This is what you need to know to trade today, Wednesday, November 9:

Equity markets are stalling on the latest rally while big hurdles await this latest rally in equities. Elon Musk hits Tesla (TSLA) with another piece sold, and Meta Platforms (META) it gets rid of about 11,000 jobs. Disney (DIS) also falls as it appears that Disney+ is paying for subscribers, which ends up hurting earnings. The question is how much is it worth and how much can you pay for a share of the streaming market. Disney is down 7% in the market.

In the sector of cryptocurrencies, the situation is even worse, as the fallout from the FTX crash continues. Bitcoin hit a new yearly low, but is currently holding on to the $17,000 zone. We will see how this plays out for risk assets, but the correlation between Bitcoin and the Nasdaq, for example, has weakened in recent weeks, so the contagion may not spread.

The Prayed it has stabilized after recent rallies and is now at $1,707. Oil prices are lower. There was a surprising buildup of crude inventories on Tuesday from API data and rumors of covid outbreaks in China are weighing on demand. Oil has dropped to $87.20. Dollar Index rises to 110, but all is quiet ahead of tomorrow’s CPI data.

The markets europeans down: Eurostoxx and FTSE flat, but Dax down 0.6%.

The United States Futures also down: Dow, Nasdaq and S&P are over -0.4%.

Wall Street Top News

Democrats appear to be doing better than expected, as Trump-endorsed candidates are doing worse than anticipated.

The Republicans should win the House of Representatives, but the Senate seems to be sticking with the Democrats.

The IEA says OPEC+ may have to rethink supply cuts.

Disney (DIS) falls as streaming costs grow.

Meta Platforms (META) cut 11,000 jobs.

Tesla (TSLA): Elon Musk sells more shares.

Canopy Growth (CGC) EPS falls, but earnings beat forecasts.

profits from AMC Entertainment (AMC) show a loss of cash and fewer users even though profits beat estimates.

Roblox (RBLX) falls hard by not making a profit.

D.R. Horton’s (DHI) increases your profits, but falls in EPS and revenue.

Lucid (LCID) says orders were lower in the third quarter, shares fall 7%.

Novavax (NVAX) cut its earnings forecasts again.

Occidental Petroleum (OXY): EPS is in line with earnings, beating forecasts.

FedEx (FDX) says package volumes are lower than forecast.

Taiwan Semiconductor (TSM) will build a new plant in Arizona.

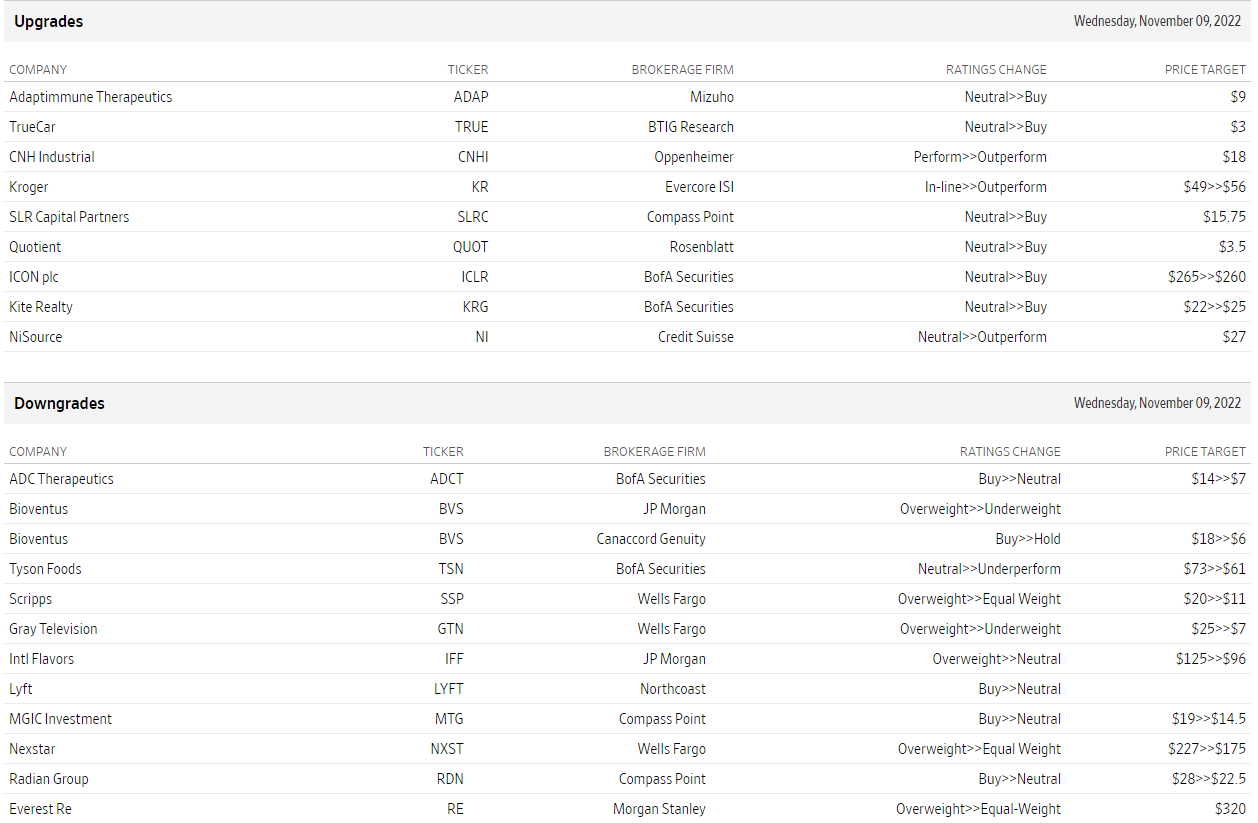

Ups and downs

WSJ.com

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.