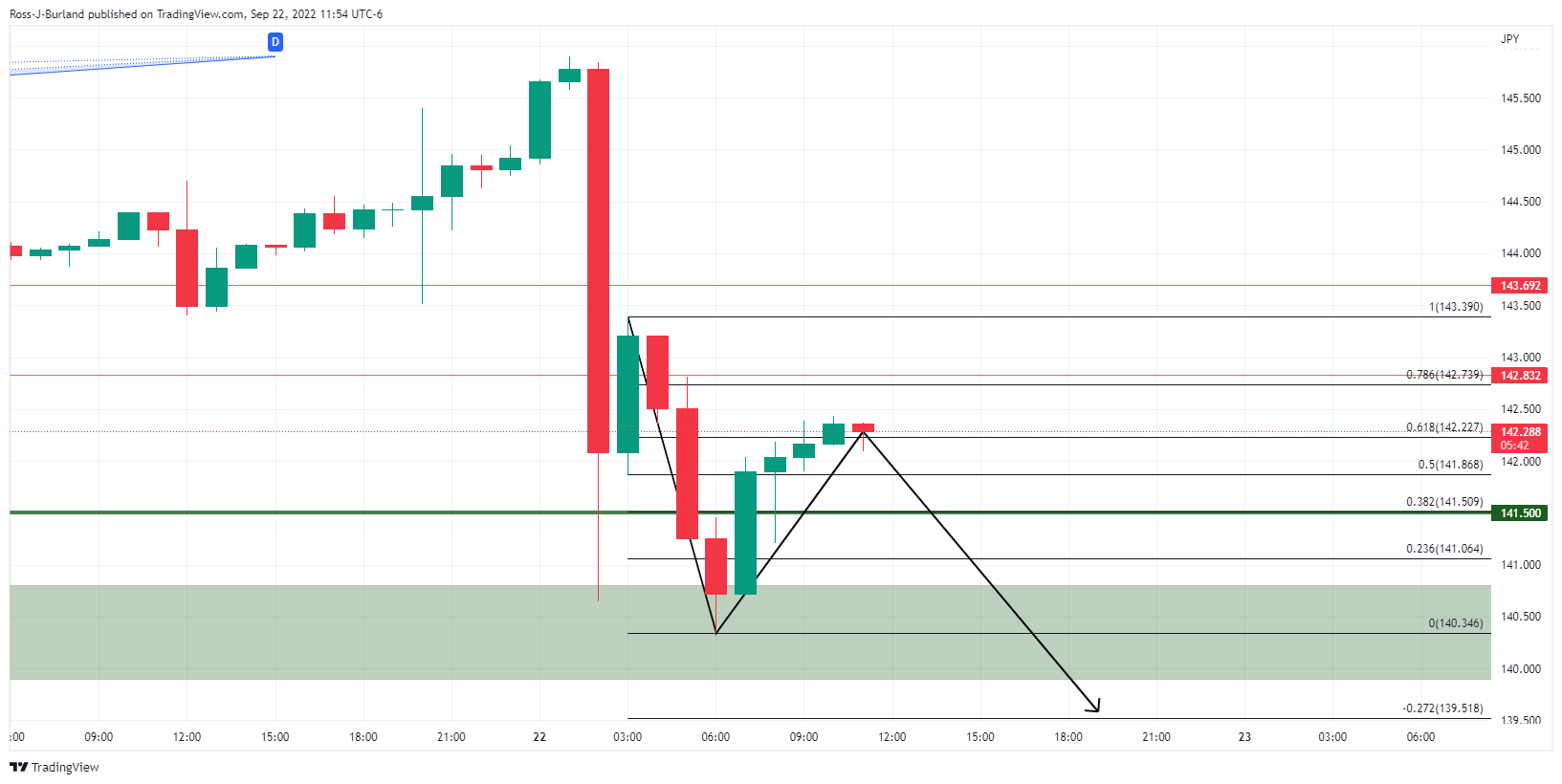

- USD/JPY bears are trading at a 61.8% ratio around 142.20.

- If the bears commit, a break below 140.50 opens up prospects for a continuation lower towards 140.00.

Based on the above analysis, the bears of the USD/JPY are about to pounce as the US dollar meets 4hr resistance, the yen continued to challenge the bears with the added fuel of fundamentals.

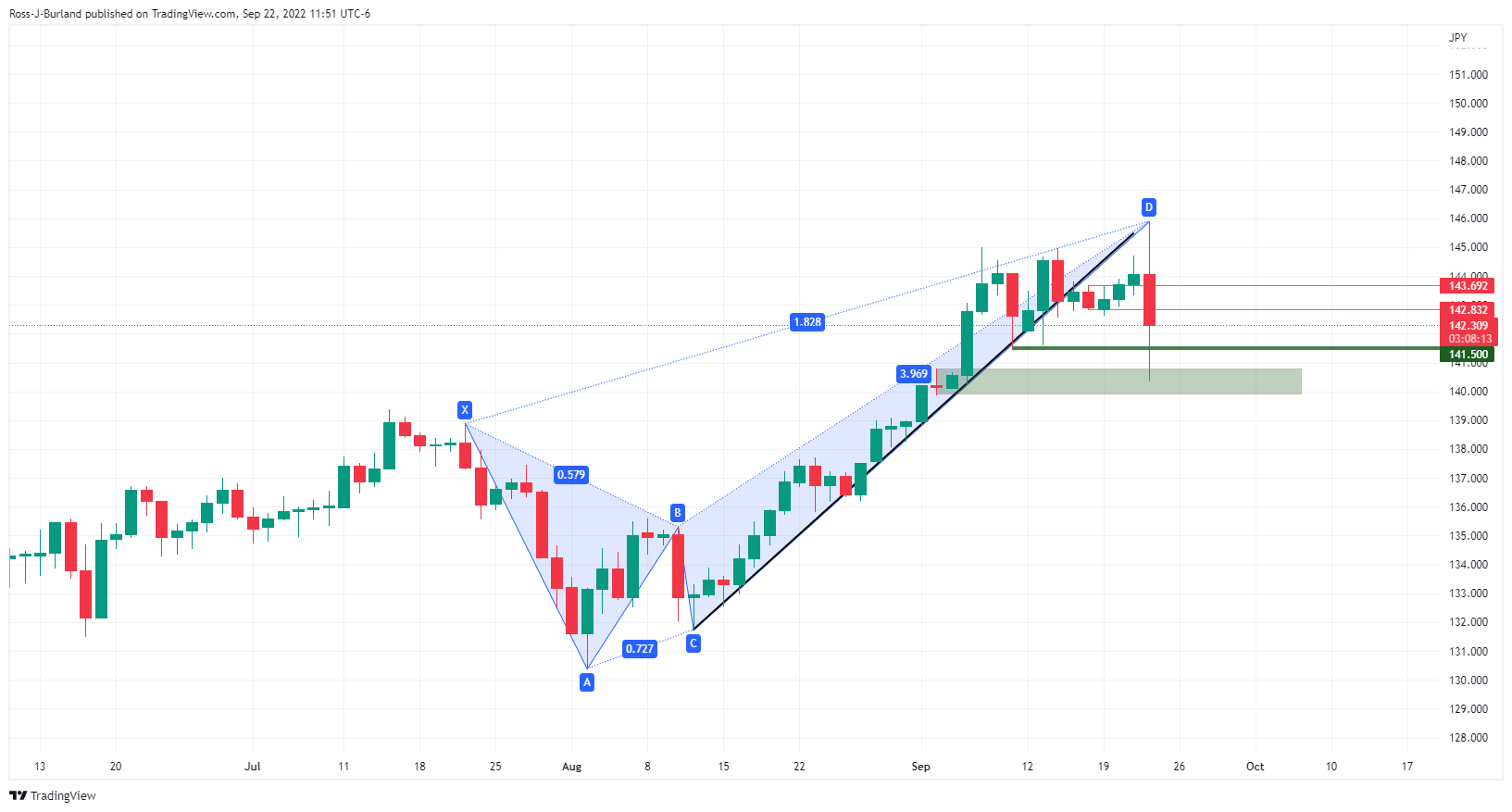

The news that the Ministry of Finance (MoF) stepped in for the first time since 1998 has the pair on track to break a critical daily structure like the following:

USD/JPY Preview

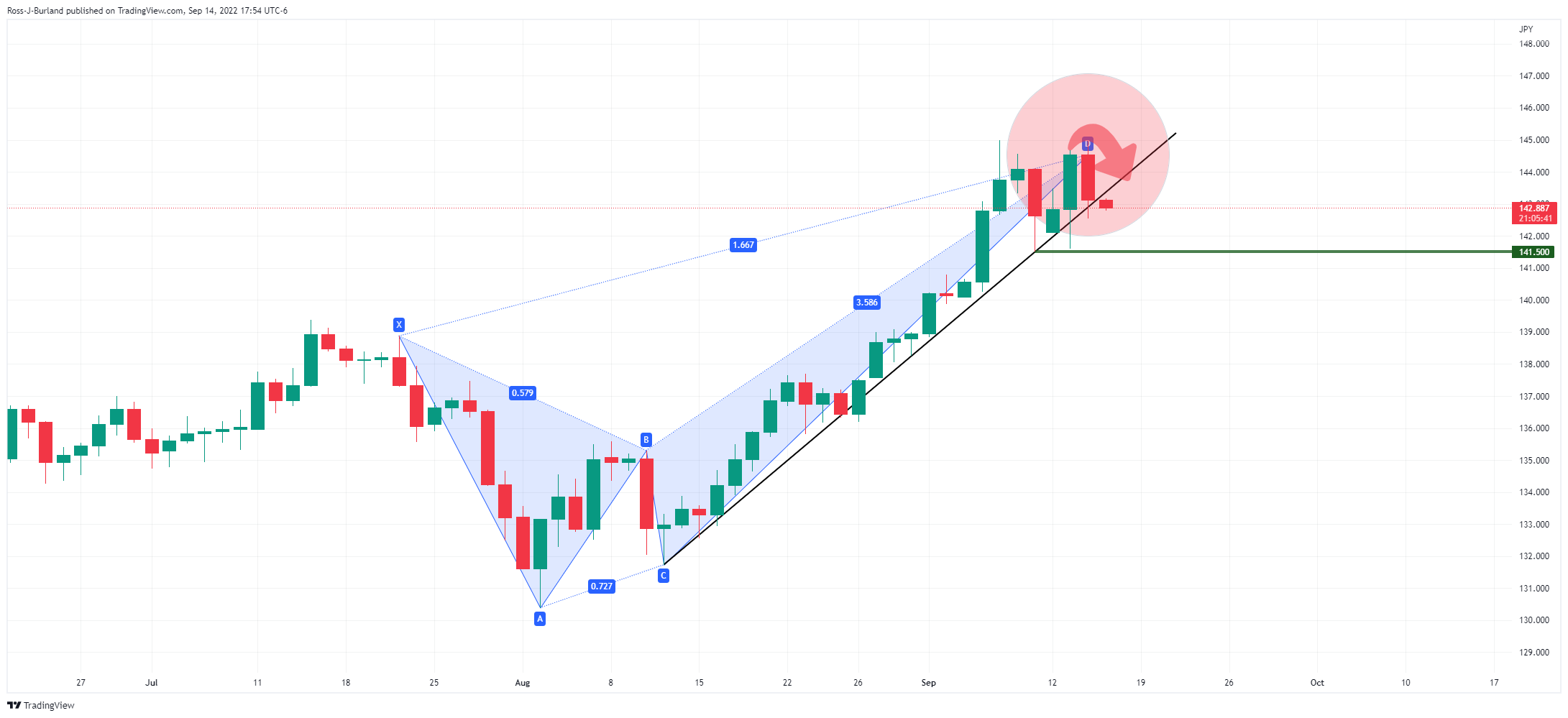

Previous verbal intervention from Japanese officials had caused a bid in the yen and helped see a harmonic pattern in USD/JPY which resulted in a continuation as the week progressed.

USD/JPY update

The pair has extended its decline and is embarking on the break of the 140.80 support.

Meanwhile, the hourly charts show that the price is slowing down in a stealth correction which could now see the bears move into a critical resistance level near the 61.8% ratio around 142.20. Should the bears commit, a break below 140.50 opens up the prospects for a continuation lower to take out 140.00.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.