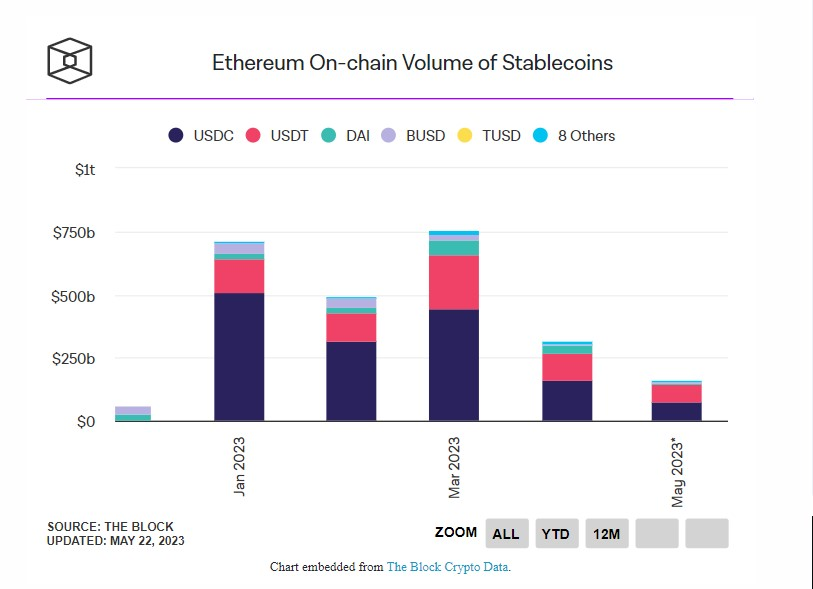

According to The Block, the volume of trading with the popular stablecoin USDC in May amounted to $73.1 billion. For comparison, in April the figure reached $158.9 billion. as last month the trading volume was $110.6 billion. And in March, the trading volume with USDT alone exceeded $400 billion.

“Most likely, the drop in trading volume with stablecoins is due to the increase in commissions in the Ethereum network. At the same time, transaction volumes with USDC fell noticeably more than with USDT. It seems that this is due to the decoupling of the stablecoin from the dollar in previous months and the general decrease in the capitalization of the token,” says The Block analyst Rebecca Stevens.

She also noted that there has been a noticeable drop in trading volume with Binance USD (BUSD), however, in this case, the indicator has been steadily falling since February of this year. Recall that the peak of transaction fees was fixed on May 11 at $22.5. However, even now the figure remains quite high and reaches $9.5.

Earlier, the European Banking Authority suggested that the Central Bank impose a ban on large stablecoins if they pose a threat to the monetary policy of specific countries.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.