- USD/CAD stop hunting is underway and bears are fixing on previous support structures.

- The setbacks of 38.2% and 61.8% are in sight.

The USD/CAD Stop hunting has begun at the new time following Wednesday’s Bank of Canada decision and ahead of Thursday’s key US data.

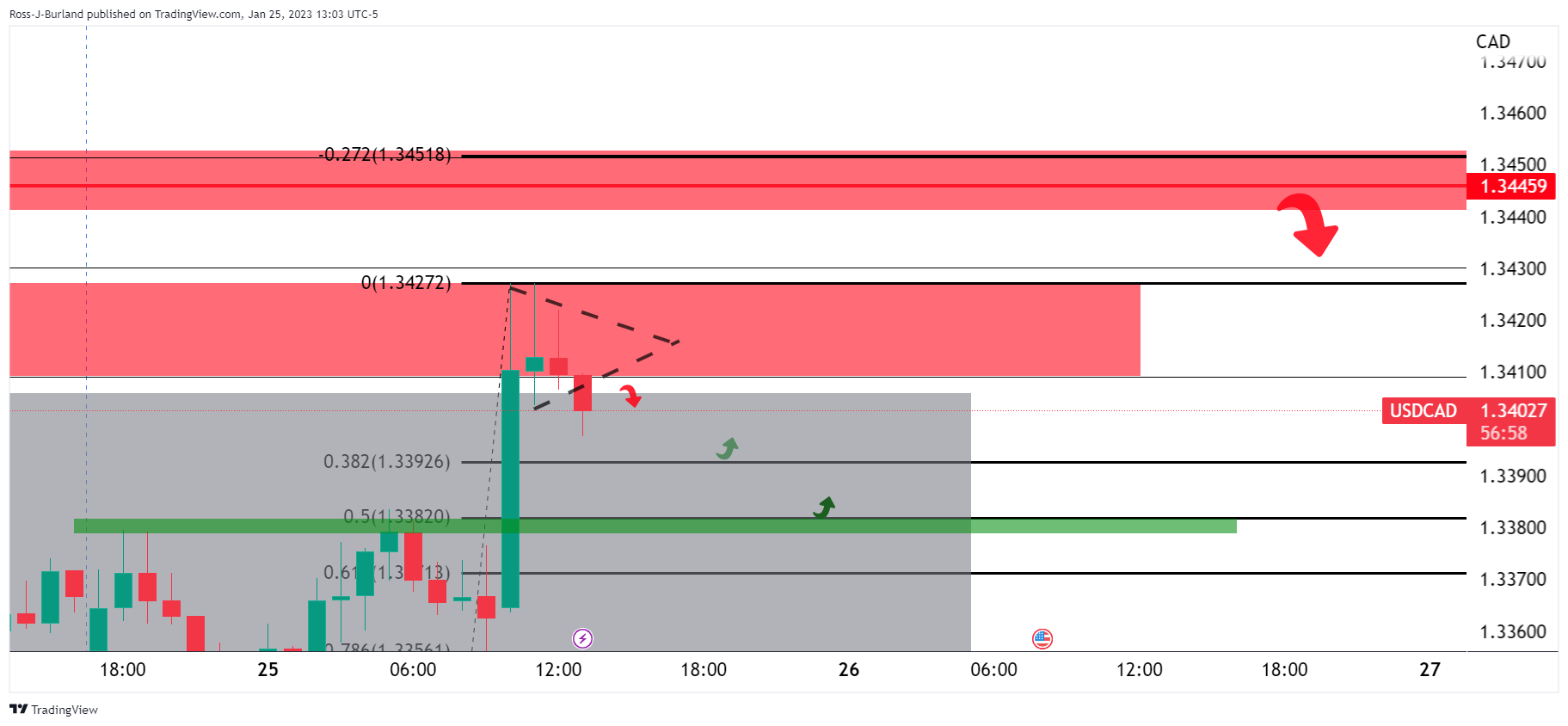

Illustrated below is the price action through the event and the move to longs in the money that could continue up to the Fibonacci scale, with the 38.2% and 61.8% retracements in sight.

USD/CAD MTF Analysis

Ahead of the new time, the chart above is bearish due to failures to break higher through resistance and the fall behind uptrend line support.

USD/CAD daily chart

This is not to say that there is no prospect of a breakout higher as on the daily chart above. There are prospects for a move higher after a stop hunt:

USD/CAD H1 Chart

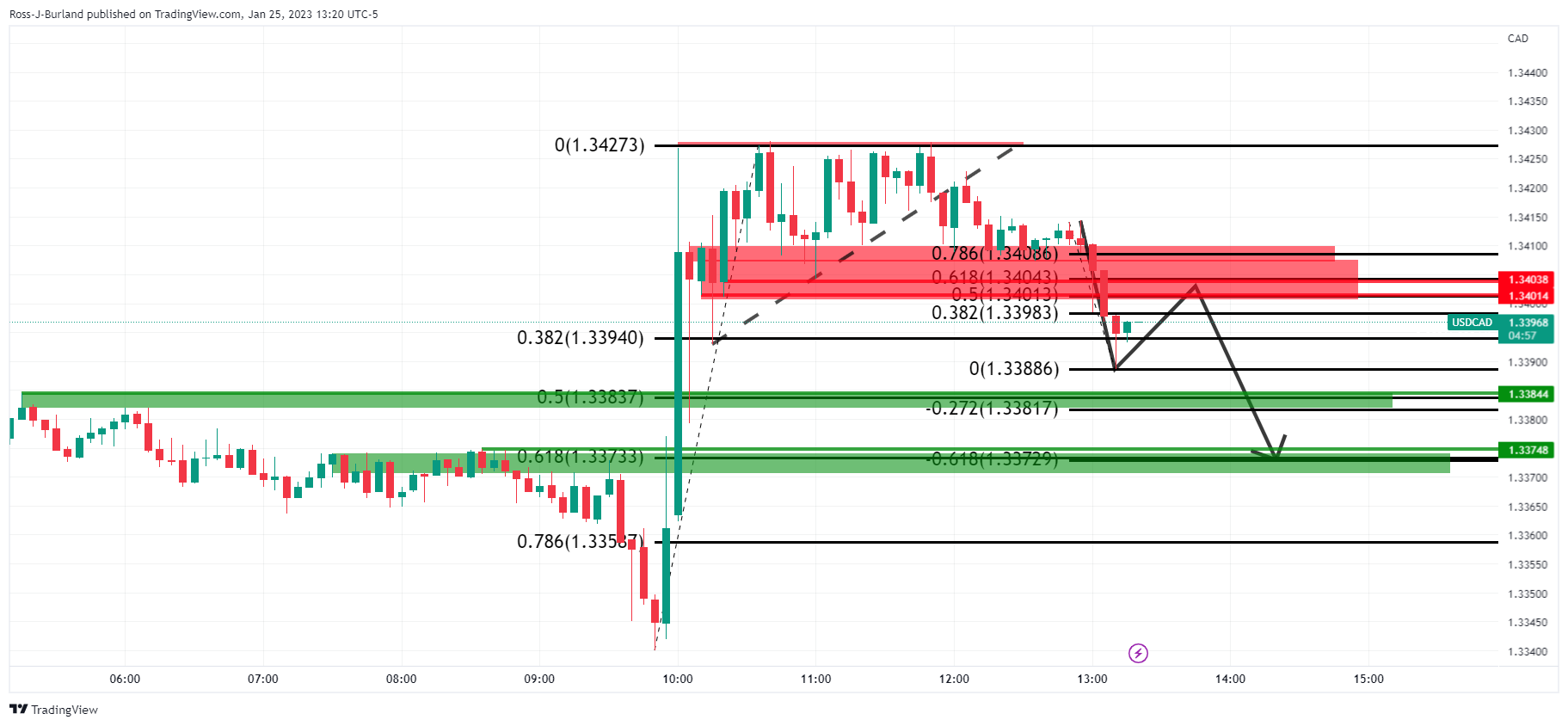

The price is trapped in a box (gray zone) between resistance and support. The BoC rally was slowing down in a triangle and a breakout was inevitable with the path of least resistance down:

The stop hunting is underway as seen above. The structures are as follows according to the 5-minute chart:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.