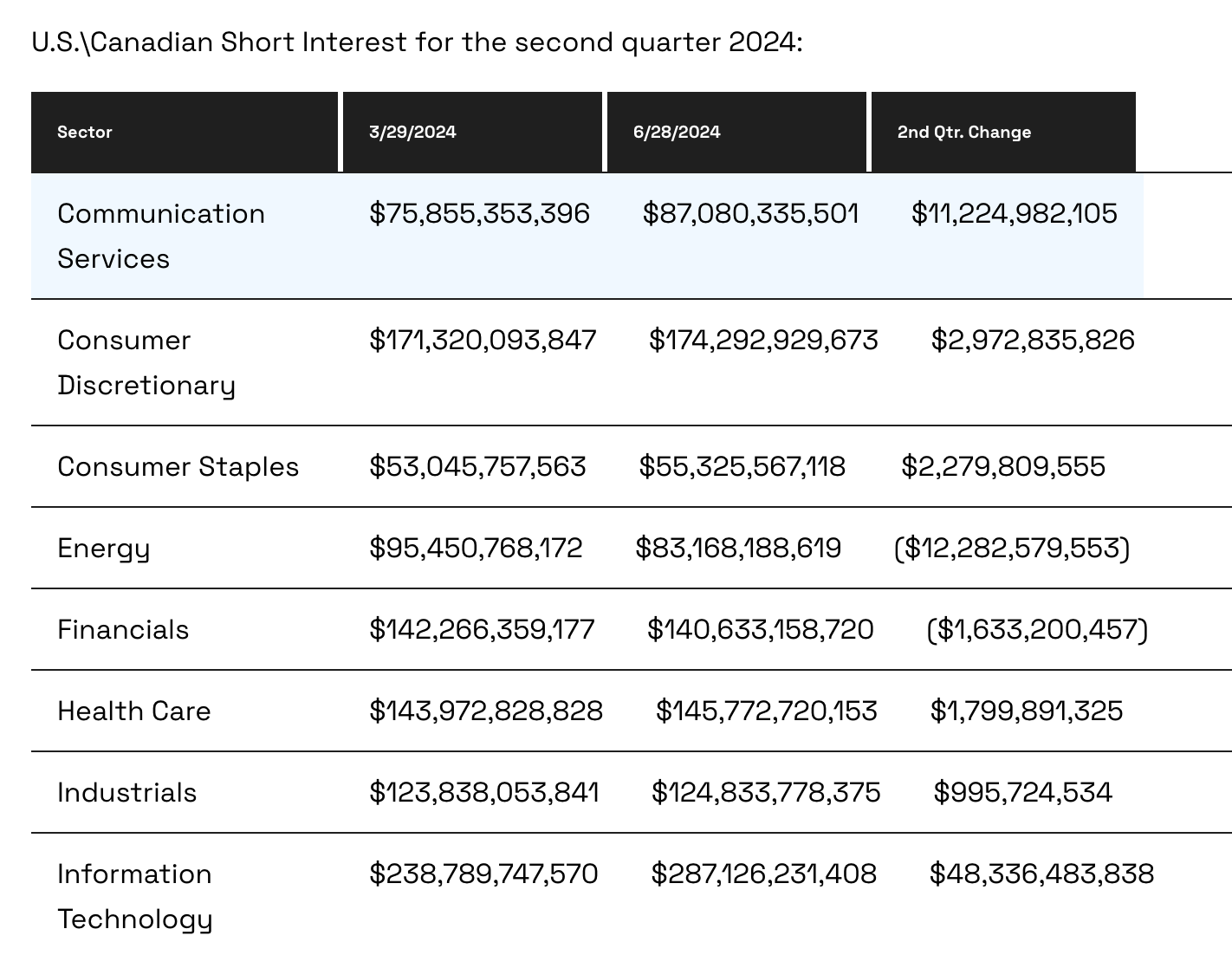

Short positions in the US and Canadian markets increased by $57.9 billion to reach $1.2 trillion in the second quarter of 2024, according to a new report report S3 Partners company.

According to analysts, traders most often opened shorts in such economic sectors as information technology, consumer goods, healthcare and communications services.

Open short positions in US and Canadian bonds in the second quarter. Source: S3 Partners.

Open short positions in US and Canadian bonds in the second quarter. Source: S3 Partners.

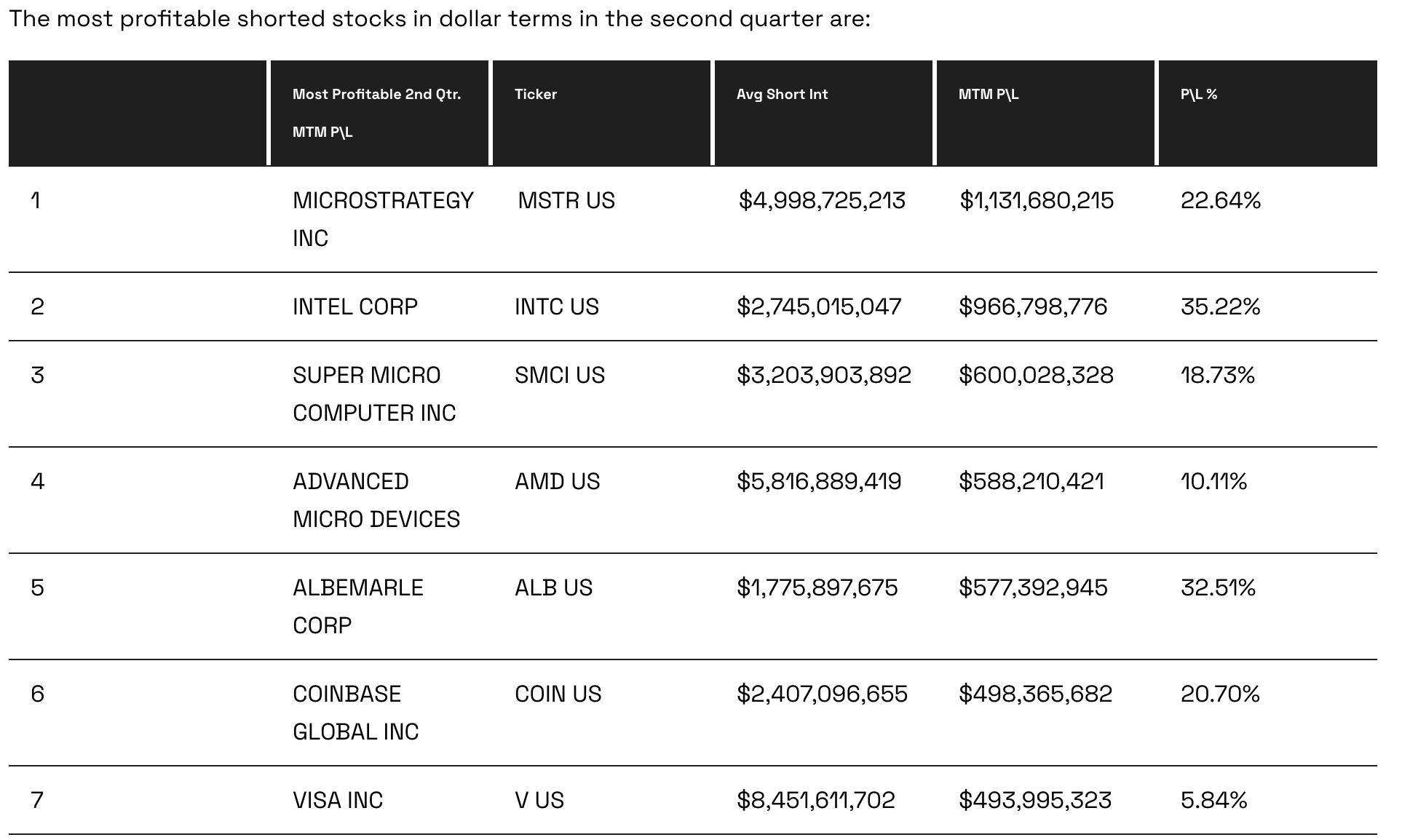

The biggest gains in dollar terms were made by holders of short positions in shares of MicroStrategy (MSTR), Intel (INTC), Super Micro Computer (SMCI), Advanced Micro Devices (AMD), Albemarle (ALB), Coinbase (COIN) and VISA (V).

Profit on company shares in dollar equivalent. Source: S3 Partners.

Profit on company shares in dollar equivalent. Source: S3 Partners.

In particular, MicroStrategy traders who opened short positions managed to earn $1.13 billion in the second quarter of 2024. In percentage terms, their profit amounted to 22.64%.

The traders who made the smallest profits from short positions were those who traded shares of Nvidia (NVDA), Apple (AAPL) and Tesla (TSLA).

In June 2024, Nvidia’s market capitalization hit a record high of $3.3 trillion, making it the most valuable company in the world. The company’s shares have more than tripled in just one year.

As for MicroStrategy, the company continues to accumulate bitcoin on its balance sheet. In June, it acquired 11,931 BTC for $786 million. The tech giant owns more than 1% of the total bitcoin supply.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.