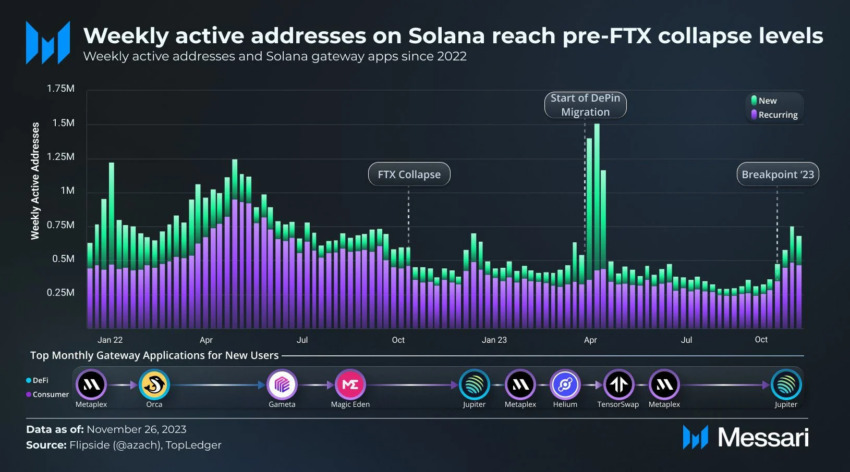

User activity and the volume of locked funds (TVL) of the Solana network are growing steadily, which can be considered a sign of recovery of the ecosystem.

According to analytical Messarithe number of weekly active Solana addresses has reached levels last seen before the collapse of the infamous FTX crypto exchange.

Solana shows signs of recovery

On December 6, researcher Ellie Zack of Messari reported that the number of weekly active Solana addresses has doubled since December 2022. TVL volume has increased by about 47% over the past month and currently stands at $1.19 billion, which is also the same level as before the FTX collapse.

However, the figure is still 89% below the peak of nearly $10 billion reached during the last bull market. Moreover, Solana suffered more than other DeFi protocols – the total TVL volume of decentralized platforms dropped by about 74% compared to ATH.

Zak also noted that, despite the growth in the number of dApps, users are showing much less interest in them than six months ago. NFT trading volume on Solana, meanwhile, has remained relatively stable since September.

What happens to the price of SOL

The native blockchain token SOL has seen an impressive rally in recent weeks, despite many in the crypto market predicting a poor fate for it following the fall of FTX. Within a month, its price soared by 55%, even surpassing Bitcoin (BTC).

At the time of writing, SOL is trading at $64.77. However, this is still 75% below the all-time high reached in November 2021.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.