The collapse of the Silicon Valley bank was the largest since the 2008 crisis in the United States. The US Federal Deposit Insurance Corporation (FDIC) was forced to take action and take control of the bank’s operations. Silicon Valley has served many tech companies, including Circle, the company behind the USDC stablecoin.

Considering that USDC capitalization exceeds $41 billion, the temporary unavailability of $3.3 billion should not be a significant problem, especially since deposits in Silicon Valley are insured by the FDIC, although there are rumors of a possible loss of 40% of these funds. The announcement that Circle was holding significant amounts of funds in the bank led to some panic. The stablecoin exchange rate got rid of the dollar exchange rate and decreased by 2% on some sites. USDC is currently trading at $0.996.

The DAI stablecoin also had problems – the security of this token is partially contained in USDC. Therefore, the DAI rate also untied the dollar. The tokens are currently trading at $0.96.

Circle representatives said they are not taking any special action yet, but are waiting for “clarification of the situation” from US regulators. Currently, about 25% of USDC reserves are held in six US banks, including the bankrupt Silvergate and Silicon Valley. Some sources say there are problems with Signature Bank, where Circle also holds part of the reserves.

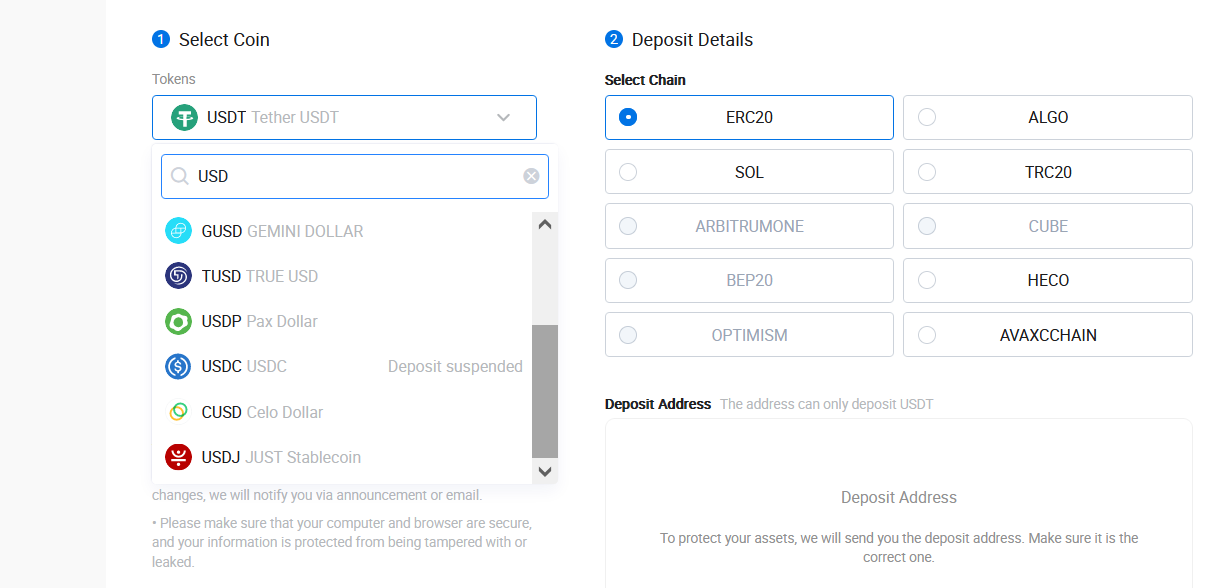

Against this background, the American cryptocurrency exchange Coinbase suspended conversion of USDC to fiat currency. In a statement, representatives of the site said that the service will be restored on Monday, when banks have working hours. Binance, the largest exchange, has suspended the conversion of USDC to BUSD.

Reports have also begun to surface that various cryptocurrency exchanges have suspended deposits in USDC. One of the reasons may be the desire to smooth out the impact of sales on the stablecoin price. However, the use of smart contracts for the exchange of USDT, USDC, DAI and others has grown significantly – investors are trying to get rid of problem assets. Against this background, the volume of gas for transactions in the Ethereum network has grown to 220 Gwei.

The situation also affected arbitrage traders – many began to take loans in USDT to trade on the difference in rates in stablecoins. The interest for the use of funds almost instantly soared to 100% per annum.

Interestingly, the Tesla CEO is already declared about the possible purchase of Silicon Valley Bank and its transformation into a digital bank.

Earlier in the US, the Silvergate cryptocurrency bank collapsed. Bits.Media published a large-scale material on how this and other factors influenced the decline of the cryptocurrency market.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.