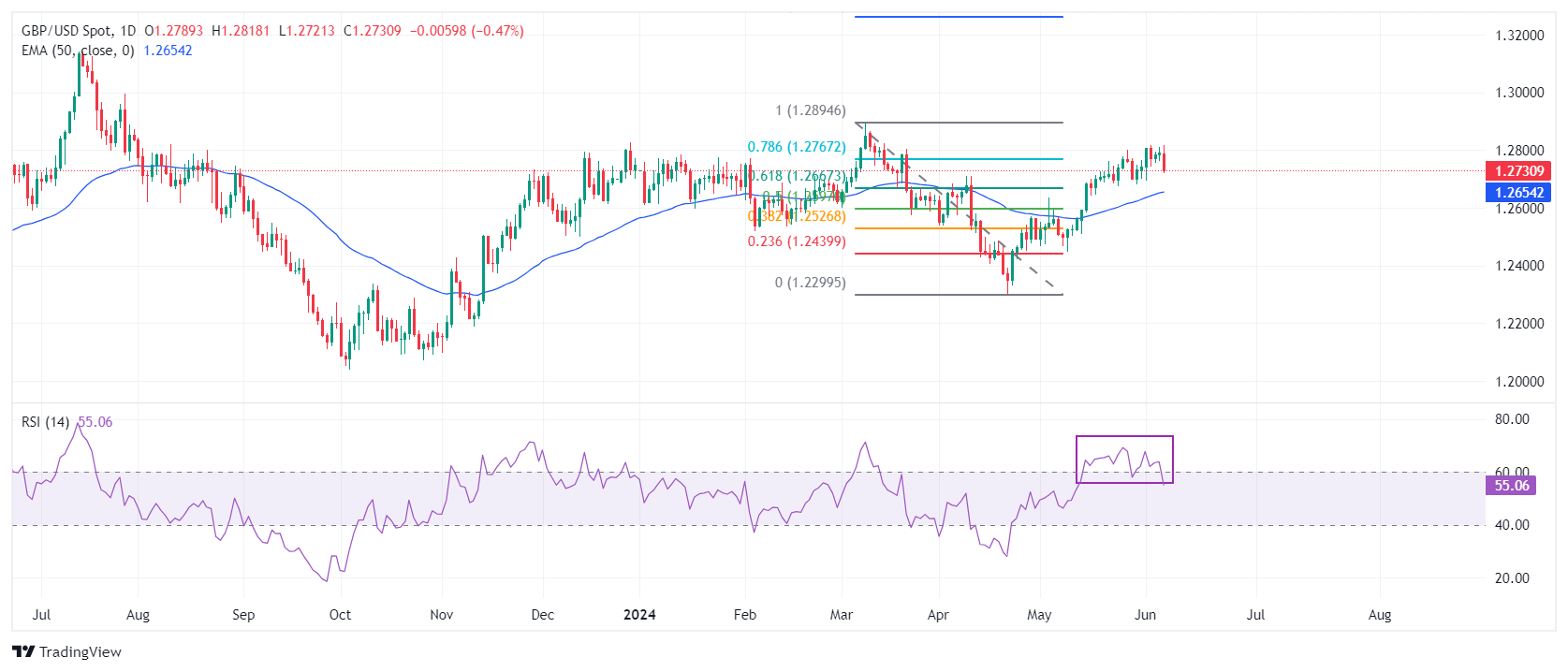

Technical Analysis: British Pound Declines Below 78.6% Fibonacci Retracement

The British Pound falls sharply against the US Dollar after US NFP data for May turned out to be stronger than expected. The GBP/USD short-term outlook turns volatile as it falls below 1.2770, the support of the 78.6% Fibonacci retracement (plotted from March 8 high of 1.2900 to April 22 low at 1.2300).

The Pound still maintains the bullish trajectory as the 20-day and 50-day EMA at 1.2710 and 1.2650, respectively, are tilted upward, indicating a strong bullish trend.

The 14-period Relative Strength Index (RSI) has fallen into the 40.00-60.00 range, suggesting that the momentum that was tilting towards the upside has moderated for the time being.

economic indicator

Non-farm payrolls

The most important result contained in the employment report is the monthly change in non-farm payrolls published by the US Department of Labor. The report publishes job creation estimates for the previous month and revisions to the data for the previous two months. Monthly changes in payrolls can be very volatile and the publication of this report generates high volatility in the dollar. A result above the market consensus is bullish for the dollar, while a result below expectations is bearish.

Why is it important for operators?

The monthly US employment report is considered the most important economic indicator for currency traders. Published on the first Friday following the reported month, the change in the number of employees is closely related to the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers the evolution of the labor market when setting its policies, which affects currencies. Despite several leading indicators shaping estimates, Non-Farm Payrolls tend to surprise markets and trigger substantial volatility. Actual numbers that beat consensus tend to be bullish for the USD.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.