The issuer of the stablecoin USDT has blocked the cryptocurrency obtained as a result of cyber fraud.

By freezing a cryptocurrency implicated in cybercrime, Tether is trying to reassure critical public opinion and regulators that its security policies are sound.

Tether fights cybercrime

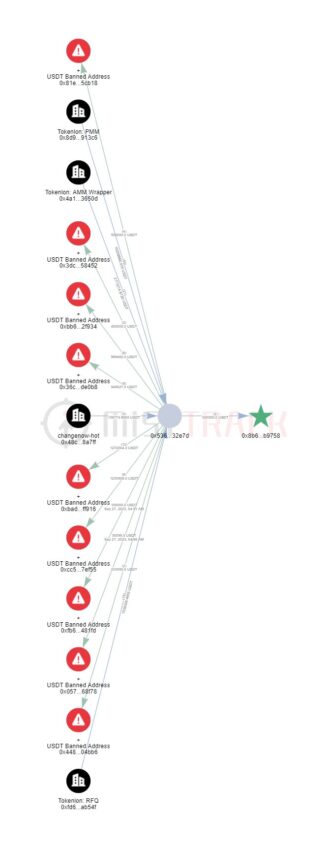

MistTrack, a cryptocurrency tracking platform created by SlowMist, discoveredthat USDT issuer Tether has frozen cryptocurrency assets at 12 addresses. This information was confirmed by the security director of SlowMist, known under the nickname 23pds.

12 Tether addresses with frozen USDT. Source: MistTrack

Tether has taken similar measures before. BeInCrypto reported that in November 2023, Tether froze 225 million USDT associated with a human trafficking syndicate in Southeast Asia. This case is the largest in the history of the cryptocurrency industry.

Tether is committed to transparency and openness. Company representatives claim that 90% of issued stablecoins are backed by cash and liquid assets.

Tether vs regulators

Despite its best efforts, Tether often faces criticism. JP Morgan experts recently noted that the growing market share of USDT could threaten the stability of the cryptocurrency ecosystem.

Other reports say terrorist organizations and sanctioned countries sometimes use USDT to circumvent US financial restrictions.

For example, US Deputy Treasury Secretary Wally Adeyemo testified before the Senate Banking Committee in April. He emphasized that Russia uses alternative payment methods, including USDT Tether, to evade sanctions.

Tether versus the crypto industry

Tether CEO Paolo Ardoino and Ripple fintech startup CEO Brad Garlinghouse recently had a public spat.

In an episode of the World Class podcast, Garlinghouse said that the US government will not lag behind Tether. He mentioned how severe the consequences would be for the crypto industry if the authorities impose sanctions on Tether.

In response to this statement, Ardoino accused Garlinghouse of creating fear and panic in the market (the so-called FUD). According to him, the head of Ripple is trying to clear his place before entering the stablecoin market.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.