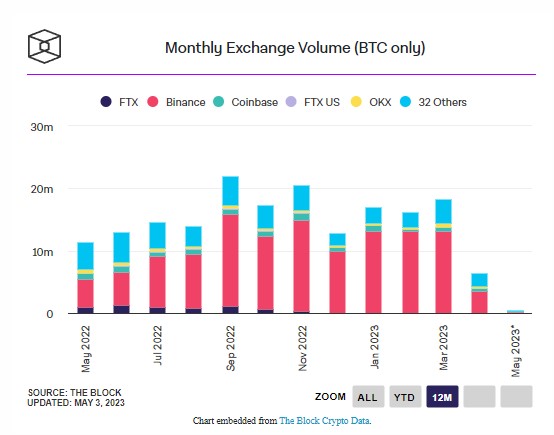

According to The Block analysts, in April of this year, the volume of trading in the spot cryptocurrency market collapsed by 65%. Experts attribute the incident to the introduction of commissions on the Binance exchange.

The total trading volume for April decreased by 10 million BTC, to $265 billion. This is 65% less than in March. In March, the Binance exchange held a promotion in which it canceled commissions for trading on the spot market in transactions with BTC. In April, the site returned commissions, which immediately led to a decrease in trading volume. At the same time, the rate of the first cryptocurrency in April did not show a significant decrease or increase.

Earlier, the analytical company CruptoQuant reported that the leverage ratio for bitcoin reached an all-time low of 0.195, previously demonstrated in December 2021.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.