By Javier Blas

No matter which measure of success or failure you use, Russian President Vladimir Putin is winning in the energy markets. Moscow is milking its oil cow, earning hundreds of millions of dollars every day to finance the invasion of Ukraine and buy domestic support for the war.

Once European sanctions against Russian crude oil exports go into effect in November, governments across Europe will face some intractable dilemmas as the energy crisis begins to bite consumers and companies.

Ejection

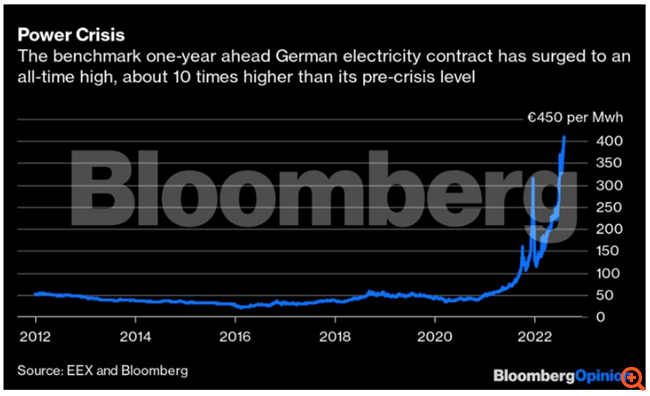

Electricity costs for homes and businesses are expected to soar from October as rising oil revenues allow Putin to sacrifice gas revenue and squeeze supplies to Europe.

Prices in the UK are likely to rise by 75%, while in Germany some municipal utilities have already warned that prices will rise by over 100%. Russia has successfully instrumentalized and weaponized energy supply.

Western governments will come under increasing pressure to spend billions either by subsidizing household bills or, as is already happening in France, by taking control of electricity companies.

Recovery

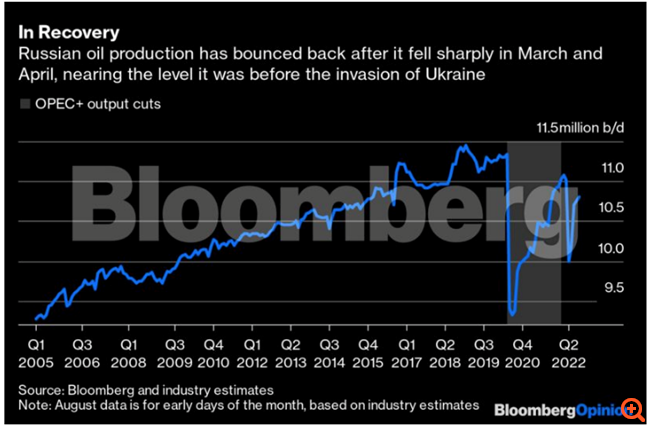

The first indicator of how Putin has turned the oil tide is Russian crude production. Last month, the country’s output rose to near pre-war levels, averaging nearly 10.8 million barrels a day, marginally less than the 11 million pumped in January, just before the invasion of Ukraine. Based on industry estimates, Russia’s oil output is slightly higher so far this month.

This is no fluke: July marked the third consecutive month of recovery in oil output, with output rising significantly from a low for the year of around 10 million barrels recorded in April, when European buyers began shunning Russia and Moscow was trying to find new buyers.

After these initial difficulties, Russia found new customers for the millions of barrels on the day that European oil refiners stopped buying due to “self-sanctions”. Most of this crude oil ends up in Asia – mainly India – but also Turkey and elsewhere in the Middle East. And some is still showing up in Europe, with buyers still buying Russian crude ahead of scheduled formal sanctions in early November.

Everyone who bet that Russian oil production would continue to decline – myself included – was wrong.

The second indicator is the price of Russian oil. Initially, Moscow was forced to sell its crude varieties at huge discounts to other types of oil in order to lure buyers. In recent weeks, however, the Kremlin has regained pricing power, taking advantage of the tightness in the market.

ESPO crude, a type of Russian oil from the Far East, is a good example of the new trend. At its low earlier this year, it was trading at a discount of more than $20 a barrel to Dubai crude, Asia’s oil benchmark. Recently, ESPO crude oil began to change hands at absolute parity with its Dubai counterpart.

Urals crude, the flagship of Russian oil exports to Europe, does not benefit as much as ESPO, as its main buyers have traditionally been countries such as Germany rather than India. But it is also recovering in terms of price, recently selling $20 to $25 a barrel cheaper than global benchmark Brent, while trading at a discount of nearly $35 in early April.

Moscow is finding new commodity traders, often operating from the Middle East and Asia and possibly funded by Russian money, willing to buy its crude and ship it to oil-hungry markets. With Brent crude hovering near $100 a barrel and Russia able to offer smaller discounts, there is a lot of money flowing into the Kremlin. For now at least, energy sanctions have not worked.

Politician

The final indicator of Russia’s success is political rather than market related. In March and April, Western policymakers were optimistic that the OPEC cartel, led by Saudi Arabia and the United Arab Emirates, would abandon its alliance with Russia. The opposite has happened.

Despite US President Joe Biden’s trip to Riyadh, Putin has maintained his influence within the OPEC+ alliance. Immediately after Biden left Saudi Arabia, Russian Deputy Prime Minister Alexander Novak, the person who manages Russia’s relationship with the cartel, flew to the kingdom. A few days later, OPEC+ announced a small increase in oil production, keeping pressure on global energy markets.

The victory in the oil market means Putin can afford to forgo some revenue when he cuts gas sales to Europe, putting pressure on Berlin, Paris and London, which are bracing for huge increases in retail energy prices and possible shortages which may lead to rationing this winter. Moscow makes so much money selling oil that it can afford to cut crude supplies to Eastern European countries, as it did earlier this week.

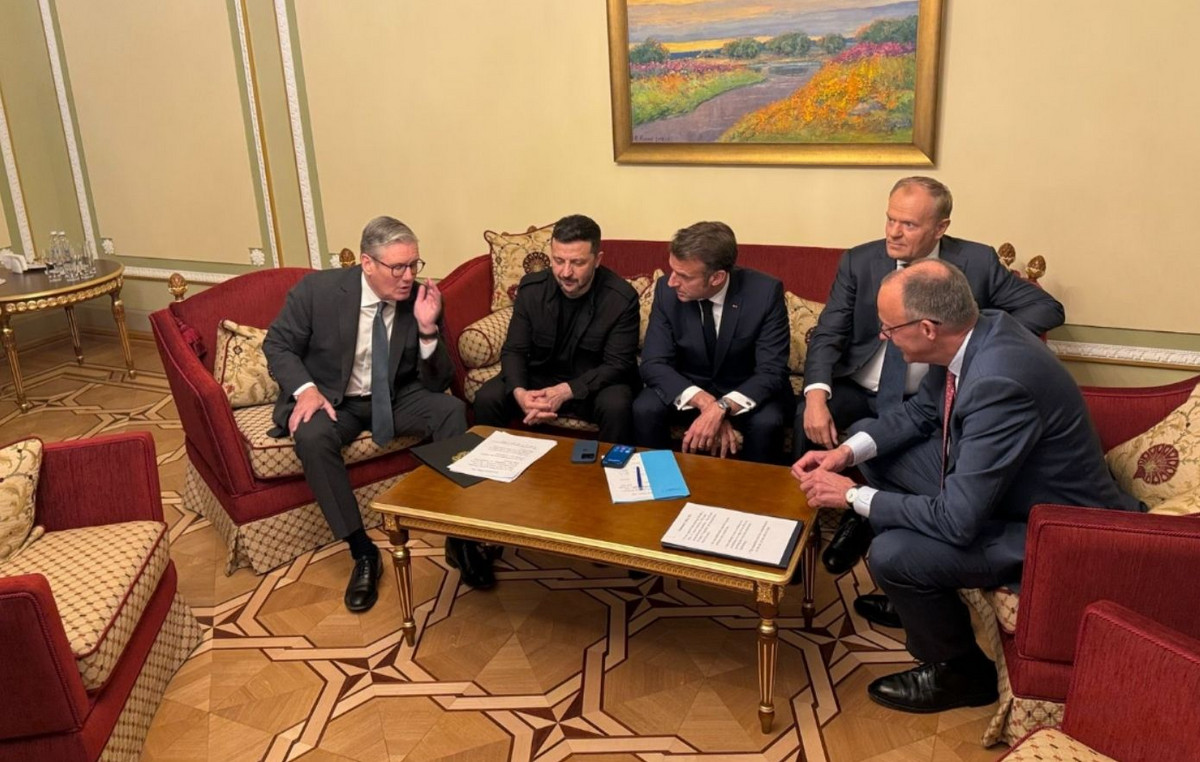

The combination of cold weather, rising demand for electricity and a spike in prices later this year risks undermining Western support for Ukraine. European politicians who have been eager to win international plaudits by demonstrating their support for Kyiv may be less willing to foot the domestic bill for preventing energy poverty among their constituents.

Publicly, European governments remain steadfast in their determination to wean themselves off Russian energy. Privately, logically, they must recognize the difficulties that this attitude threatens to bring to their economies.

Putin is winning the energy battle. Let’s hope this paper does not prove strong enough to induce Western politicians to soften their stance on actual war.

Source: Bloomberg

I’m Ava Paul, an experienced news website author with a special focus on the entertainment section. Over the past five years, I have worked in various positions of media and communication at World Stock Market. My experience has given me extensive knowledge in writing, editing, researching and reporting on stories related to the entertainment industry.