- Inflation corresponding to the first half of May was -0.21%, slightly exceeding the consensus of -0.22%.

- Annualized Gross Domestic Product remained in line with expectations at 1.6%.

- The Mexican peso depreciated after the manufacturing PMI and unemployment benefit requests in the United States were released.

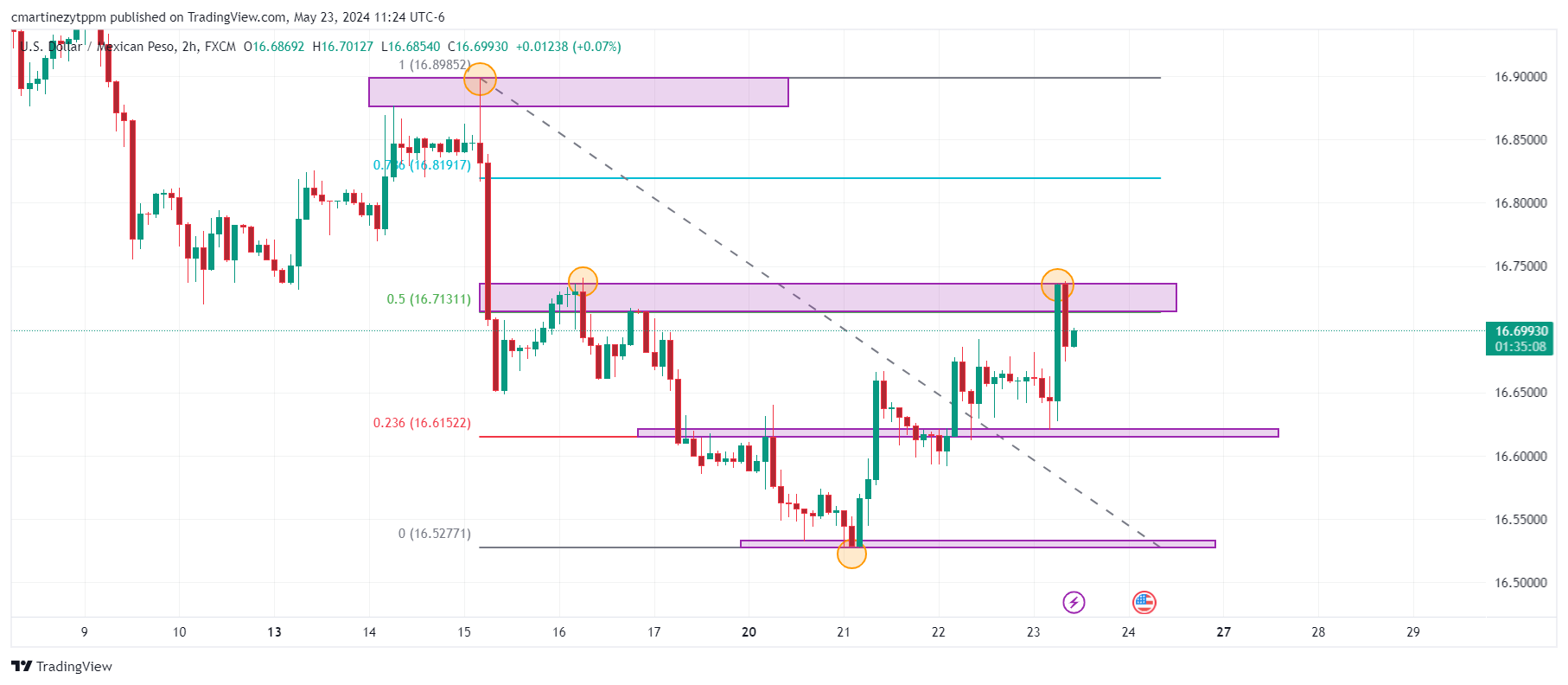

USD/MXN posted a daily low of 16.62 in the American session, bouncing to a daily high of 16.73. It is currently trading at 16.69, gaining 0.22%.

US economic data strengthens the dollar

The Manufacturing PMI Index improved to 54.4 in the preliminary estimate in May, beating expectations of 51.1. On the other hand, weekly unemployment benefit claims registered an increase of 215,000, below the estimate of 220,000. This data drove the USD/MXN higher, reaching one-week highs of 16.73.

Technical levels in the Mexican Peso

The first support in the short term is found at 16.61, the minimum of the session on May 22, in convergence with the 23.6% Fibonacci retracement. The next support is at 16.53, the May 21 pivot point. The nearest resistance is at 16.90, May 15 high.

Two-hour chart of the Mexican Peso

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.