- USD/CHF loses ground, breaking the three-day winning streak around 0.8970 on Wednesday.

- Fed’s Powell signaled the central bank is getting closer to feeling comfortable with interest rate cuts.

- Political uncertainties and geopolitical risks could boost safe-haven assets like the CHF.

The USD/CHF pair trimmed gains near 0.8970 during the early European session on Wednesday. The pair’s bearish momentum is supported by the weakness of the Dollar following Jerome Powell’s Semi-Annual Monetary Policy Report on Wednesday.

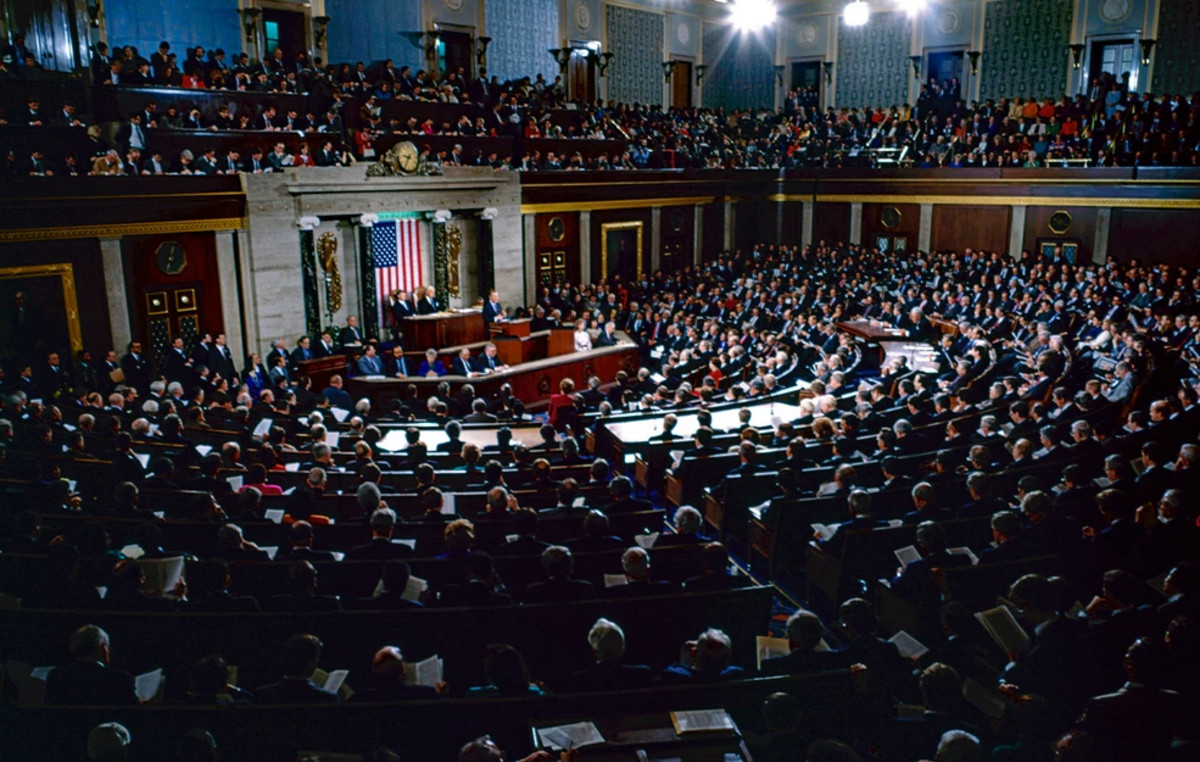

U.S. Federal Reserve Chairman Jerome Powell indicated that the central bank is getting closer to feeling comfortable with interest rate cuts. He also said that evidence of lower inflation and more “good data” could open the door to interest rate cuts.

The financial market is now pricing in a 74% chance of a Fed rate cut in September, up from 71% last Friday, according to data from the CME FedWatch tool. However, Federal Open Market Committee (FOMC) members at their June meeting indicated only one cut this year. The expectation of a Fed rate cut could put some selling pressure on the US Dollar (USD) in the near term.

Traders will focus on dollar weakness ahead of US Consumer Price Index (CPI) inflation data on Thursday, which will be the highlight this week. US CPI is forecast to show a 3.1% year-on-year increase in June, compared with a 3.3% increase in May. Core inflation is projected to remain stable at 3.4% year-on-year in June. Any signs of further gold consolidation

On the Swiss front, signs of lower inflationary pressures in Switzerland could prompt the Swiss National Bank (SNB) to continue cutting interest rates, which is likely to put some selling pressure on the Swiss Franc (CHF). However, the downside of the CHF could be limited amid political uncertainties in France and geopolitical tensions in the Middle East.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.