- USD/JPY pair hits 10-month highs at 147.70, buoyed by risk aversion and 10-year US Treasury yields rally to 4.261%.

- Despite positive business activity data in Japan, the yen remains weak as the lower-than-expected PMI for China’s Caixin services fuels global economic concerns.

- Upcoming data from the US ISM Non-Manufacturing PMI and S&P Global Services PMI could put pressure on the dollar.

The Japanese Yen (JPY) fell to 10-month lows against the US Dollar (USD), driven by risk aversion and a rally in US Treasury yields, mainly the 10-year yield, as business activity slows around the world, as revealed by S&P Global. Thus, the USD/JPY pair is trading at 147.65 after reaching an annual high of 147.70.

The Japanese Yen reaches its annual low, while investors opt for the Dollar; upcoming PMI data could influence the Fed’s next move

Market sentiment remains bearish as China revealed its expanding Caixin Services PMI at a rate below estimates of 53.6 to 51.8, and also down from the previous month’s reading of 54.1. This sparked fears around the world, with investors seeking safety turning to the dollar and US Treasury yields.

Although Japan reported an improvement in business activity in August, as revealed by the Jibun Bank Services PMI at 54.3, as expected and above July’s 53.8, it failed to prop up the battered Yen.

In the US, after the Labor Day holiday, the calendar revealed that August factory orders showed a slight improvement despite plunging to -2.1%, above estimates of -2.5%. Data from the US Commerce Department ended a four-month winning streak.

As for central banks, Christopher Waller, a member of the US Federal Reserve, stated that recent data gives the US central bank room to decide its next decision on interest rates. Lately, Cleveland Fed President Loretta Mester has asserted that the Fed will not continue to tighten until inflation reaches 2%, nor will it wait until there to lower rates.

Meanwhile, US Treasury yields continue their upward trend, with the 10-year Treasury yield advancing six basis points to 4.261%, a tailwind for USD/JPY. The Dollar Index (DXY), which measures the dollar’s performance against six currencies, posted solid gains of 0.61% to 104,794, its highest level since March 13, 2023.

Release of the US ISM Non-Manufacturing PMI for August, which is expected to slow slightly from 52.7 to 52.5, while the S&P Global Services PMI is likely to follow suit, with estimates of 51 from July 52.3 . If both readings come out as expected, the dollar could be under pressure as it could soothe the Fed’s pause in September while denting the odds of another interest rate hike in November.

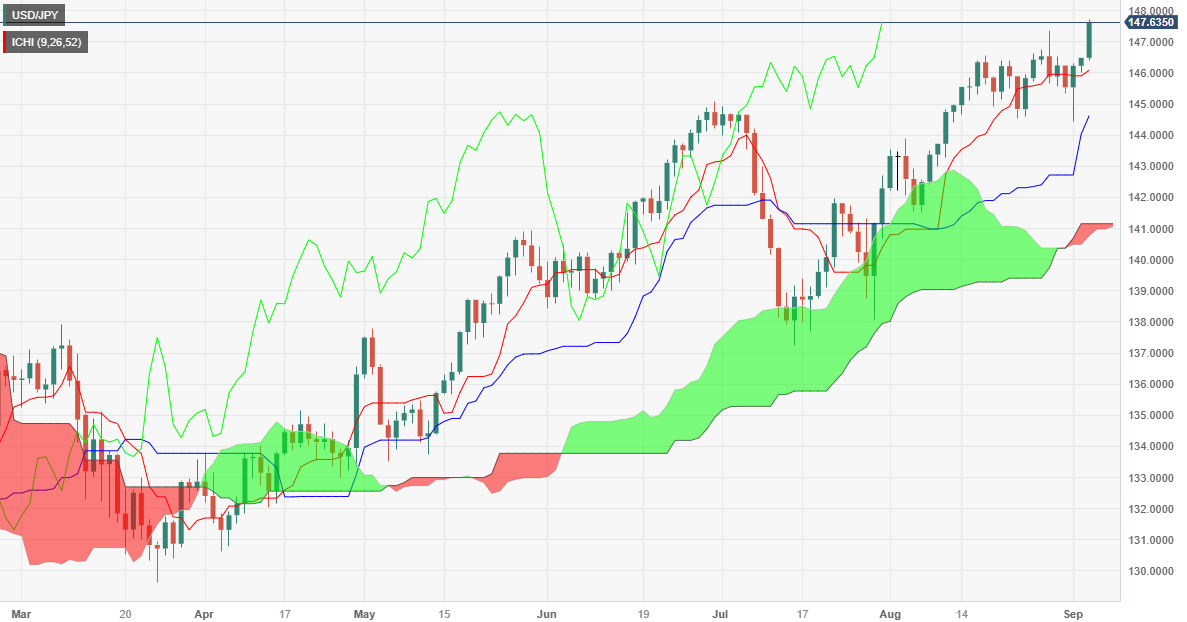

USD/JPY Price Analysis: Technical Perspective

From a daily chart standpoint, USD/JPY maintains a bullish bias as it pushes towards fresh year-to-date highs around the session. The next stop would be the psychological level of 148.00, followed by last November’s high of 148.82, before challenging 149.00. Conversely, if sellers intervene, downside risks would arise at the Tenkan-Sen line at 146.09, followed by the Senkou Span A at 145.35. A break of this last level would expose the sellers to a fall. A break of the latter would expose the Kijun-Sen at 144.62 and then 144.00.

USD/JPY

| Overview | |

|---|---|

| Last price today | 147.67 |

| Today Change Daily | 1.18 |

| today’s daily variation | 0.81 |

| today’s daily opening | 146.49 |

| Trends | |

|---|---|

| daily SMA20 | 145.58 |

| daily SMA50 | 143.29 |

| daily SMA100 | 140.64 |

| daily SMA200 | 136.87 |

| levels | |

|---|---|

| previous daily high | 146.5 |

| previous daily low | 146.02 |

| Previous Weekly High | 147.38 |

| previous weekly low | 144.44 |

| Previous Monthly High | 147.38 |

| Previous monthly minimum | 141.51 |

| Fibonacci daily 38.2 | 146.32 |

| Fibonacci 61.8% daily | 146.21 |

| Daily Pivot Point S1 | 146.18 |

| Daily Pivot Point S2 | 145.86 |

| Daily Pivot Point S3 | 145.7 |

| Daily Pivot Point R1 | 146.65 |

| Daily Pivot Point R2 | 146.81 |

| Daily Pivot Point R3 | 147.12 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.