American fintech broker Robinhood has integrated the second level (L2) solution Arbitrum. It will be easier to exchange tokens.

Users of the Robinhood crypto wallet will be able to exchange tokens on the largest network on Ethereum – Arbitrum. Developers about this wrote in X (formerly Twitter).

All for the sake of ease of token exchange

According to the official press release, Robinhood wallet clients can make transactions on the Arbitrum network. Among the main advantages: low commissions and high speed. The L2 network is considered one of the most cost-effective solutions for cryptocurrency transfers. The average commission is $0.26.

For several weeks, token exchange through Arbitrum has been available in beta. However, on February 29, access to the new function was opened to all users of the Robinhood crypto wallet.

According to data from official website, the fintech broker's wallet supports Ethereum and Polygon. There are no service fees charged when exchanging tokens.

Robinhood introduced its own non-custodial crypto wallet in September 2022. Users received full access only in March last year. Previously, the broker allowed users to buy cryptocurrency through the MetaMask wallet. However, this feature is currently only available to US customers.

In early December, the company launched cryptocurrency trading in Europe. European investors were able to buy and sell more than 25 tokens, including Bitcoin (BTC), Ethereum (ETH) and Solana (SOL).

What's happening with Arbitrum

Following the news, the native token of the Arbitrum ecosystem, ARB, jumped in price by more than 11% to $2.05. According to CoinGeckoby the time of writing, the value of the asset had been adjusted to $2.

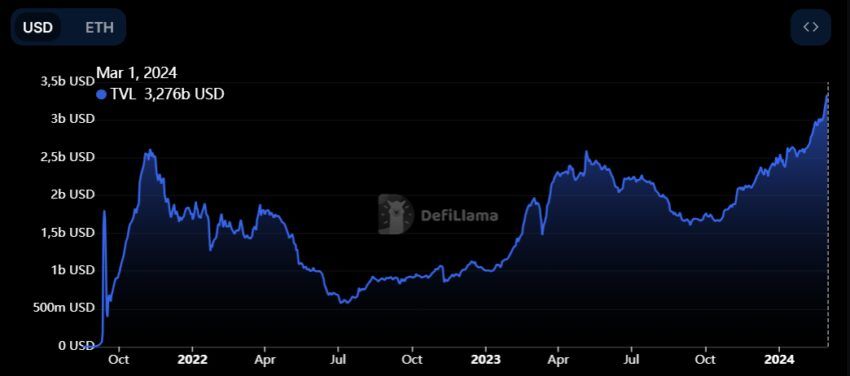

According to DefiLlamathe total value of locked funds (TVL) on the Arbitrum network currently exceeds $3 billion. Over the past two months, the figure has increased by $820 million and continues to grow.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.