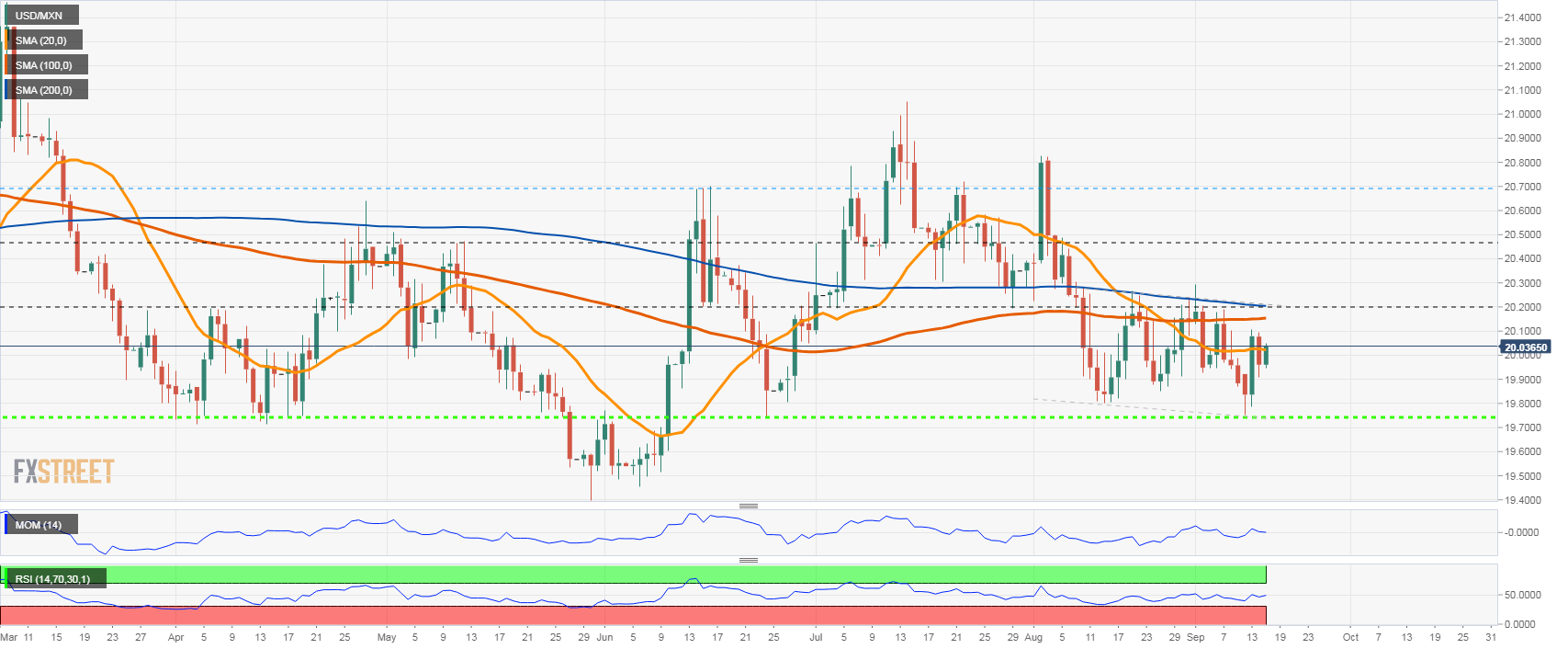

- USD/MXN has moved between 20.20 and 19.80 since mid-August.

- The Mexican peso fails to break 19.80 and falls back.

- Stocks turn lower on Wall Street, supporting the dollar.

The USD/MXN rises on Thursday amid a stronger US dollar overall. The pair is trading at 20.07, the highest intraday level. Wall Street is turning from neutral to bearish, favoring the dollar.

On the upside, immediate resistance is at 20.10 (highs of 8 and 13 September). A consolidation above could point to further gains and a test of the critical area between 20.17 and 20.20. A daily close above 20.20 would be a positive technical development suggesting further gains ahead, targeting the 20.45 area.

On the other hand, the first support is located at 19.95, but a more important barrier is found at 19.90. The key zone is 19.80 and a break lower would put USD/MXN on track towards 19.70.

Eyes on the Fed

Following the numerous US economic reports (jobless claims, retail sales, Philadelphia Fed and industrial production) on Thursday and in particular Tuesday’s CPI, the focus now turns to the FOMC meeting in next week. The central bank is expected to raise interest rates by 75 basis points on Wednesday. Banxico is expected to do the same on September 29.

USD/MXN daily chart

Technical levels

USD/MXN

| Panorama | |

|---|---|

| Last Price Today | 20.0614 |

| Today’s Daily Change | 0.1192 |

| Today’s Daily Change % | 0.60 |

| Today’s Daily Opening | 19.9422 |

| Trends | |

|---|---|

| 20 Daily SMA | 20.0249 |

| 50 Daily SMA | 20.2453 |

| 100 Daily SMA | 20.1529 |

| 200 Daily SMA | 20.3075 |

| levels | |

|---|---|

| Previous Daily High | 20.0909 |

| Previous Daily Minimum | 19.9088 |

| Previous Maximum Weekly | 20.1884 |

| Previous Weekly Minimum | 19,868 |

| Monthly Prior Maximum | 20.8261 |

| Previous Monthly Minimum | 19.8019 |

| Daily Fibonacci 38.2% | 19.9784 |

| Daily Fibonacci 61.8% | 20.0214 |

| Daily Pivot Point S1 | 19.8704 |

| Daily Pivot Point S2 | 19.7985 |

| Daily Pivot Point S3 | 19.6882 |

| Daily Pivot Point R1 | 20.0525 |

| Daily Pivot Point R2 | 20.1628 |

| Daily Pivot Point R3 | 20.2346 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.