- USD/ZAR fell towards 18,933, near the 20-day SMA.

- South Africa reports inflation figures for August and retail sales for July on Wednesday.

- The Federal Reserve (Fed) is expected to pause but leave the door open for further increases.

In Tuesday’s session, the USD/ZAR faced some selling pressure and dropped to 18.933, losing 0.25%, and appears to be on track to retest the 20-day SMA at 18.880.

All eyes are on Wednesday. South Africa reports the Consumer Price Index (CPI) for August, with the headline figure expected to rise slightly to 4.8% year-on-year, while the core inflation rate is expected to remain stable at 4.7% year-on-year. Retail sales for July are expected to be -1.0% year-on-year, compared to a decline of 0.9% year-on-year in June. Looking ahead to Thursday’s South African Reserve Bank meeting, the decision is likely to be to keep interest rates at 8.25%, despite some earlier expectations of a hike. At the moment, for the next twelve years, the markets do not foresee any increase and discount that the bank will maintain rates at 8.25%.

On the Fed side, markets expect the bank to keep rates steady at 5.25-5.50%, but Chairman Powell is likely to strike a hawkish tone and signal future rate hikes that could benefit the dollar. The strong performance of the US economy, especially in the services sector, and a mixed labor market suggest that the Fed could leave room for a further hike to curb inflation risks.

USD/ZAR Levels to watch

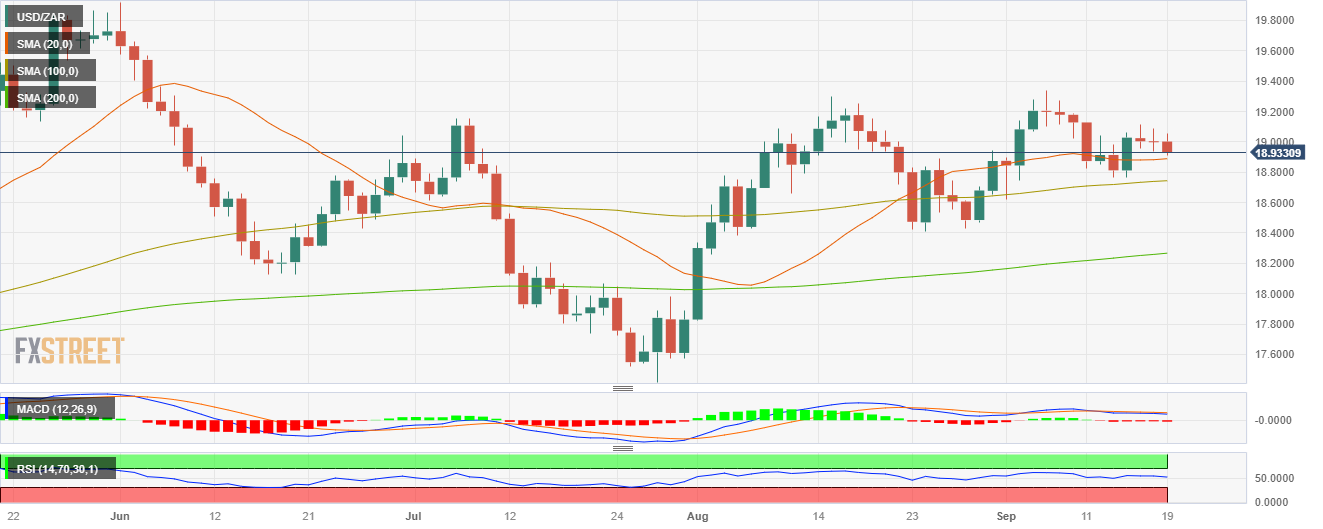

The daily chart shows signs of bullish exhaustion for USD/ZAR. The Relative Strength Index (RSI) indicates a neutral stance above its midline, showing a flat slope in positive territory, while the Moving Average Convergence (MACD) presents neutral red bars. In a broader picture, the pair is above the 20,100,200-day SMA, suggesting that the bears are struggling to challenge the overall uptrend.

Support Levels: 18,880 (20-day SMA), 18,728 (100-day SMA). 18,500.

Resistance levels: 19,000, 19,050, 19,150.

USD/ZAR Daily Chart

USD/ZAR

| Overview | |

|---|---|

| Latest price today | 18,933 |

| Today Daily Change | -0.0688 |

| Today’s daily variation | -0.36 |

| Today’s daily opening | 19.0018 |

| Trends | |

|---|---|

| daily SMA20 | 18.8827 |

| daily SMA50 | 18.5785 |

| SMA100 daily | 18.7397 |

| SMA200 daily | 18.2589 |

| Levels | |

|---|---|

| Previous daily high | 19.0902 |

| Previous daily low | 18.9346 |

| Previous weekly high | 19.1283 |

| Previous weekly low | 18.7634 |

| Previous Monthly High | 19.2985 |

| Previous monthly low | 17.8264 |

| Daily Fibonacci 38.2 | 18.9941 |

| Fibonacci 61.8% daily | 19.0308 |

| Daily Pivot Point S1 | 18.9275 |

| Daily Pivot Point S2 | 18.8533 |

| Daily Pivot Point S3 | 18.7719 |

| Daily Pivot Point R1 | 19.0831 |

| Daily Pivot Point R2 | 19.1645 |

| Daily Pivot Point R3 | 19.2387 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.